The Pound-to-Canadian Dollar in the Week Ahead: 200-Day Moving Average a Key Battleground

- GBP/CAD is still trading in a range above the 200-day MA

- It is within a broader downtrend and looks vulnerable to further weakness

- Brexit machinations will continue to dominate Sterling and inflation data is the main release for CAD

Image © Kasto, Adobe Images

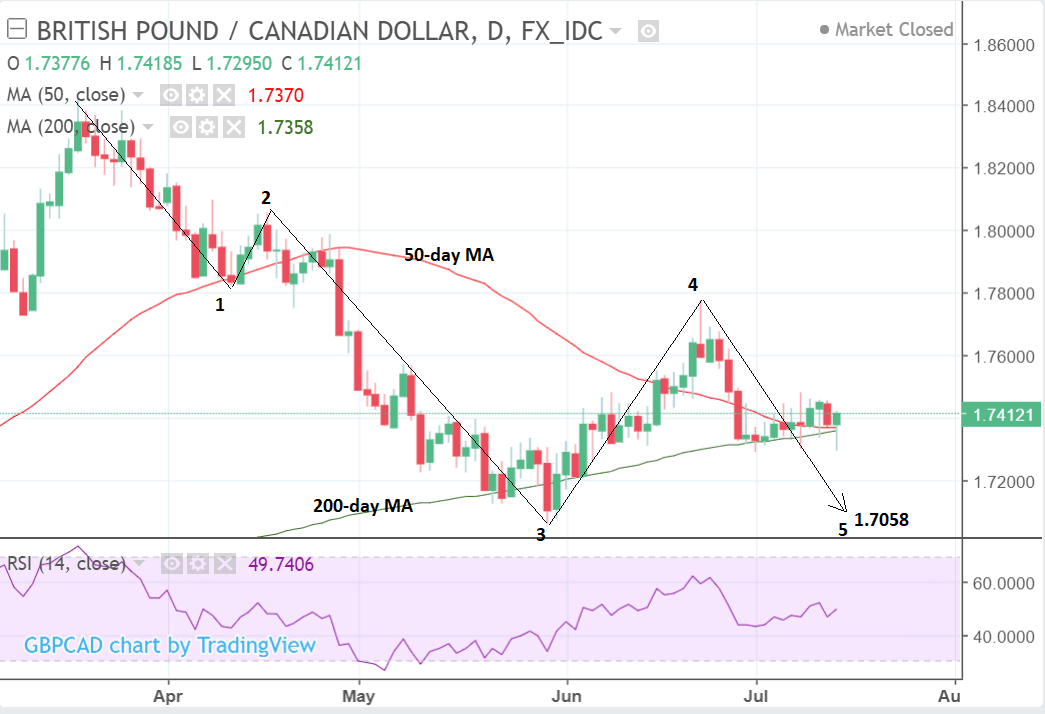

According to our latest technical studies, the GBP/CAD pair appears to be in a broad cyclical downtrend which our studies suggest is likely to move all the way down to the May lows at 1.7058.

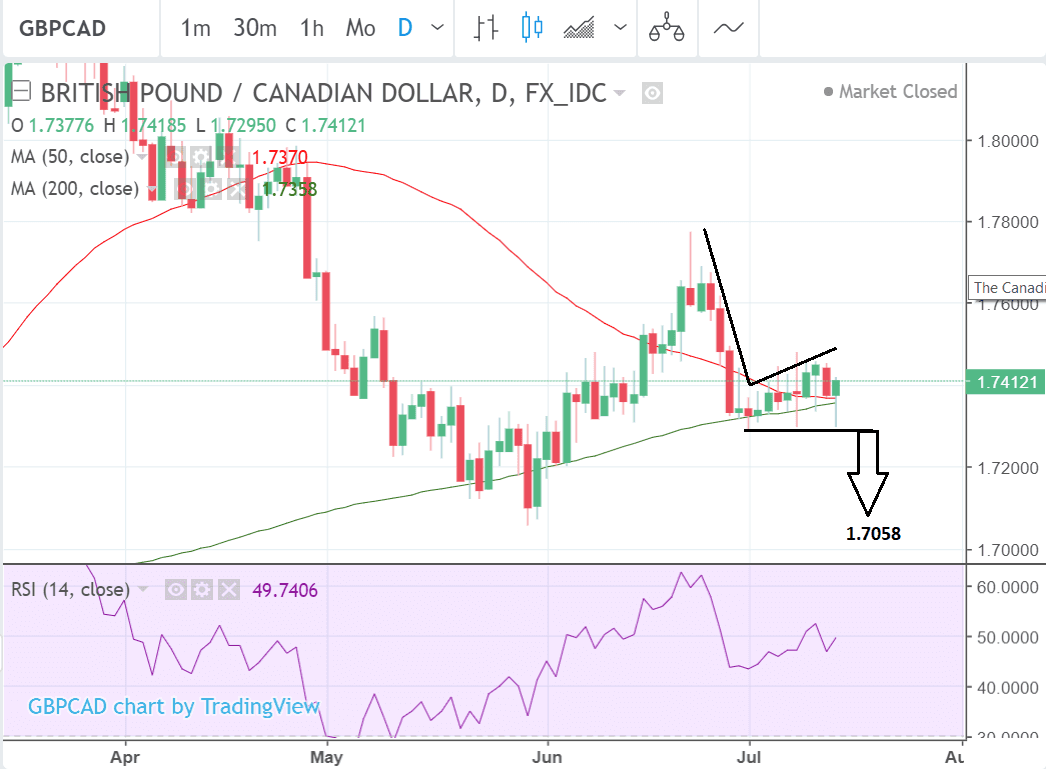

The pair continues to trade above the 200-day moving average (MA) which is acting as a stubborn level of support that might well keep the exchange rate aloft over coming days.

