Pound Poised to Outperform Swiss Franc Near-Term

Image © Pavel Ignatov, Adobe Images

- GBP/CHF showing signs of basing and rising

- Pair may have formed bullish inverse H&S

- Potential for move to 1.28

GBP/CHF is trading with a marginally bullish bias at the moment, and technical studies are suggesting a preference for the Pound to rise further versus the Franc although the impending vote on Theresa May’s Brexit deal, and more importantly the aftermath, could shift the dial.

We are actually not looking for a massive move in response to the inevitable defeat of the Brexit deal, rather any big move in the future will come as clarity emerges as to whether a subsequent vote on the deal has a chance of succeeding. Therefore, the GBP/CHF exchange rate could be governed by technical considerations for some time yet.

GBP/CHF has recovered ever since the turn of the year when it appeared to bottom at the January 3 flash-crash lows. Since then it has risen steadily and is now at a level where it is arguably indicating a bullish reversal may be unfolding.

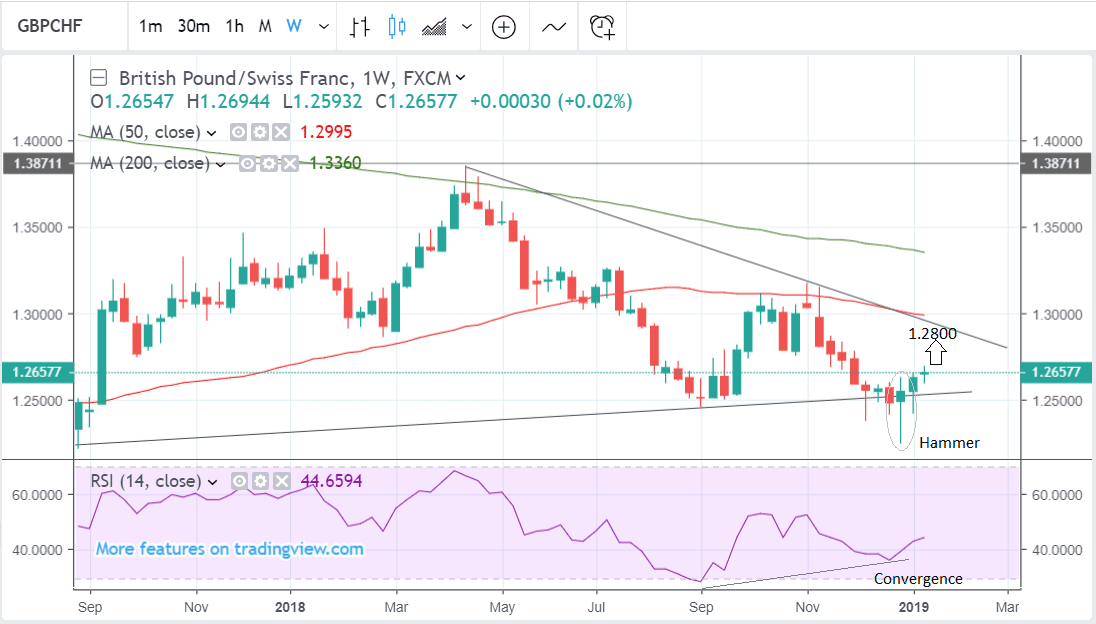

The bullish hammer which formed at the start of January is arguably a strong reversal sign in itself, especially in the way it punctuated the end of the downtrend.

Another bullish sign is the convergence between price and the RSI momentum indicator in the bottom panel, which suggests the crash lows lacked bearish conviction. Making the pair extra susceptible to a recovery.

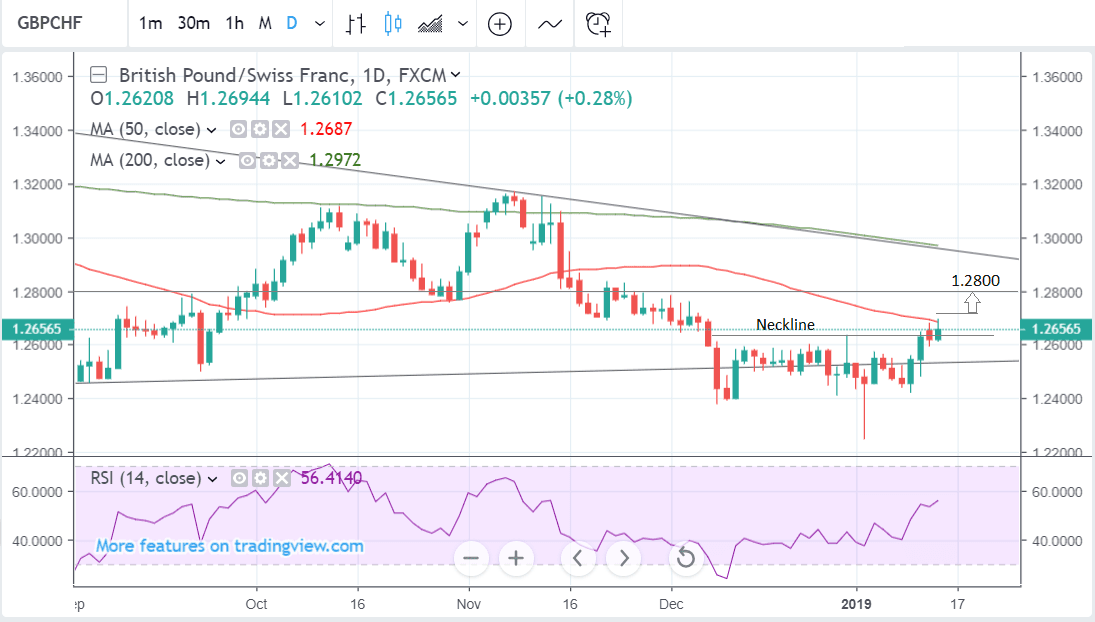

One obstacle standing in the way of further upside is the 50-day moving average (MA) on the daily chart and this suggests a risk of failure.

The MA would need to be clearly broken for the uptrend to get the green-light, with a break above the 1.2700 providing the necessary confirmation. Such a move would then be expected to extend higher to the 1.2800 level.

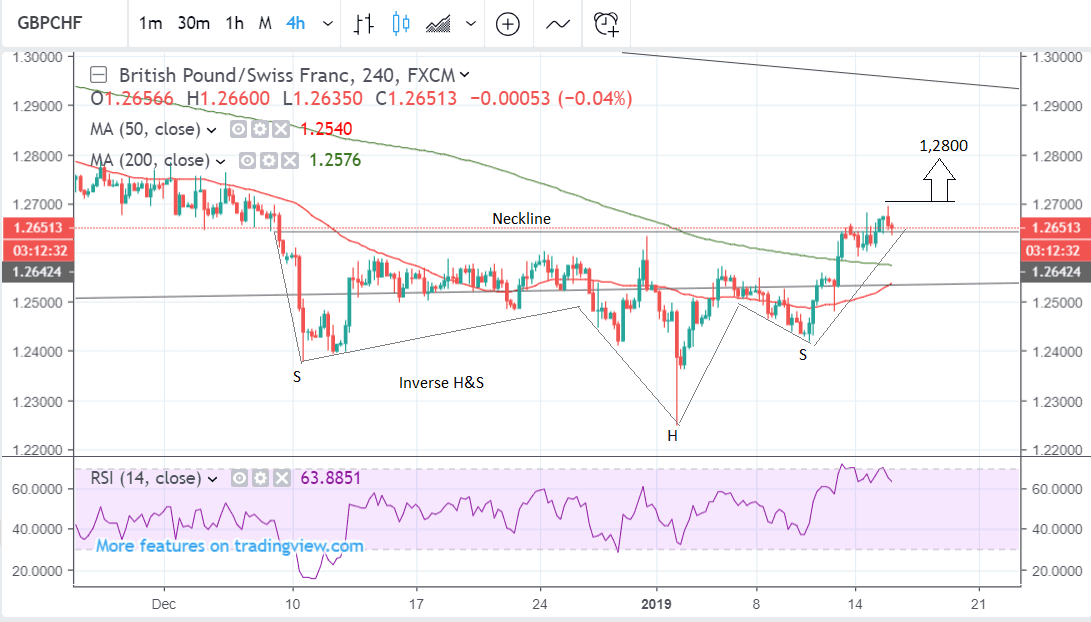

The pair also seems to have formed what looks like a basing pattern at the lows during December and January when it was trading mainly in the 1.24-26 zone.

The 4hr chart above shows the basing pattern in more detail: it looks like a bullish inverse head & shoulders pattern (H&S).

The exchange rate now actually looks like it has just broken above the neckline at the pattern highs, which is the green-light for a go-head higher. Although it is pulling back temporarily, it will probably recover and move up towards the 1.28 target.

A re-break above the recent highs and 1.27 would provide confirmation and suggest a minimum expectation upside target at the aforesaid 1.28, based on the height on the pattern extrapolated by 61.8% higher.

Prepare for moves in Sterling and order your ideal exchange rate in advance. Foreign exchange specialists at RationalFX will be working extended trading hours today to deliver advantageous rates to their clients. To get in touch with the team at RationalFX, please see here.