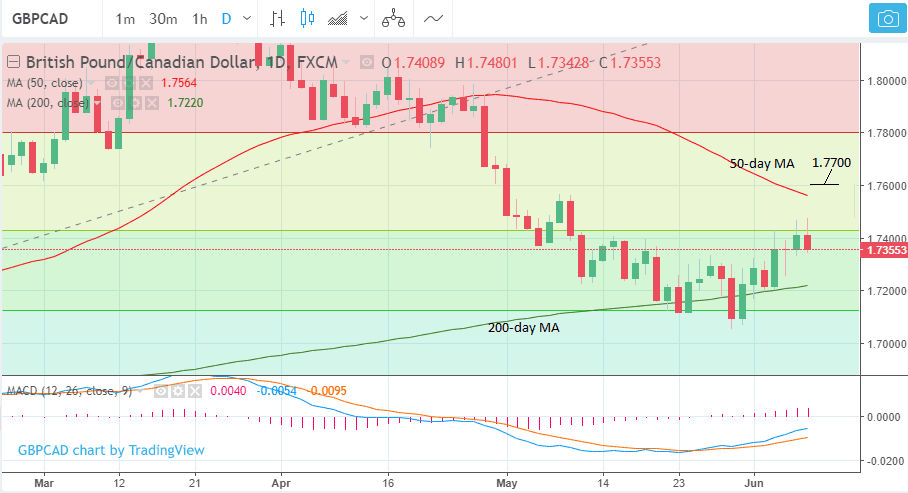

Pound-to-Canadian Dollar Rate Week Ahead Forecast: New Uptrend Meets First Major Obstacle

- GBP/CAD is in short-term rally higher

- 50-day MA capping gains at 1.75

- Watch UK employment data for Sterling volatility

Image © kasto, Adobe Stock

Latest technical studies of the Pound-to-Canadian Dollar exchange rate are showing that the short-term uptrend remains in force but is meeting some short-term obstacles which could very well lead to a temporary pullback.

The weekly chart shows that overall there is strong evidence to suggest the uptrend is resuming after a substantial pull-back.The exchange rate has corrected back down 50

% of the previous rally to the midpoint of the previous move which is a level prices often rotate and resume the uptrend from.

The pair also met the 50-week moving average (MA) which provided underpinning support at the recent 1.70 lows. The pair also formed a very bullish-looking hammer candlestick which further supports the idea of a rebound higher.

In the end, GBP/CAD has rallied, reaching highs of 1.7480 before weakening.

The pair is not far now from a major barrier in the form of the 50-day MA at 1.7564, and we see upside as limited as a consequence of the MA.

Large moving averages often present an obstacle to the trend, and when prices meet them they often stall, pull-back or even reverse.

There is a possibility that a temporary pull-back could bring the exchange rate lower over the next couple of trading sessions due to the formation of a possible tweezer top candlestick pattern on the daily chart (circled above).

Yet despite this, the short-term trend remains up and expected to continue, with a break clearly above the 50-day, confirmed by a move above 1.7600, leading to an extension to a probable initial target at 1.7700.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

The Pound this Week: Big Data Releases

It's a busy week on the data front for the Pound.

Monday, June 10

Manufacturing production numbers are out, and markets are looking for the month-on-month reading for April to read at 0.3%, taking the year-on-year number up to 2.9%.

Any disappointment might hurt Sterling as markets are looking for economic data to start reflecting a pick-up in activity into the second half of the year, which could ultimately lead to an interest rate rise at the Bank of England in August.

Should expectations for an interest rate rise is August increase over coming weeks, on the back of improving data, the Pound should ultimately find more support.

Tuesday, June 11

This is the big one for Sterling.

The ONS will release employment and wage data at 09:30 which will in turn be closely watched by policy-setters at the Bank of England.

Average earnings, bonus included, is forecast to read at 2.6%, a beat on this should help Sterling find a bid as higher inflation = higher inflation on the horizon = higher interest rates at the Bank of England.

For Sterling, a beat on this 2.6% figure must be delivered if it is to go higher.

"However, recent outturns of pay growth – as captured by the 3M/3M growth rate – suggest the underlying trend in pay growth has fallen back recently," warns a preview note of the event released by economists at UniCredit Bank.

Wednesday. June 12

Another big day for Sterling as actual inflation numbers are released and the same dynamics as described above apply.

Headline inflation is forecast to read at 2.5% on an annualised basis, up from 2.4% in the previous month.

Clearly inflation is heading in the wrong direction for the Bank of England which is targeting a 2.0% inflation rate, and should the number beat 2.5% expectations for an interest rate rise will surely be ushered forward.

Be careful to watch the core CPI number - this is arguably more important than the headline number as it accounts for organically generated price rises that reflect economic growth dynamics.

Core is forecast to read at 2.1% a hit or miss against this number will likely move Sterling.

Thursday, June 13

Retail sales numbers are out, and with markets focussing on data once more, Sterling could react to any surprises.

Expectations are for UK consumers to be finding their feet again following a tough start to the year.

Retail sales are forecast to read at 0.6%.

The Canadian Dollar this Week: NAFTA Jitters to Extend

This is a quiet week for Canada in terms of data releases and Bank of Canada event risk.

Instead, expect the Canadian Dollar to be heavily invested in headlines concerning global trade generally, and the future of the NAFTA partnership specifically.

"Trade uncertainties are countering positive fundamentals that should be on show today with a strong jobs report from Canada expected," says Derek Halpenny, European head of global markets research at MUFG. The G7 leaders’ summit is taking place in Quebec today and tomorrow and Prime Minister Trudeau is unlikely to hold back in criticising President Trump. Fears also continue to mount over a collapse of NAFTA."

The outcome of this weekend's G7 summit could therefore be instrumental in setting up the tone for CAD trading in the week ahead.

Last week the Canadian Dollar slumped after White House economic advisor Larry Kudlow suggested President Donald Trump is contemplating scrapping the North American Free Trade Agreement (NAFTA) in favour of bilateral deals with Canada and Mexico.

"Yesterday we met with the president a couple times and he is very seriously contemplating kind of a shift in NAFTA negotiations. His preference now, and he asked me to convey this, is to actually negotiate with Mexico and Canada separately," Kudlow told Fox & Friends. "I think the important thought here is he may be moving quickly towards these bilateral discussions."

Reports meanwhile show senate Republicans are pressing President Trump to end talks on renegotiating NAFTA by Labor Day which falls on September 3 fearing the trade dispute will cast a shadow on the midterm elections.

Republican lawmakers told Trump during a meeting at the White House on Wednesday that they want the negotiations wrapped up by August amid growing fears that the trade fight will eventually slow the economy and lead to a backlash from voters.

The pressure is on.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.