Pound-Franc: Case for Gains after Break Above Trendline and Formation of Bull Flag

Image © Adobe Images

- Break above trendline likely to signal more upside

- Formation of bull flag and ‘buyzone’ pullback, further bullish signs

- Both Pound and Franc sensitive to Brexit outcome

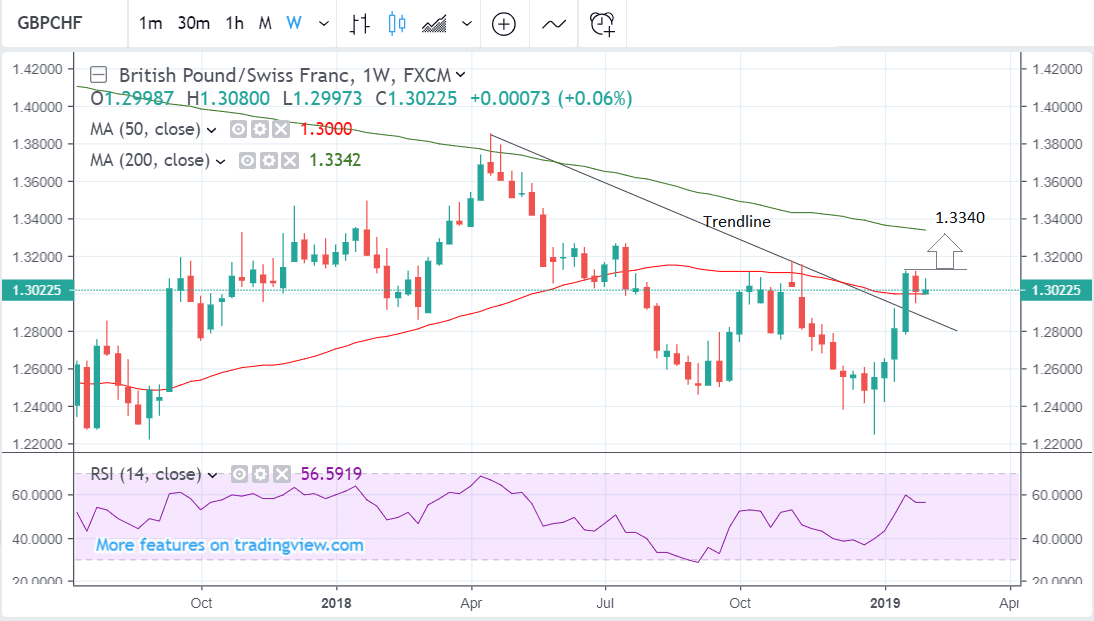

The Pound-to-Franc exchange rate has broken above a major trendline and is consolidating before a probable extension higher. Longer-term it is predisposed to more upside should Brexit tensions unwind.

From a technical point of view, the pair has now successfully broken above a trendline drawn from the April 2018 highs, and although it has spent the last week pulling back, the expectation is for the uptrend to resume and extend higher.

An initial target of 1.3250 is forecast as stipulated in our previous analysis. This would be followed by a target at 1.3340 at the level of the 200-week moving average (MA) as large moving averages often provide tough resistance to trending prices.

