Canadian Dollar Hit Hard by Raft of Poor Data

- Retail sales, inflation numbers miss expectations

- Canadian Dollar down sharply ahead of the weekend

- Pound-Canadian Dollar x-rate at 1.7717, US-Canadian Dollar x rate at 1.3337

The Canadian Dollar is the worst performing global currency on the day, over the past week and over the past month. Today's retail and inflation data only serve to cement the currency's position as global FX's laggard.

The British Pound surged to a fresh three-month high against the Canadian Dollar on Friday, June 22 following the release of an unambiguously poor raft of top-tier economic data that sent the Canadian Dollar reeling.

The Canadian Dollar had already been under pressure for a number of weeks against an host of major currencies and desperately needed a ray of sunshine from the economic docket to provide some cheer.

However, monthly inflation numbers for May showed prices rose a mere 0.1% where markets had been expecting a reading of 0.4%, this takes the annualised CPI number to 2.2%, well below the 2.5% forecast.

Statistics Canada meanwhile report core inflation actually contracted by 0.1% in May, down on the 0.1% growth recorded in April, a sign that domestically-generated inflationary pressures have gone into reverse.

Markets are selling the Canadian Dollar as they bet the data will surely delay the next interest rate rise at the Bank of Canada.

Retail sales data for April was also released and a shock -1.2% was reported by Statistics Canada, where markets had been forecasting the sector to remained static at 0%.

"Following three consecutive monthly increases, retail sales in April declined 1.2% to $49.5 billion. The decrease was primarily due to lower sales at motor vehicle and parts dealers. Inclement weather in many parts of Canada may have contributed to the overall decline in April," say Statistics Canada.

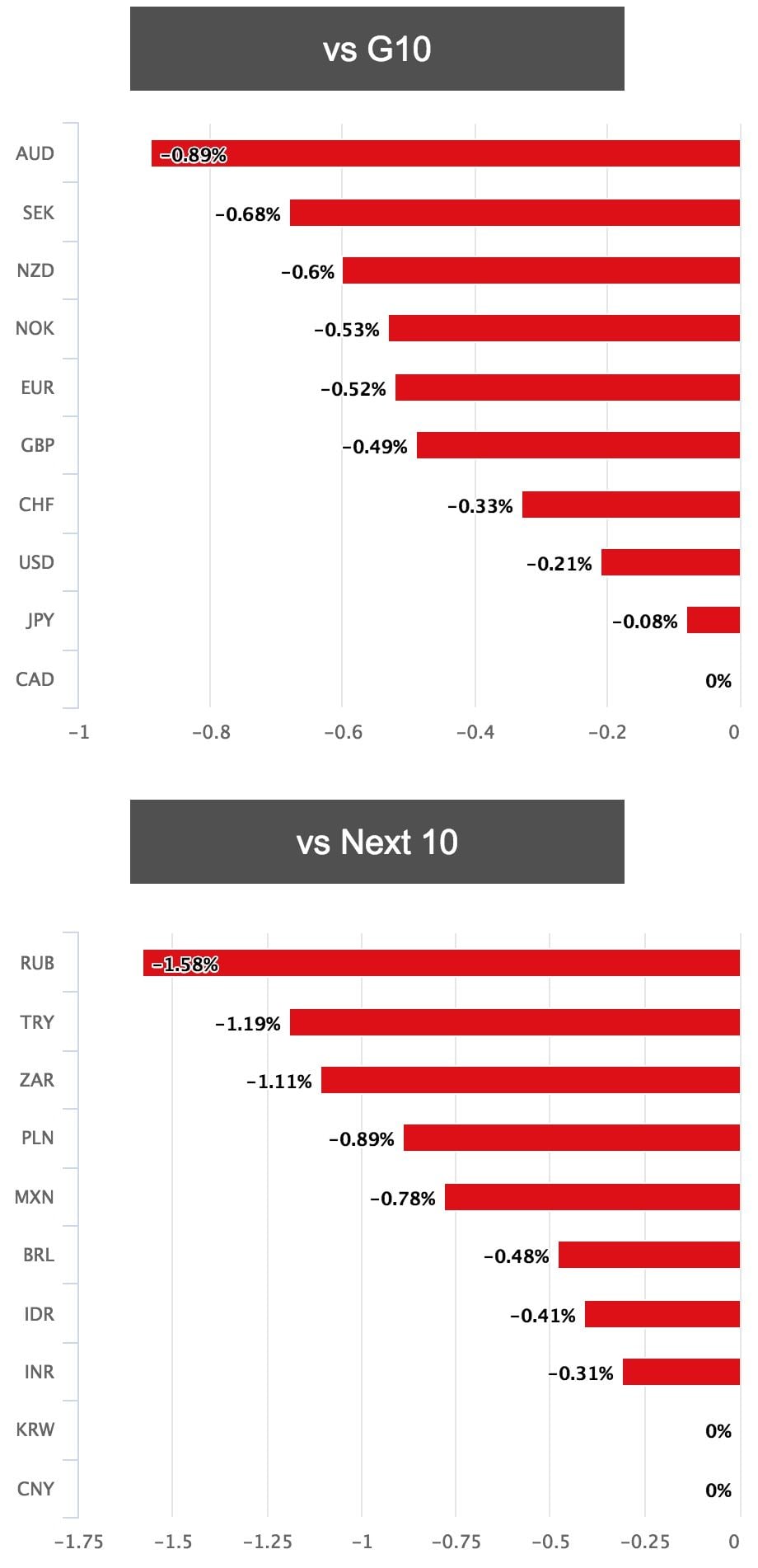

The Canadian Dollar is, as a result of the disappointing data, the worst performing major global currency on the day:

Above: The Canadian Dollar's performance against the world's largest currencies today.

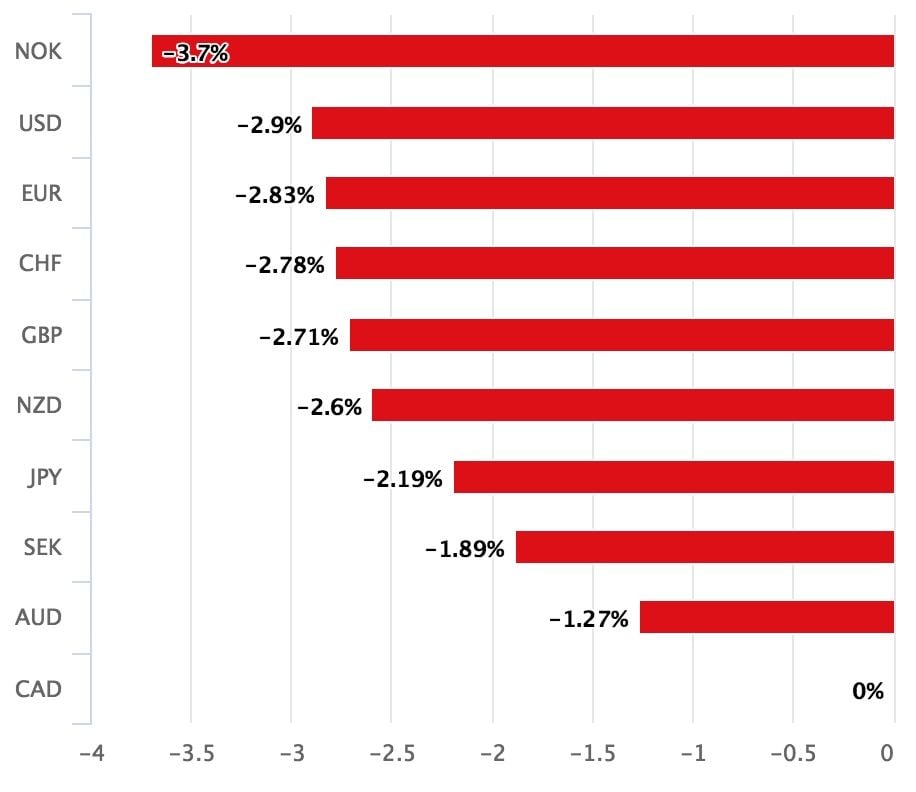

In fact, if we look at the CAD's performance on a weekly, and then monthly, level we see just how poorly the currency is performing.

Above: The Canadian Dollar's performance against the G10 over the past trading month.

"The soft patch in Canadian data continued today," says Royce Mendes, an economist with CIBC. "Today's bad data make it even more difficult for the Bank of Canada to hike rates in July. But, with the most important numbers yet to come in GDP and employment, there's still time for the data to turn."

Heading into today's data dump market expectations were reflecting a 66% probability for an interest rate hike at the Bank of Canada’s next rate decision on July 11, but futures markets are now suggesting a 54% chance.

"The combination of somewhat slower economic growth, softer inflation data (also released this morning) and the sharp deterioration in the tone of trade discussions with the U.S. also aren’t all that encouraging, though, making a July Bank of Canada interest rate hike look like a closer call than previously thought," says Nathan Janzen, Senior Economist with RBC Capital Markets.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.