Dollar Pierces Major Trendline Against Swiss Franc as Bullish Trend Grows

- USD/CHF has broken above a key chart level which opens the door to further gains

- The pair's upside potential may stretch to 1.0250

- Commerzbank posits a more conservative target at 1.0039

© moonrise, Adobe Stock

The US Dollar has reinforced its uptrend against the Swiss Franc after breaking through a key make-or-break level on the USD/CHF chart.

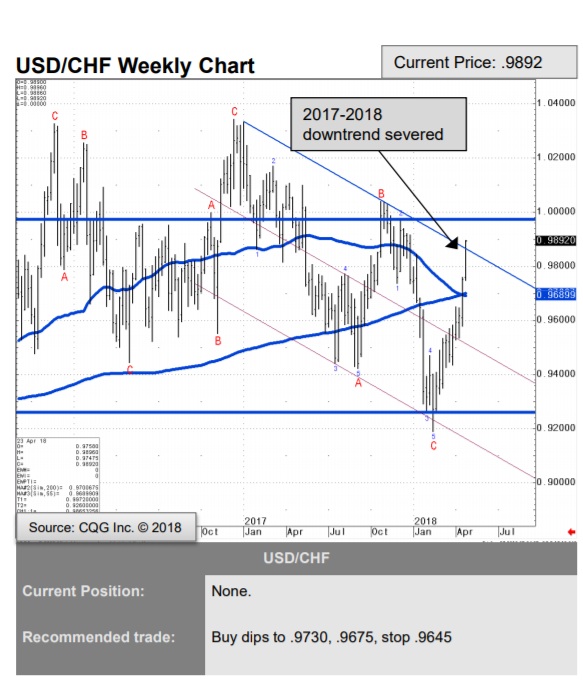

Analysts are turning increasingly bullish the Dollar against its Swiss rival after the exchange rate broke above a major trendline drawn from the 2016 peak down through 2017/18.

The piercing of a major trendline is a very bullish technical indicator for a currency pair and usually suggests more upside on the horizon.

"USD/CHF has overcome the 78.6% retracement at 0.9857 and the 2017-2018 downtrend at 0.9858. We will need to see a weekly close above here to confirm the break," says Karen Jones, an analyst at Commerzbank.

As of Monday morning the pair remains well above the trendline so it is safe to say it managed to close above the trendline at the end of the previous week.

The 1-3 week future outlook for the pair is bullish according to Jones, who expects a move higher to a target at 1.0039.

Image (C) Commerzbank.

Our own view is that the pair may move substantially higher. The usual method for forecasting how high a break above a trendline will follow through is by taking the length of the move immediately prior to the trendline (labeled 'a' above) and extrapolating it higher above the trendline (labeled 'b'). Such a method generates an upside target of about 1.0250, according to our calculations.

Commerzbank is not the only bank which sees further upside on the horizon, so does Swissquote.

The pair is forming a bullish pattern which recommends more upside, according to Peter Rosenstreich, head of a market strategy bullish breakout, Swissquote.

"The technical structure suggests short-term upward moves," says Rosensteich who is also bullish longer-term ever since the Swiss National Bank unpegged the Franc.

"The technical structure favours a long-term bullish bias since the unpeg in January 2015," says the analyst.

One proviso to the ultra-bullish stance of these analysts is Karen Jones's observation that the Demark indicator has signaled exhaustion on intraday charts, which is short-term bearish.

"Caution is warranted near term as we have 13 counts on the intraday charts," says Jones.

However, this is unlikely to impact on the more constructive outlook of the weekly charts.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.