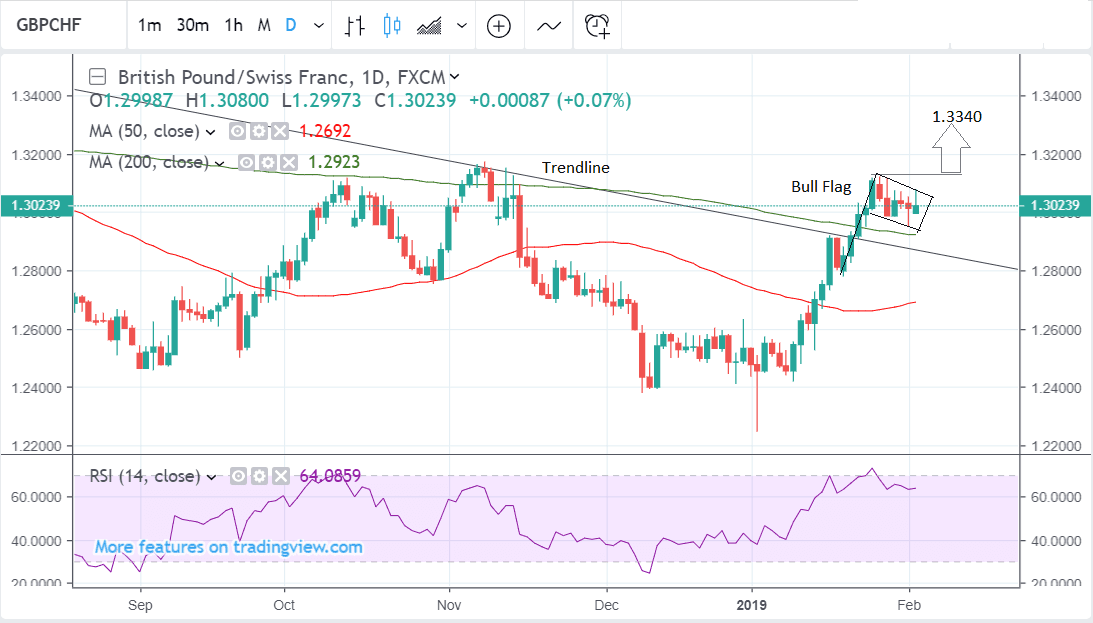

The pair has probably formed a ‘bull flag’ continuation pattern on the daily chart which indicates further probable upside for the exchange rate conditional on a break above the 1.3120 highs.

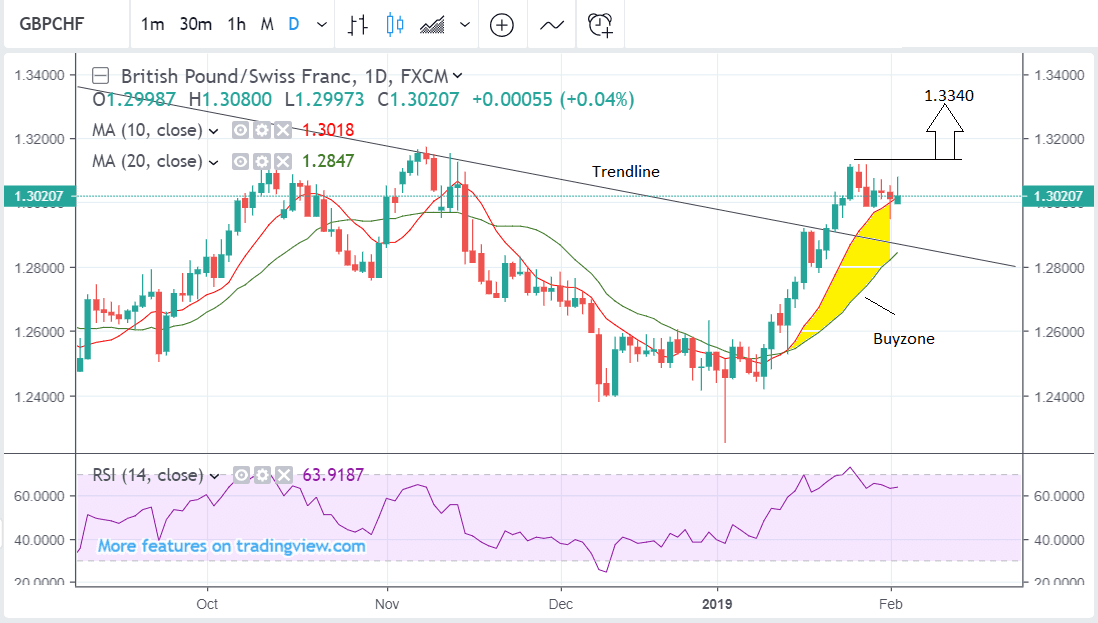

GBP/CHF has pulled back into the space between the 10 and 20-day MAs - an area some call the ‘buyzone’ because there is a higher-than-average chance of a resumption of the uptrend - this further suggests upside potential for the pair.

Normally an additional ingredient required to confirm a resumption higher is for price action to form a bullish candlestick in the ‘buyzone’. This has not happened yet but if it does it will provide a strong bullish continuation signal.

The RSI momentum indicator has just moved out of the overbought zone and although this is a signal the exchange rate could be reversing, we do not think the shallow pull-back in the price-action which accompanied the signal supports a probable reversal, instead, we see a probable correction before the uptrend resumes.

GBP/CHF is likely to be more sensitive than most pairs to a radical change in Brexit sentiment. The Swiss Franc is a safe-haven currency, which means it rises when markets are in turmoil. The current broad backdrop of uncertainty due to Brexit has probably strengthened the Franc as investors have favoured it as a safe place to entrust their capital.

Working in Sterling's favour from a fundamental perspective would be the sealing of Prime Minister Theresa May's Brexit deal over coming weeks. We have seen movement in this direction with Brussels hinting that a legal guarantee that the Irish backstop, if ever triggered in the future, could only ever be a temporary state of affairs. Should this satisfy a majority of UK parliamentarians, this could lead to a rise in GBP pairs.

The rise may be especially sharp in the GBP/CHF pair, because simultaneously as the Pound is rising, the Franc will probably weaken as flows reverse due to the uncertainty unwinding, and this would propel the pair even more rapidly higher than in a normal Sterling pair.

Most analysts think there is a very low probability of a 'no deal' Brexit and since most Brexit scenarios involving a deal would lead to an appreciation in Sterling, the outlook is generally held as bullish for the currency, and therefore even more bullish for GBP/CHF.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement