Swiss franc Poised for More Losses against Dollar, Pound as Risk Environment Changes

- Possible change in risk appetite signalled by Turkey's Lira

- CHF could be a loser if sentiment improves

- Technical indications are also bearish for CHF

A revival of investor risk appetite is weighing on safe-haven currencies like the Swiss Franc, and major Franc pairs are reaching key reversal levels.

The change in sentiment is reflected in the Turkish Lira's lack of downside even after the release of negative CPI data recently.

Normally vulnerable currencies are even more sensitive to weak data than usual, however, the Lira's resilience suggests investors may be changing their perception of risk.

Recent fears whipped up by the Italian budget controversy have flushed out many early adopters of the weak Franc position, and this has left the trade less crowded potentially helping the CHF weaken even more rapidly than before.

USD/CHF is seen as especially poised to make gains.

"Traders are poorly positioned for a USD/CHF rally that may go beyond the current year high," says Jeremy Boulton, an analyst at Thomson Reuters. "If USD/CHF tops its daily cloud top at 0.9885 and 100-DMA 0.9864, it may fly."

The 'cloud' Boulton is referring to is the red patch on a type of chart known as Ichimoku cloud charts, which are a Japanese invention designed to give a quick reference of the state of the trend.

When an asset price is trading above the cloud it is considered to be in a strongly bullish territory with a backdraught higher; and vice versa for when it is below the cloud.

The colour of the clouds indicates the general backdrop - which in this case is bearish because the colour is red. Nevertheless, this doesn't invalidate the bullish indication when prices break above the cloud.

Our own chart analysis adds further bullish evidence to that already mentioned by Reuters.

We note the three-bar continuation pattern which has also formed on the pair suggesting a high probability of further upside on the horizon.

The possibility of a breakout is further enhanced by the position of the ADX indicator which is rising and indicating a stronger trending market could be evolving.

A break above Wednesday's highs at 0.9926 would signal a probable continuation higher of about 100 points to 1.0026, although risk-averse traders might want to target the resistance level at 0.9980, initially.

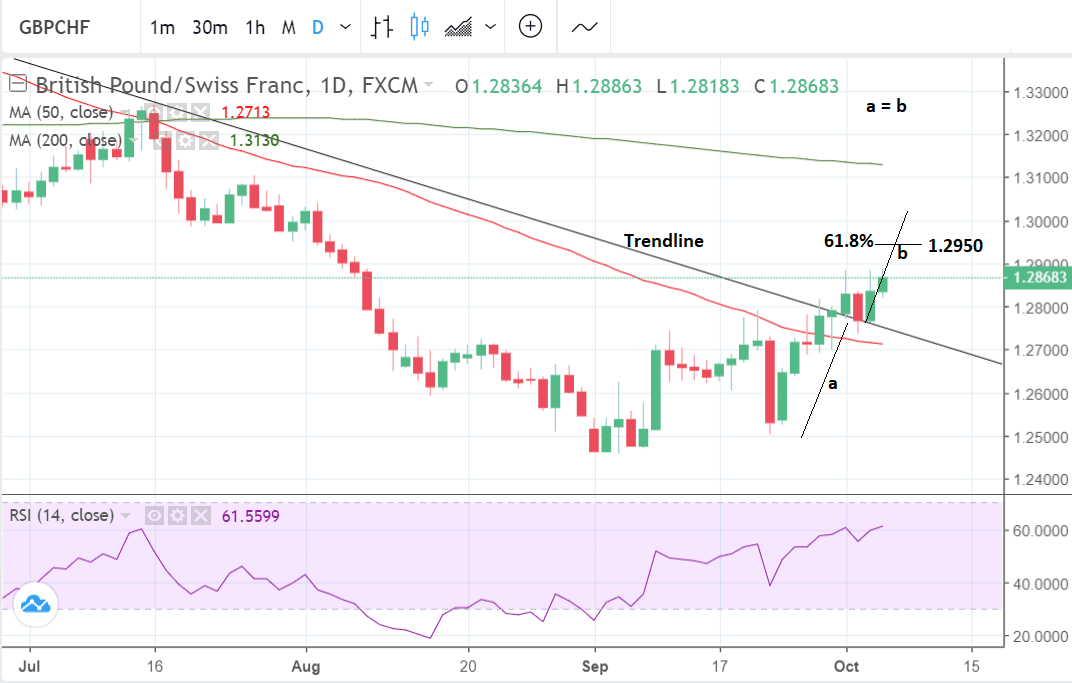

GBP/CHF is likewise poised for more gains too.

It has broken clearly above a major trendline and, after a brief pull-back, known as a 'throw-back' move, it has started to go higher again. This is a very bullish technical signal for the pair.

Prices normally follow-through the same distance after a trendline break (b) as the move immediately prior to the break (a), or for the conservatively minded trader at least 61.8% of the move.

This generates a conservative target at 1.2950 and an eventual target at 1.3010. A break above the 1.2884 highs would provide confirmation of an extension.

The strongly rising momentum, measured by RSI in the bottom panel is a further indicator the pair is likely to continue climbing.

The general look-and-feel of the price action at the lows since the pair bottomed in September appears redolent of a classic bottom.

The pair has also met the top of a red 'cloud' on the Ichimoku chart, and a break above it would constitute a game-changing moment for the pair, and alter the outlook to one encompassing a more bullish vista.