GBP/USD Rate Levels and Possibilities after Fall Below 1.19

- Written by: James Skinner

"There would initially be more downside in sterling if UK wage and inflation developments push the BoE towards an even more dovish policy stance over the coming months" - BMO Capital Markets.

Image © Adobe Images

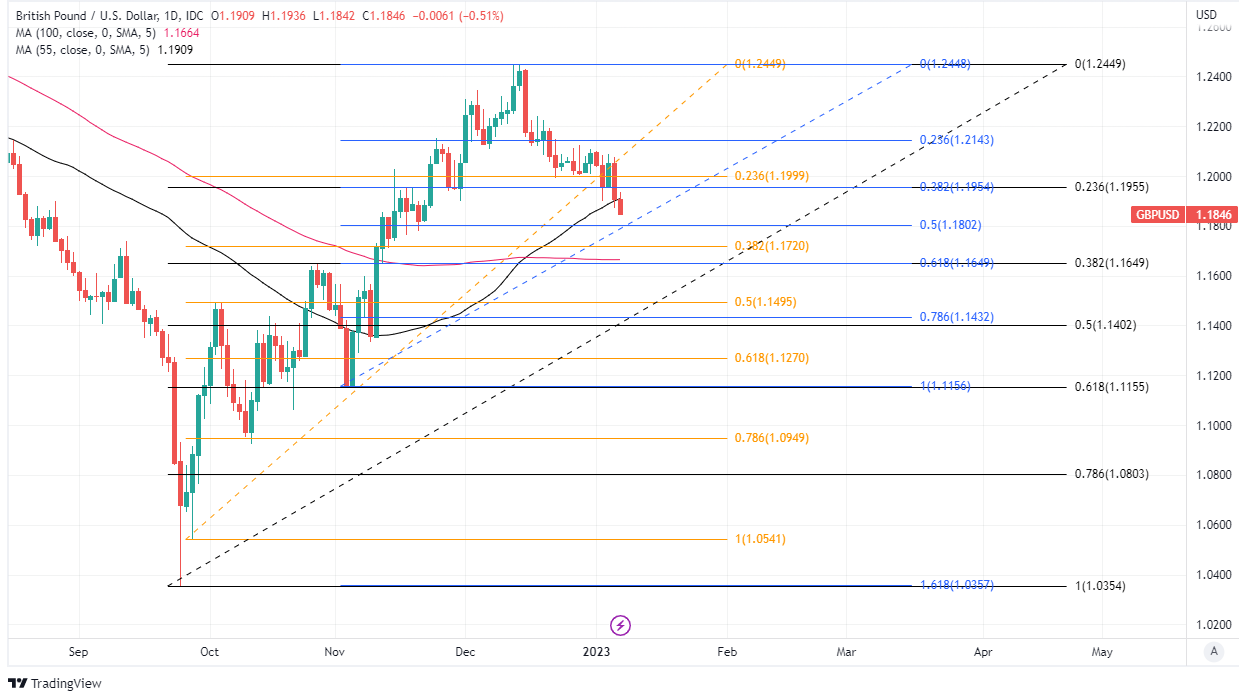

The Pound fell notably against a broadly stronger Dollar this week in price action that has taken Sterling back below 1.19 and seemingly invited a test of nearby technical support around 1.18 on the charts, although some analysts say losses as far as 1.1650 are also a possibility.

Sterling was one of the worst performing G20 currencies on Friday when rising against the Canadian Dollar, Swedish Krona, South African Rand and Japanese Yen while ceding ground relative to all others in the basket amid a further strengthening of the U.S. Dollar.

Dollars were bought widely following data indicating that U.S. labour demand remained robust into year-end including the Automatic Data Processing Inc (ADP) payroll count for December and November's Job Openings and Labor Turnover Survey (JOLTS) from the Bureau of Labor Statistics.

"On balance, we expect sterling to remain soft and any stronger US jobs data could be worth a move to 1.1780/1800," says Chris Turner, global head of markets and regional head of research for UK & CEE at ING, ahead of Friday's non-farm payrolls report for December.

"A more obvious target at 1.1650 feels a little too far," he adds.

Above: Pound to Dollar rate shown at daily intervals with selected moving-averages and Fibonacci retracements of September, October and November rallies indicating possible areas of technical support for Sterling.

Above: Pound to Dollar rate shown at daily intervals with selected moving-averages and Fibonacci retracements of September, October and November rallies indicating possible areas of technical support for Sterling.

How much are you sending from pounds to dollars? Your potential USD savings on this GBP transfer: $1,702 By using specialist providers vs high street banks GBP to USD Transfer Savings Calculator

The Pound had appeared to stabilise around 1.19 on Thursday, a level that coincides closely with its 55-day moving average, but fell further in Friday's London session and might be at risk of extended declines in the days ahead.

Friday's losses brought the 50% Fibonacci retracement of November's rally around 1.1802 into view but could quickly see levels as low as 1.1649 tested if the Dollar rises further or if Sterling itself comes under pressure.

"With a 6M investment horizon, we would look for opportunities to get long of GBPUSD on dips below 1.20," says Stephen Gallo, European head of FX strategy at BMO Capital Markets.

"Using a short-term investment horizon again, we would be inclined to sell the 1.22 level in cable," Gallo writes in a Thursday research briefing.

While demand for the Dollar was the dominant driver of GBP/USD losses this week, data emerging from the UK economy has done little to encourage an appetite for Sterling and could yet incite further selling up ahead.

Above: Pound to Dollar rate shown at daily intervals with selected moving-averages and Fibonacci retracements of September, October and November rallies indicating possible areas of technical support for Sterling. Click image for more detailed inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Above: Pound to Dollar rate shown at daily intervals with selected moving-averages and Fibonacci retracements of September, October and November rallies indicating possible areas of technical support for Sterling. Click image for more detailed inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

"There would initially be more downside in sterling if UK wage and inflation developments push the BoE towards an even more dovish policy stance over the coming months," Gallo warns.

S&P Global PMI figures suggested on Friday that Britain's construction sector fell deeper into recession in December while Halifax figures indicated a -1.5% fall in house prices barely days after the Bank of England (BoE) data showed mortgage approvals falling to their lowest in November since May 2020.

Other BoE data showed households turning increasingly to credit and corporate expectations for inflation remaining elevated at multiples of the BoE's target, while other S&P Global PMI surveys warned that the UK economy was likely in recession during the final quarter.

"The week's economic data was consistent with our view that 2023 is likely to see a shallow recession. But the extent of the collapse in housing market activity in late-2022 is a concern," writes Andrew Goodwin, chief UK economist at Oxford Economics, in a Friday research briefing.

"We remain optimistic that the correction in prices will be limited to the low double digits, but the risk of a bigger correction – with larger spillovers to the real economy – is very real," he adds.

Above: Pound to Dollar rate shown at weekly intervals with selected moving-averages and Fibonacci retracements of 2021 fall indicating possible areas of technical resistance for Sterling. Click image for more detailed inspection. If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.

Above: Pound to Dollar rate shown at weekly intervals with selected moving-averages and Fibonacci retracements of 2021 fall indicating possible areas of technical resistance for Sterling. Click image for more detailed inspection. If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.