UK Government Bond Yields Highlight Uncertainty Over BoE Forecasts

- Written by: James Skinner

Image © Adobe Images

Fluctuations in government borrowing costs saw the 'yield curve' tip and turn between flat and steep formations in year-end trade and price action suggesting that investors may think the latest Bank of England (BoE) forecasts are too gloomy in their outlook for the UK economy.

British government bond yields rose in volatile year-end trade on Friday and at times the levels of the 02-year, 10-year and 30-year yields reflected an upward-sloping yield curve that would typically only be seen in market conditions where investors have positive expectations for the UK economy.

For instance, during European trade in London the 02-year, 10-year and 30-year yields were seen at 3.67%, 3.71% and 4.01% respectively at one stage and in contrast with the shape of yield curves elsewhere in the world including in the U.S. and Germany.

One way of interpreting this is that the bond market thinks the economy is strong and that BoE forecasts of a deep and protracted recession up ahead are overly gloomy, which would also suggest upside risks to investor expectations for Bank Rate.

"In the MPC’s November Monetary Policy Report projections, conditioned on the elevated path of market interest rates at that time, the UK economy was expected to be in recession for a prolonged period and CPI inflation was expected to remain very high in the near term," the BoE said in December.

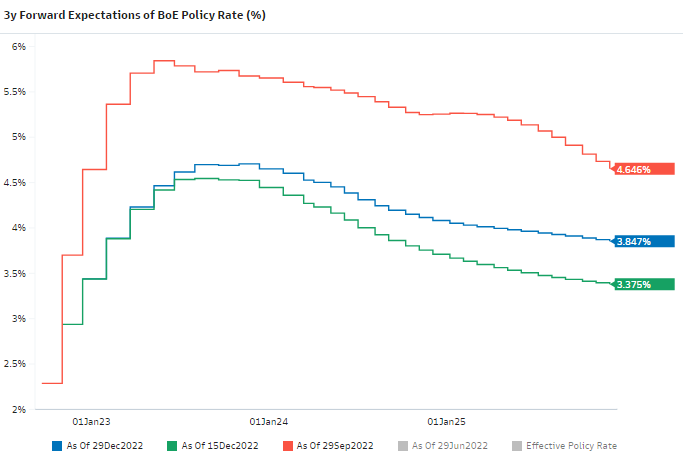

Above: Changes in market-implied expectations for BoE Bank Rate at selected intervals. Source: Goldman Sachs Marquee. If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.

Above: Changes in market-implied expectations for BoE Bank Rate at selected intervals. Source: Goldman Sachs Marquee. If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.

"Inflation was expected to fall sharply from mid-2023, to some way below the 2% target in years two and three of the projection. This reflected a negative contribution from energy prices, as well as the emergence of an increasing degree of economic slack and a steadily rising unemployment rate," it added.

Friday's fluctuations in bond yields came amid reduced trading activity in financial markets and a quiet period for the UK economic calendar, although Friday brought with it the release of better-than-expected house price data.

The Nationwide House Price Index fell by -0.1% in December when economists looked for a -0.7% reading while for 2022 overall the barometer rose by 2.8% when economists had looked for only a 2.3% increase.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"Both of these data points are consistent with the market notion that the BoE's growth forecasts are too gloomy and some of its inflation forecasts too low.

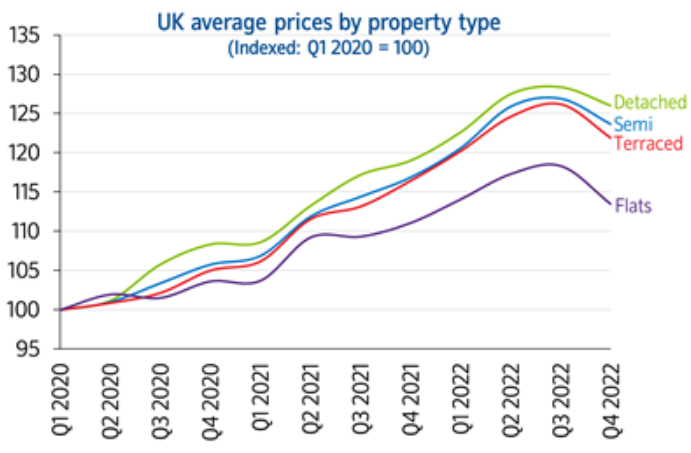

"The slowdown in house price falls in December is little comfort when leading indicators point to further sharp declines," writes Andrew Wishart, a senior property economist at Capital Economics, in a review of Thursday's data.

"Despite mortgage rates edging lower in recent weeks, we continue to think that both further falls in mortgage rates and lower house prices are needed before house prices can stabilise," he adds.

Source: Nationwide House Price Index.

Source: Nationwide House Price Index.