Upgraded Economic Forecasts Seen Keeping BoE's Hawks in Driving Seat

- Written by: James Skinner

"The MPC's previous 8-quarter recession is likely to be shortened significantly, especially if they predict 22Q4 growth to be zero or positive (as they are likely to)" - TD Securities.

Image © Pound Sterling Live

The Bank of England (BoE) interest rate outlook had appeared less certain following the division over December's decision but a better than expected economic performance since then is now seen ensuring the 'hawks' remain a majority on the Monetary Policy Committee (MPC) next week.

While economic data covering the month of December has made clear this last week that the UK economy is not near out of the woods, the surprise increase in GDP for the month of November remains a potential game changer for the final quarter performance with likely implications for BoE forecasts.

"“Consensus” now reluctantly accepts there is a chance the UK did not in fact enter technical recession in 2022," says Dr Savvas Savouri, chief economist and partner at Toscafund Asset Management, a London-based hedge fund with around $4BN under management.

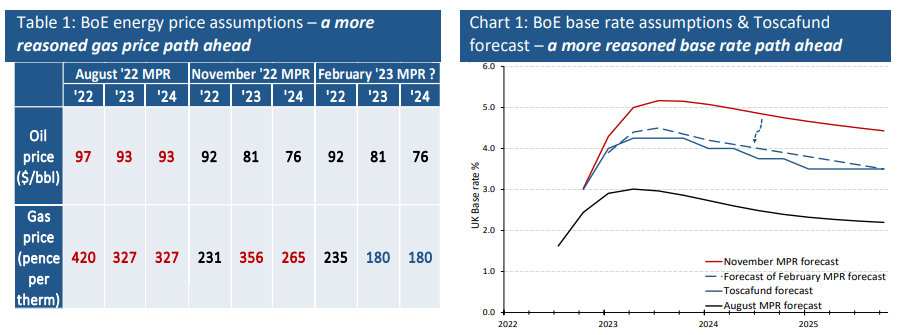

"In our view, a crucial factor in understanding how the Bank’s recessionary forecasts would in time prove wrong, was their stubbornly high assumptions on energy prices and interest rates," Savouri writes in a Thursday briefing.

Source: Toscafund Asset Management. Click image for closer inspection.

Source: Toscafund Asset Management. Click image for closer inspection.

To optimise the timing of international payments you could consider setting a free FX rate alert here.

Savouri and colleagues have differed with BoE forecasts since May when the bank began to warn of the effects rising energy prices could have on inflation, incomes and spending, effects that were tipped to drive an almost two-year recession in November's forecasts.

But with wholesale energy prices falling notably since then and expectations for Bank Rate coming down in tow, Savouri and others see the BoE having little option but to upgrade its forecasts next week, which all but assures another increase in Bank Rate.

"So, there are those contributing factors and we will have to do the analysis over the next couple of weeks (next monetary report) to see what we turn those into," Governor Andrew Bailey told a regional newspaper last week.

"But it is a pattern I would say unfortunately of weak activity over quite a prolonged period. When people talk about recession I understand it is quite a strong word to use, but it is a shallow one by historic standards," he added.

November's economic forecasts assumed wholesale energy prices would remain near then-elevated levels and also accepted the market's implied expectations for Bank Rate to reach 5.2% by the middle of this year as a given.

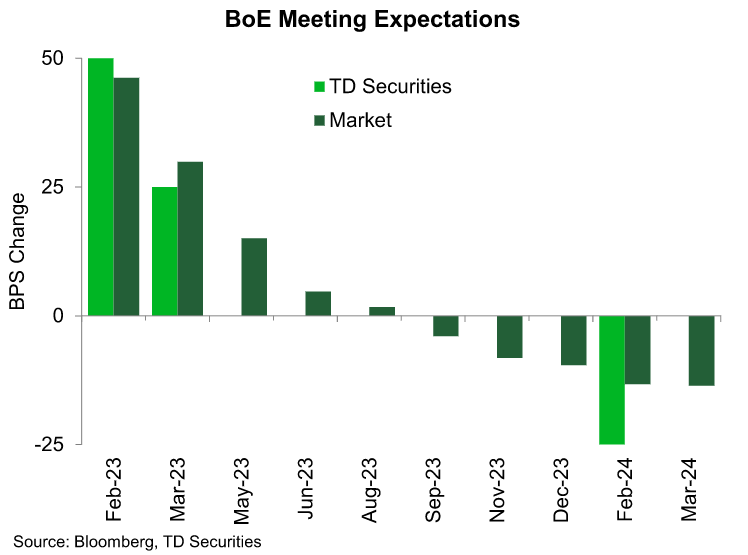

Source: TD Securities. Click image for closer inspection.

Source: TD Securities. Click image for closer inspection.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

But the implied peak for Bank Rate has fallen to 4.5% since November and the declines in wholesale energy prices are significant enough to make further increases in household energy bills unlikely for the immediate months ahead.

This means an automatic uplift to the BoE's forecasts for GDP and possibly also downward pressure on its forecasts for inflation next week.

"The news since November generally supports a positive revision to the outlook. The MPC's previous 8-quarter recession is likely to be shortened significantly, especially if they predict 22Q4 growth to be zero or positive (as they are likely to)," says James Rossiter, global head of macro strategy at TD Securities.

"The yield curve decline is the biggest single shock since the MPC's November forecast, and is likely to have a major impact on their inflation projection. We expect it to boost Year 2 (25Q1) inflation from 1.2% to around 1.6% y/y alone. The profile of gas prices will also impact the inflation forecast," he adds.