Cryptocurrencies to Remain Supported by Lingering Excess Liquidity: Oxford Economics

- Written by: Gary Howes

Above: "The market structure hasn't changed" - Oxford Economics.

Despite a series of well-publicised failures and significant loss of capitalisation, the cryptocurrency market remains relatively unchanged in structure and is likely to remain supported by current levels of global liquidity.

This is according to new research from independent research and consultancy firm Oxford Economics.

"We're left with an overarching impression of how oddly little seems to have changed, including crypto's negligible impact on the real economy," says Tamara Basic Vasiljev, Senior Economist at Oxford Economics. "The structure of crypto markets has barely budged since their peak in November 2021."

In November 2021 cryptocurrency market capitalization reached almost $3tn as speculators bought into what they considered the most promising cryptocurrencies in a time of substantial returns, but the market has since crashed to less than $1tn.

The raising of interest rates at global central banks and an associated decline in liquidity are widely considered a driver of the industry's reversal.

"Consolidation among the smaller coins and exchanges is ongoing but the market shares of the biggest three – Bitcoin, Ethereum, and Tether – are almost unchanged," says Vasiljev.

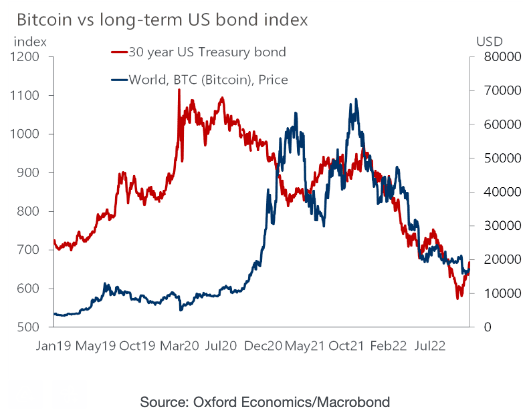

Analysis from Oxford Economics reveals that although crypto valuations have taken "a severe beating", closer inspection shows that long-term fixed-income indices and much of the tech sector have shared a similar fate:

Above: "The fixed income market has shared crypto's destiny at the long-end" - Oxford Economics.

It also finds that the experience of recent months confirms cryptocurrencies lack an economic-use story, particularly as an inflation hedge.

"But assuming no regulatory ban, crypto seems likely to survive as just another risk asset," says Vasiljev.

Her research has looked at the similarities between cryptocurrencies and alternative risk assets and finds a common driver leaps out: monetary (and fiscal) profligacy, which has enabled the broader upsurge in asset prices since the global financial crisis, especially post-pandemic.

"Policy tightening is continuing (through both policy rate hikes and balance sheet reduction), but global liquidity is still excessive. Inflation has eroded some of the swollen stock of money, but it's still about 15% above the pre-pandemic level in real terms," says Vasiljev.

She says this ongoing excess liquidity could explain the durability of crypto markets and may also indicate room for future upswings in risk assets.

"Though the real economy is likely to worsen before it gets better, excess liquidity is still sloshing around, so the crypto story (and perhaps broader rich valuations) may yet swing around," she says.