New Restrictions Loom Over London as Research Shows UK Can Ill Afford another ‘Lockdown’

- Written by: James Skinner

Image © Adobe Images

The coronavirus-contaminated United Kingdom is among the least able to afford the economic carnage that would surely come with another national shutdown, new research showed this week, as parts of the country including London were walloped with fresh restrictions on Thursday.

London, arguably the world’s financial capital and its champion of foreign exchange trading, was the latest to fall victim to so-far unsuccessful government attempts to contain the pneumonia-inducing coronavirus.

The capital, which is thought to be home to more than 9 million people and nearly 15% of the entire population, was subjected Thursday to so-called Alert Level High - level two out of a three-tier system of restrictions.

This means social contact between households is now prohibited and pubs as well as some other hospitality venues must close by 22:00. Socialising in groups of more than six is also prohibited.

“And although you may continue to travel to open venues, you should reduce the number of journeys where possible,” says Matt Hancock, health secretary, in a statement to parliament. “Things will get worse before they get better. But I know that there are brighter skies and calmer seas ahead. That the ingenuity of science will find a way through. Until then, we must come together. Because we all have a part to play to defeat this dreadful disease.”

Essex, Elmrbidge, Barrow-in-Furness, York, North East Derbyshire, Erewash and Chesterfield have also been placed into the high, or level two category.

Source: UK Government.

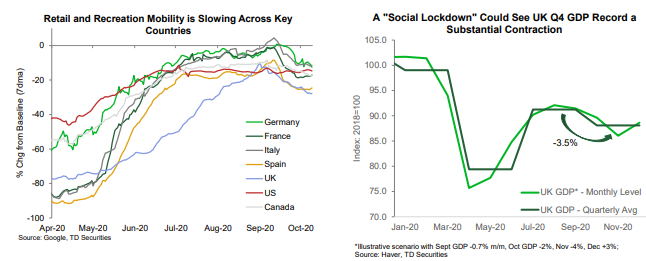

"The ONS' Business Impact of Covid-19 survey shows business turnover has flatlined since late August. Google Trends data point to fading demand for consumer services; people are travelling less too," says Samuel Tombs, chief UK economist at Pantheon Macroeconomics. "A "circuit breaker" plausibly would result in a fresh hit to GDP of about 4.5%."

Infections have risen sharply since mid-August and suggest a second wave that is far larger than the first, although hospitalisation and fatality numbers tell a different story that may or may not be because those infected with the respiratory ailment are of lower age and other lesser risk groups.

The new restrictions are a far cry from those seen in the first-quarter when the country was effectively placed under a form of house arrest but they do nonetheless impair an economic recovery that was already waning, and at a point when HM Treasury is beginning to quibble over the bill for such measures, which are also expenditures.

“UK growth is perilously close to falling into negative territory in Q4,” says James Rossiter, global head of macro strategy at TD Securities in a Tuesday note.

Source: TD Securities.

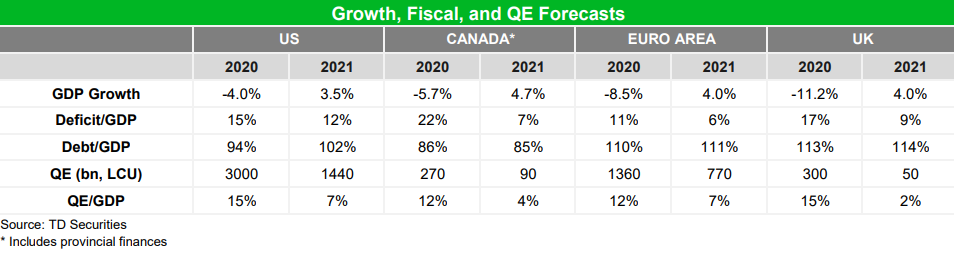

“We look for deficits to remain elevated through next year and beyond, and for public debt to remain historically high. But as we explained in a piece earlier this year, most countries should be able to sustain their higher debt/GDP ratios. The UK remains on the risky end of the spectrum,” Rossiter adds.

TD Securities, a Canada-headquartered global investment bank, found this week that economic activity in the UK, U.S., Canada and Euro area remains between -4% and -9.5% below pre-pandemic “counterfactual paths.”

Debt-to-GDP was already forecast to rise above that of the U.S. this year and to rival the ratio seen in the Euro area, before a combination of economic recovery and lesser borrowing was expected to bring the ratio back down next year.

The latter reduction might be placed at risk if current enhancements of restrictions or any further measures that might yet be announced once deeper into the winter period were to scupper the recovery and necessitate fresh increases in spending.

Source: TD Securities. June 2020.

Further restrictions are a rising risk to the recovery given that politicians, other policymakers and some pundits continue to call for a so-called circuit breaker ‘lockdown’ in which non-essential businesses would be closed and individuals largely confined to their homes.

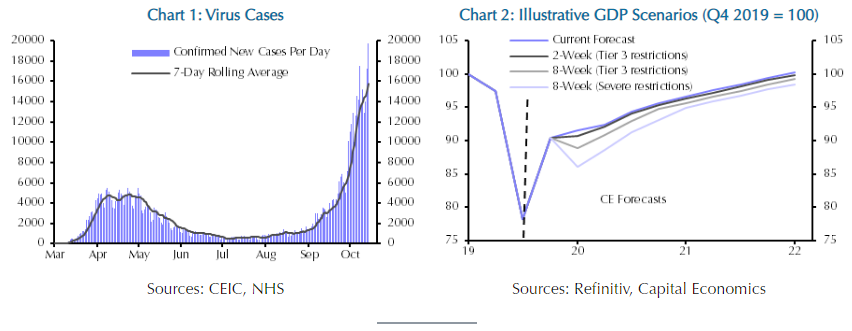

“A “circuit-breaker” lockdown where most pubs and restaurants are closed across the country would throw the economic recovery into reverse and mean that, depending on the severity and length of restrictions, it could be well into 2023 before GDP regains pre-crisis levels,” says Thomas Pugh at Capital Economics.

Office for National Statistics (ONS) depicted an underwhelming economic performance for August last week, when hospitality businesses benefited from Chancellor Rishi Sunak's Eat Out to Help Out scheme that was responsible for more than half the 2.1% increase in GDP reported.

Many economists had forecast a GDP rebound of more than twice that, with the consensus having looked for an expansion of 4.6%. The data marks a slowdown from the 6.6% rebound seen in July.

Source: TD Securities. June 2020.

GDP data came ahead of other figures revealing a sharp increase in the unemployment rate from 4.1% to 4.5% for three months to the end of September, although economists including those at Capital Economics forecast a final quarter increase to 8% even before this week's new restrictions.

October's winding down of the furlough scheme, which is to be replaced by a less generous scheme covering two thirds of wages for those who still work at least a third of their hours, is expected to lead to a wave of job losses.

“We think that the restrictions already in place will mean that GDP doesn’t rise at all in October, November or December,” Pugh writes in a note to Capital Economics clients. "Overall, any sort of nationwide lockdown would cause GDP growth to shrink again. It would also mean that the government and the Bank of England would have to up their policy support again."

Beyond crushing output in the affectted sectors, restrictions can harm household, consumer and business confidence beyond the areas in which those measures related to. This, and the winding down of HM Treasury support for the economy, is why even before Thursday's new measures GDP was expected to stall in the final quarter.