A major chart obstacle to any further Canadian Dollar strength against Sterling therefore is the 200-day and now the 50-day MA. The 200-day has been 'holding up' prices like a supportive arm ever since they found a floor at the start of July.

Large MA's are tough obstacles to break below but a move below the 1.7287 July 2nd lows would provide confirmation of a breakdown.

The next target after any break would probably be the 1.7058 lows.

The pair also seems to be unfolding in a 5-wave Elliot wave cycle lower with the market currently midway through wave 5. Wave 5 almost always reaches the end of wave 3:

GBP/CAD fell sharply from the June 22 highs and then plateaued and in the process has formed an 'L' shape which is usually indicative of a pause in the middle of a downtrend rather than a reversal higher, with an eventual break lower now highly likely:

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

What to watch in the week ahead for the Canadian Dollar

The main releases for the Canadian Dollar are inflation and retails sales on Friday, July 20, at 13.30 BST.

Headline inflation is estimated to rise by 0.3% in June from 0.1% in previous month, and 2.3% on a year-on-year basis.

Any miss on these expectations could well influence the currency in either direction.

Canadian investment bank TD securities support the consensus expectation according to their week ahead note:

"We expect headline CPI to inch higher to 2.3% y/y. Energy prices and FX pass-through will provide a tailwind on a y/y basis but we also see risks skewed to the upside as the prior weakness in core categories unwinds."

Core inflation in June, meanwhile, is forecast to rise to 1.4% from 1.3% previously.

Retail sales is expected to show no extra growth in May, although this will be higher than the -1.2% fall witnessed in April.

Retail sales ex autos are forecast to rise 0.5% from -0.1% in April.

"Retail sales should post a 1.3% gain on a rebound from weather-related weakness in April, with autos leading the advance," say TD Securities.

What to watch in the week ahead for the Pound

There is a considerable bundle of data and events in the week ahead for Sterling, which suggests it could be a highly volatile time for the currency.

On the political front there will be votes on amendments to the Trade and Customs Bill, which help form the basis of the government's new 'softer' Brexit proposal. These are expected to take place on Monday 16 and Tuesday 17.

They could be critical in gauging whether the plan has a likelihood of success and implementation.

"Another legislative showdown takes place in the UK House of Commons as the Trade and Customs Bills are voted on. Amendments to the bill have come from 'hard' Brexiteers (trying to undo the white paper) and Remainers (trying to bind the UK to a customs union). Some of these votes could come down to the wire, and have significant implications for Brexit negotiations," says Actionforex.com in their week ahead analysis.

Sterling may catch a bid if Brexit supporters in the Conservative party fail in their upcoming attempt to harden the UK government's plan on leaving the EU, as failure should increase the GBP-positive probability of a relatively soft Brexit.

We note a string of opinion polls out over recent days that shows support for the Convervatives has fallen below that of Labour with a good proportion of voters flocking back to UKIP having judged that May will not deliver the Brexit they desire.

This will remind Convervative lawmakers that bringing down the government will likely throw their party onto the opposition benches. It does also however offer the potential to sharpen the determination of Brexiteers who believe their electoral success will lie with delivering a clean 'hard' Brexit.

From a 'hard' data perspective the week has three major, potentially market moving, releases too: labour market data on Tuesday, CPI on Wednesday and retail sales on Thursday - all are at 9.30 UK time (8.30 GMT).

Their significance is further heightened by the fact that they may impact on the decision-making of the Bank of England (BOE) when it has its pivotal meeting in August. Because the probabilities of a hike or not, are so evenly balanced, next week's data could prove critical in swinging the vote one way or another.

Labour market data for May, is expected to show continued improvement with a 150K rise in employment on a three-month-on-three-month basis.

The more important wage data component of the release, which is more of an influence on inflation and therefore Bank of England decision-making, is expected to show only modest rises of 2.6% for headline and 2.8% (including bonuses).

Stronger wage rises are necessary to increase the chances of a rate hike and a disappointment could weigh heavily on Sterling.

CPI inflation data in June, out on Wednesday, is likely to show a rise due to the temporary influence of higher oil prices, however, if the main driver is in fact only fuel prices, it is unlikely to have much impact on the Bank of England who are more likely to look through inflation from temporary factors.

Therefore we believe the core CPI reading will be of more interest to the Bank of England as it shows the underlying inflationary pressures present in the economy.

Core CPI is forecast to read at 2.1% (month-on-month) while headline CPI is forecast to read at 0.2% month-on-month and 2.6% year-on-year.

"We suspect that CPI inflation edged up to 2.6% in June, owing to a rise in energy prices. But this should not mark the start of a sustained rise," says Andrew Wishart, UK economist at Capital Economics.

Retail sales for June are set for release on Thursday but the "evidence on strength," says Capital Economic's Wishart, "has been decidedly mixed."

On the one hand, the strong data in April and May will be a hard act to follow in June, yet on the other hand factors such as the good weather and the World Cup could support a rise.

"More sunshine, warm weather, and World Cup should be supportive. Our base case 0.4% forecast leaves a very strong trend for Q2 sales, and a solid hand-off to Q3," says TD securities in their note on data in the week ahead.

Markets are forecasting a reading of 0.4% on a month-on-month basis and 3.9% annualised.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here