Which MPC Members Will Vote for Rate Hikes This Month?

With the crisis in Greece now receding from the headlines, following the agreement between the Greek government and its Eurozone creditors, focus in the currency markets is shifting back to the gaps in monetary policy which are opening up across the major currency areas.

Attention is now focused firmly on the Federal Reserve in the US, and of course, the Bank of England in the UK, as both central banks approach their first interest rate hikes since the financial crisis.

By contrast, most other G10 central banks remain in easing mode, most conspicuously the European Central Bank.

Recent hawkish commentary from Governor of the Bank of England Mark Carney suggests that rates in the UK could be hiked sooner than the markets had previously been expecting.

During a speech in July at Lincoln Cathedral, Carney gave his clearest indication yet that the time for a rate hike was getting closer by hinting at a rate move “around the turn of the year”.

The path of rate increases is likely to be gradual, with rates slowly normalising to round half the historic average. This implies a long term interest rate around the 2-2.25% level.

Notorious Bank of England hawk Martin Weale has also claimed he would soon vote for an increase, while even David Miles, one of the most dovish members of the MPC, has recently stated that the time for tightening in the UK was “close”.

More from Enrique Diaz

- Bank of England's First Interest Rate Rise in Spring 2016

- Why the Pound is Where it is

- Further GBP v USD Falls Will be Gradual

The minutes from the latest Bank of England meeting in July were similarly hawkish. Policymakers once again voted unanimously to keep rates unchanged for the seventh consecutive month at 9-0.

The then deepening crisis in Greece and ongoing financial market volatility in China played a role in maintaining unanimity, with “some” (most likely three or more members) mentioning Greece as the reason for maintaining rates. However, absent such uncertainty, it is clear that the decision to dissent would have been a much more finely balanced one.

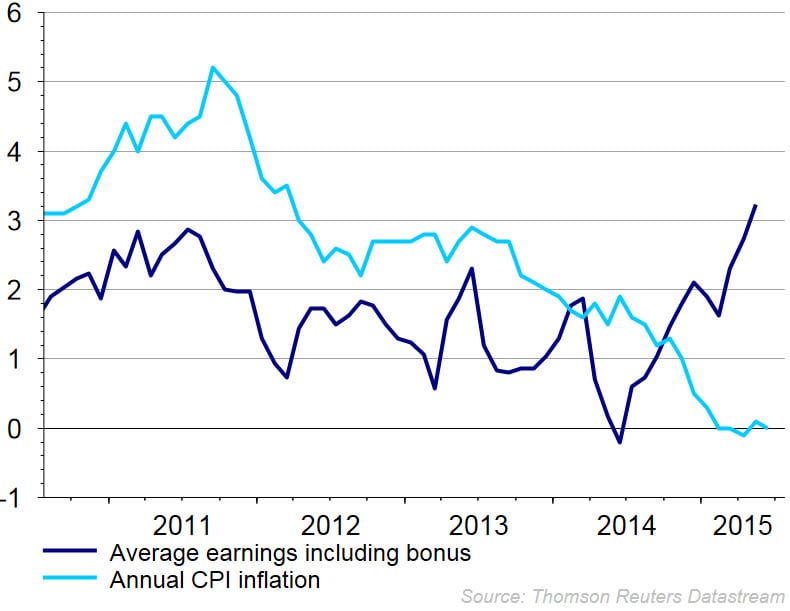

This increased hawkishness comes amid a further acceleration in earnings growth, which last month soared to a five month high 3.2% (Figure 1).

Economic growth is also robust, printing 2.8% annualised in the second quarter initial estimate, while fears of a prolonged period of low inflation have all but evaporated.

Now that the Greek crisis is behind us, and given the recent solid economic performance in the UK and hawkish rhetoric from policymakers, we would expect three dissenters to vote for an immediate hike at the August meeting.

Weale and Ian McCafferty, the only two members who voted for change between August and December last year, will be the likely candidates. Meanwhile Kritstin Forbes, an external member since July last year, has also recently implied that she too could soon be voting for an increase.

The key to timing may lie in the hands of newly appointed external MPC member Gertjan Vlieghe, who is set to replace David Miles from the September meeting onwards.

The as yet unknown monetary policy stance of Vlieghe, a senior economist and former assistant to previous Governor Mervyn King, could be critical as to the exact timing of a rate lift-off.

Nonetheless, we expect a slow build up towards a majority for a hike with the Bank of England now in a strong position to begin hiking rates as early as February of next year. This sooner-than-expected rate hike will provide strong support for Sterling against almost every major currency, save the US Dollar, as we expect the Federal Open Market Committee (FOMC) to raise the US interest rates at their September meeting.