Goldman Sachs Cuts Odds of UK Recession

- Written by: Gary Howes

Image © Adobe Images

The surprisingly strong UK GDP data announced midweek leads economists at Goldman Sachs to revise higher their growth forecasts for the economy and lower expectations for a recession taking hold.

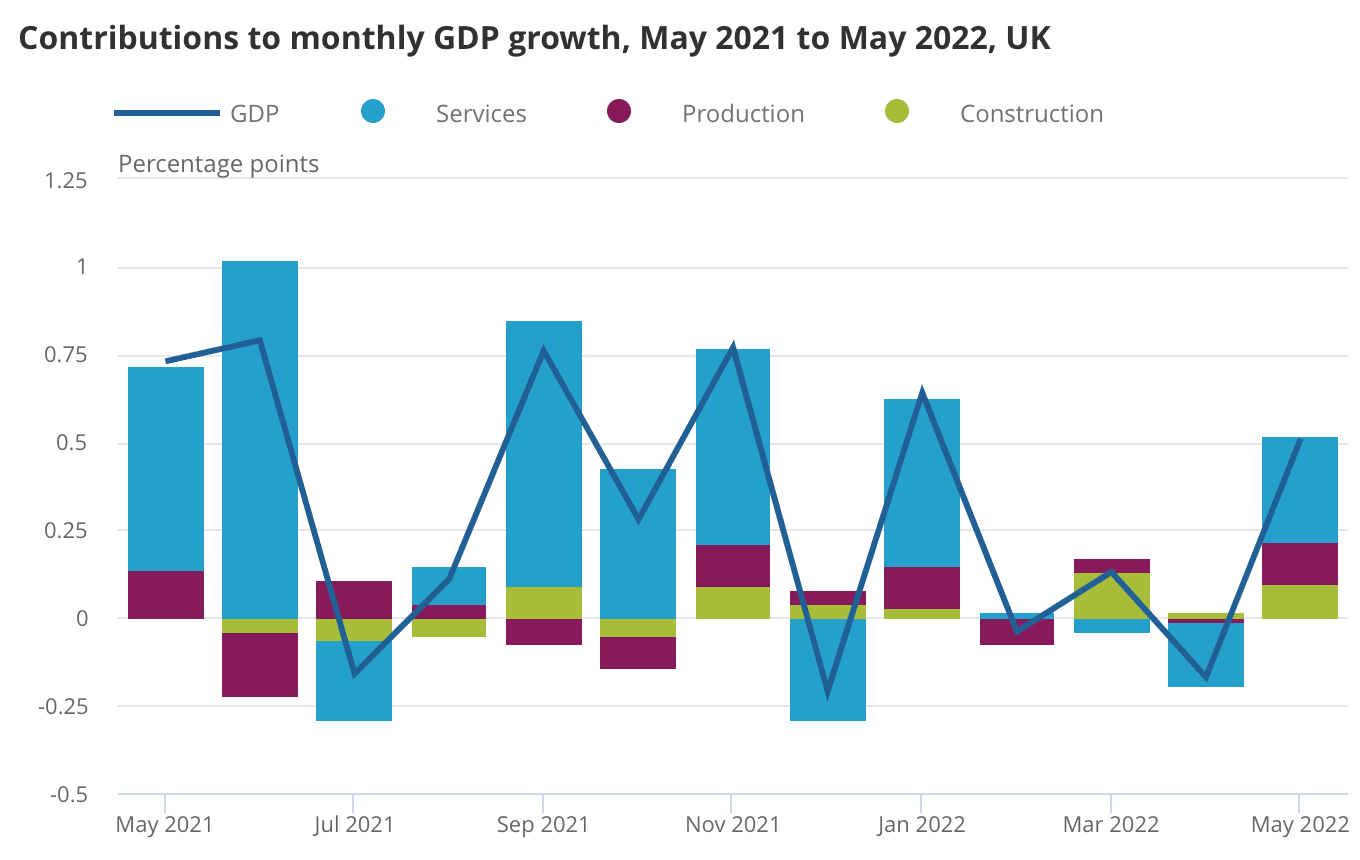

UK GDP rose 0.5% in the month to May said the ONS, beating expectations for growth of 0.1% and signals a return to growth from the -0.2% posted in April.

In the three months to May the economy grew 0.4% which bettered a consensus forecast of 0%.

"The strength in May was fairly broad-based, with positive growth in services, production and construction," says economist Steffan Ball at Goldman Sachs.

All components of the UK economy contributed to the better than expected data: manufacturing production increased 2.3% in the month to May against a consensus forecast for 0.2%. Industrial production grew 0.9% against expectations for flat output and construction output increased 4.8% against the 4.4% expected.

The all-important index of services - important because it represents the largest sector of the UK economy - rose 0.1%, beating expectations for -0.1%.

"Folding in both the back revisions and the surprising jump in activity in May boosts our estimate of Q2 GDP growth from -0.7% to +0.3%," says Ball.

Goldman Sachs assume some of the positive momentum will continue into the coming months, which leads them to expect third quarter GDP to increase by +0.4% (vs +0.1% previously).

"Given we no longer estimate Q2 growth to be negative, we are lowering our recession probability for the year ahead to 35% (from 45% previously)," says Balls.

This is now just slightly higher than in the U.S. where odds of a recession sit at 30%.

But the odds are lower than in the Eurozone where Goldman Sachs' economists price odds of a recession at 50%.