Pound-Franc Rate Expected to Break Through Support

Image © Adobe Stock

- GBP/CHF steep downtrend forecast to continue

- Support at 1.1790 currently supporting but vulnerable

- Main driver of Swiss Franc is global trade tensions

The Pound-to-Franc exchange rate is trading at around 1.1885 at the time of writing around 0.50% lower this week so far.

Concerning the outlook, studies of the charts indicate the downtrend remains dominant and intact despite the pair reaching key historic lows, and this suggests a bearish bias over the short-term.

The 4 hour chart - used to determine the short-term outlook, which includes the next 5 days - shows the pair having fallen to the key 2016 lows at around 1.1790 and then bouncing.

The overarching trend is down, and likely to continue. But a break below the 2016 lows, signalled by a breach below 1.1780, would provide the green-light for any continuation lower.

The next downside target is located at 1.1700.

The chart contains some bullish signs too: there is a possibility it could be forming an ABC correction with wave C higher still to unfold. If so then a break above the 1.1950 highs could confirm such a move higher, to a target at 1.2000.

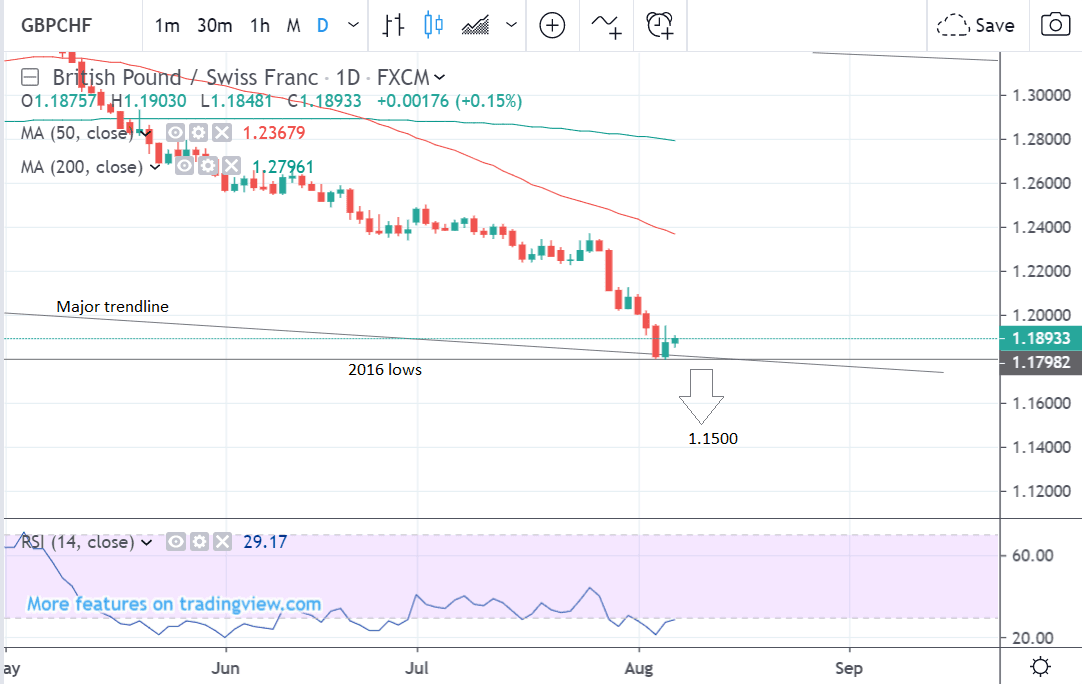

The daily chart shows the pair in a strong downtrend which has paused at the level of the 2016 lows and a major trendline.

Because of the strong downtrend the outlook continues to be bearish over the medium-term and a break below the 1.1793 lows would probably provide the green-light for a continuation down to targets at 1.1600 or even 1.1500.

Although the RSI momentum indicator is in the oversold zone below 30, which is a signal the pair may have sold off to an extreme and be due a bounce, however, it's not enough to signal an outright reversal of the trend, and any bounce is likely to be short-lived before the overarching downtrend resumes.

The daily chart is used to give an indication of the outlook for the medium-term, defined as the next week to a month ahead.

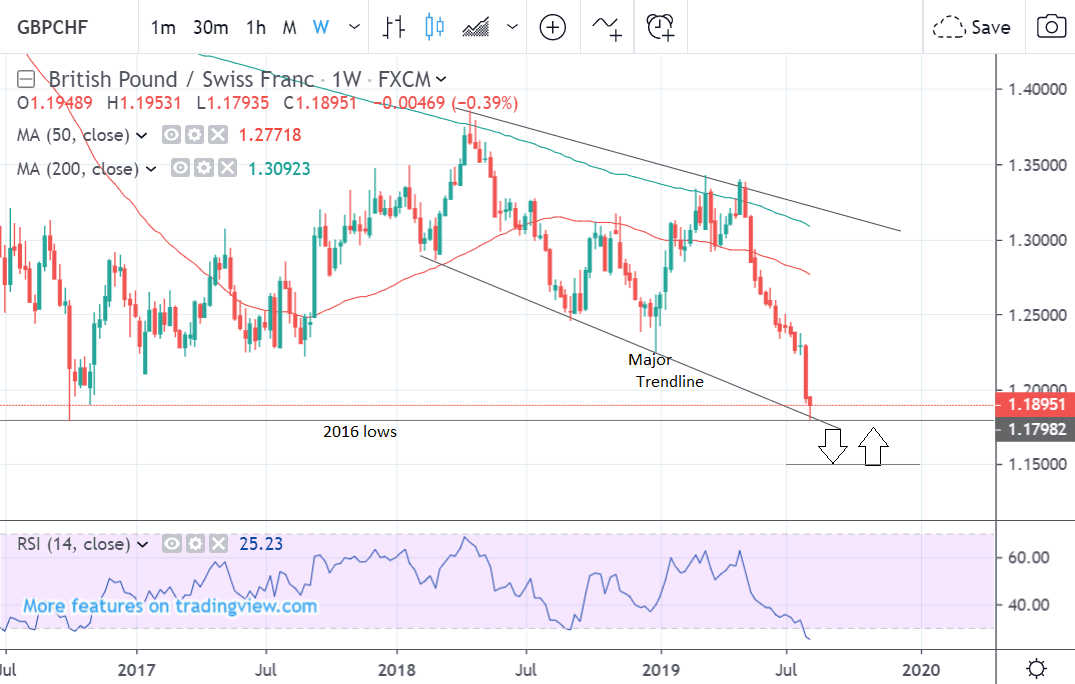

The weekly chart - used to give us an indication of the outlook for the long-term, defined as the next few months - shows how the pair has reached a major support level on the chart.

This is likely to suggest the possibility of a bounce, and although this could be the case, it is too early to say whether it will result in a reversal of the trend.

The dominant downtrend is so steep and powerful it means the bias is down.

The next major target to the downside is 1.1500, at which point there will probably be an increasing risk of a more substantial rebound higher, back up to the 1.17s in the long-term.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement