Pound / Swiss Franc Uptrend Stalls at Trendline

Image © Adobe Images

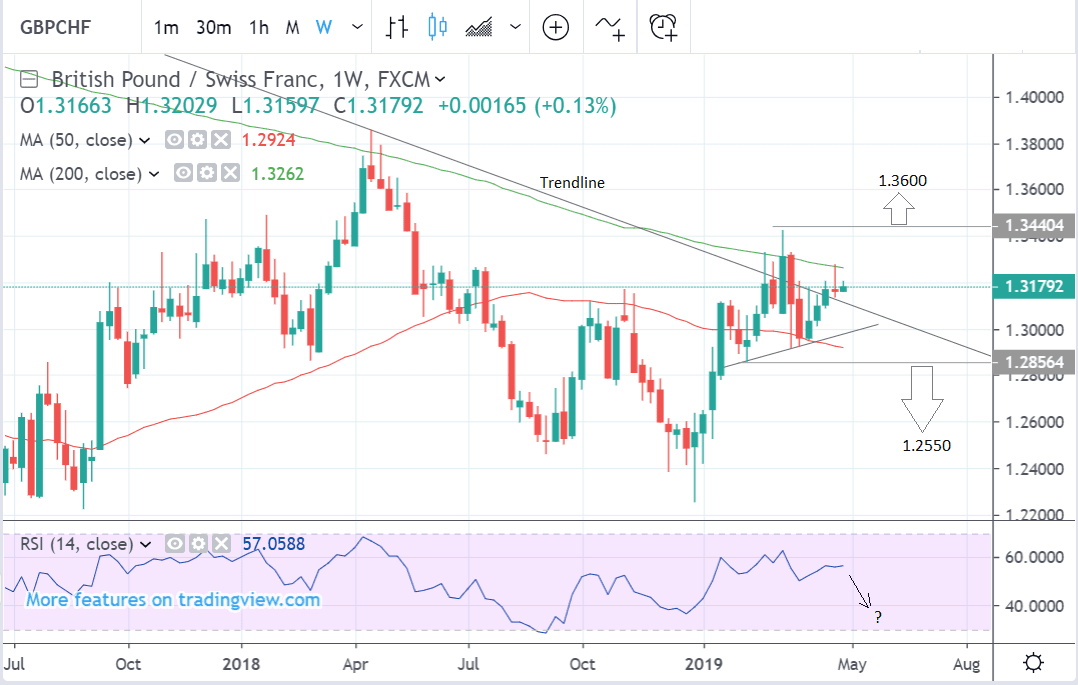

- GBP/CHF has stalled at trendline and gone sideways

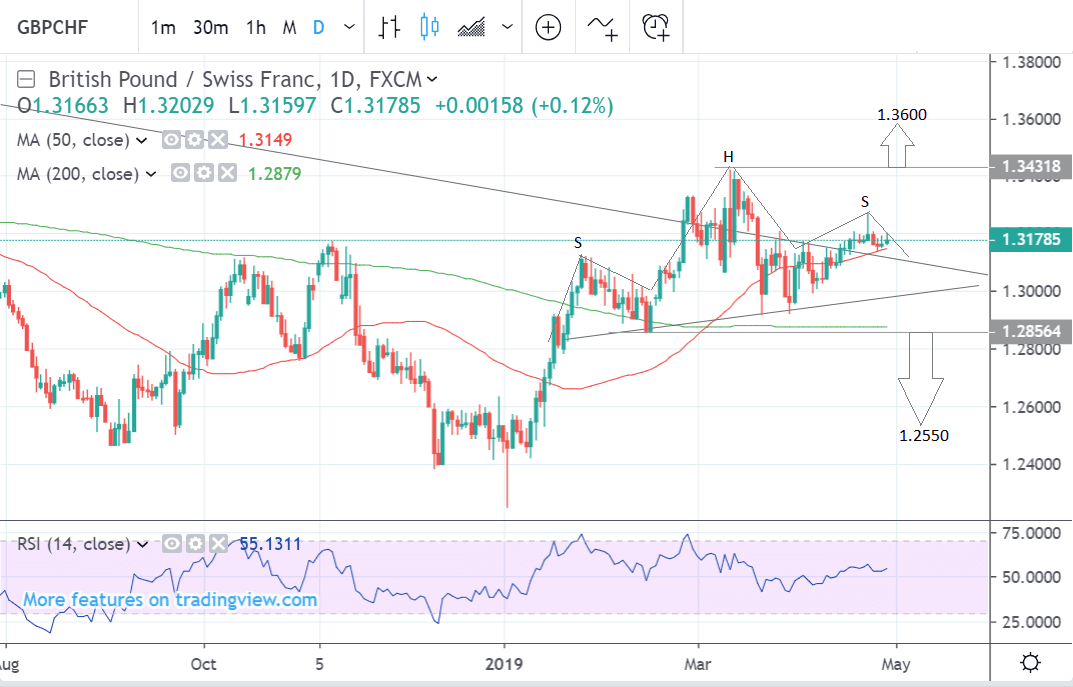

- H&S pattern on weekly chart is bearish

- Swiss Franc to take cue from risk trends

The Pound-to-Franc exchange rate is trading at 1.3182 at the time of writing, and our technical studies suggest the pairs rapid 2019 ascent will struggle to extend in the short-term.

Having risen up fairly rapidly at the start of 2019, the pair has found resistance at a major, multi-year, down-sloping trendline where it has stalled and entered a range-bound consolidation phase in the 1.28-1.34 region.

The most recent rally attempt during April stalled after touching resistance from the 200-week moving average (MA) at 1.3274.

A clear break above the March highs at 1.3423 could provide confirmation of a continuation up to a target at 1.3600 or higher, although this probably wouldn't happen inside of 1-3 months.

Alternatively, a break below the 1.2854 lows would signal a much more bearish outlook for the pair with a downside target at 1.2550, reachable within 2-4 weeks.

On the daily chart price action shows the formation of a possible head and shoulders (H&S) topping pattern. This is composed of three peaks, the central one of which is the tallest (the head), and the two either side shorter, but of a similar height (the shoulders). Incidentally, Tuesday’s exhaustion spike peak and Japanese gravestone dojis (both on the daily and weekly) could be a sign the right shoulder of the H&S is completing.

It is not absolutely certain this is a bona fide H&S. Normally the more reliable ones happen at the top of longer-term uptrends, but even so, if it is, and the pair breaks below the sloping neckline at 1.30, and more importantly also the key February lows at 1.2860, it could signal a slide down to a target at 1.2550, probably over the next 1-4 week timeframe.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The Swiss Franc: What to Watch Over Coming Days

Risk trends are likely to be the main driver of the Swiss Franc, which is a safe-haven asset and so appreciates when investors get fearful.

Chinese data is likely to be a major focus, therefore, for Swiss Franc traders as it is integral to global investor sentiment. In the week ahead, this means Chinese Markit and Caixin manufacturing activity in April, out on Tuesday at 2.00 BST and Thursday at 2.45 respectively. The main question is whether the PMIs can maintain their unexpected rebound in March.

“Investors should wait before counting their chickens as the official manufacturing gauge (Tuesday) is predicted to stay unchanged at 50.5 in April, while the Caixin PMI (Thursday) is forecast to edge only marginally higher to 50.9,” says Raffi Boyadijian, an economist at FX broker XM.com.

Clearly, a disappointment will weigh on sentiment but boost the Franc, whilst vice-versa for a stronger reading.

Oil is also a major influence on risk appetite and the Franc.

The recent surge in oil prices led to fears the high cost of fuel could weigh on global growth, however, last week the price of oil appeared to top and lost ground and is currently trading at $63.00, which is over $3.00 lower than its 2019 peak.

The probability remains that oil will rise further as Iran sanctions bite, and this could support the Franc.

“At present, all signs point to higher oil prices. If no real additional oil is brought onto the market, shortages will become visible within months. Statements made by U.S. president Trump and U.S. Secretary of State Mike Pompeo that Saudi Arabia and the UAE will add supplies to counter the loss of Iranian volumes are currently only wishful thinking, and not based on any hard promises from Riyadh or Abu Dhabi,” says Dr. Cyril Widdershoven a global energy expert writing for oilprice.com.

Saudi Arabia is unlikely to open its taps to fill the gap in supply left by Iran as there is more of an incentive to keep oil prices higher, says Widdershoven. Oil at current or higher prices is ‘just right’ for Saudi Arabia’s economic diversification goals.

“For Saudi Arabia, additional production increases are not needed. The current price and production levels are sufficient to support the ongoing economic diversification plans, stabilizing the position of Crown Prince Mohammed bin Salman. Oil market stability has also generated enough positive sentiment in the market that NOCs like Aramco are able to enter the international bond market by force. Low cost financing is an attractive tool for Saudi Arabia and the UAE to boost their economies in the short run,” says Widdershoven.

On the domestic front, there is much data also out for the Franc in the coming week, including retail sales, manufacturing PMIs, the KOF leading indicator and consumer confidence and inflation data.

The KOF leading indicator for April is out at 8.00 BST on Tuesday and is forecast to show a fall from 96.9 to 97.4.

The KOF is a fairly reliable leading composite indicator for the Swiss business cycle.

Another major leading indicator is consumer confidence which is out at 6.45 on Friday. This is expected to show a balance of -3 in Q2 from -4 previously. This still indicates a marginally pessimistic overall outlook.

Swiss inflation in April is out at 7.30 and forecast to show a slowdown of 0.2% from 0.5% in the previous month. Year-on-year it is expected to show a continued 0.7% rise, when stats are published at 7.30 on Friday.

Retail sales is forecast to show a marginal -0.2% decline in March from a year ago, when it fell by -0.4% when it comes out at 7.30 on Thursday.

Manufacturing PMI in April is expected to rise to 50.5 from 50.3 when it is released at 8.30 on Thursday.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement