Pound-to-Canadian Dollar Rate is Showing Bearish Reversal Signs, Says Scotiabank

The Pound is expected to weaken further against the Canadian Dollar as bears chase a technical sell-off brought on by Sterling weakness says research from Canadian lender Scotiabank.

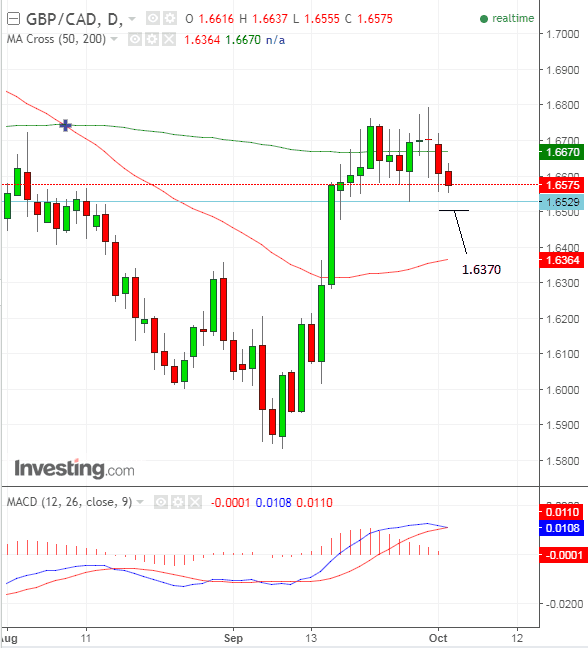

The Pound-to-Canadian Dollar pair has pulled back sharply after rallying up and touching the 200-day moving average at 1.6670:

Large moving averages such as the 200-day often act as dynamic support and resistance zones where prices will often stall, pull-back or - as in this case - even completely reverse trend.

"GBPCAD appears vulnerable to near-term weakness following a multi-week consolidation around its 200-day MA at 1.6670," said Scotia's, FX Strategist, Shaun Osborne.

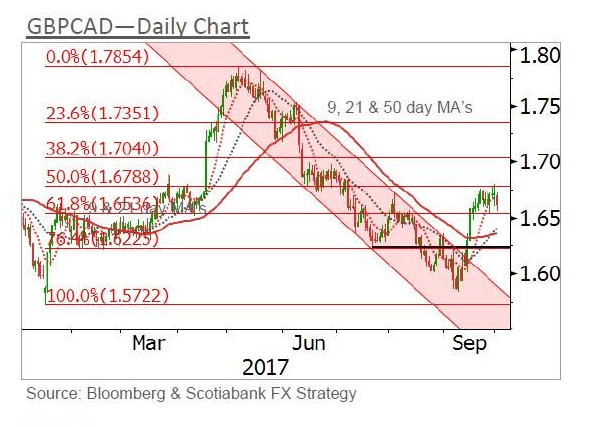

The recent 1.67 highs coincided with the 50% Fibonacci retracement level from the previous decline and this further enhances the reversal-potential of the level, as Fibonacci levels, like MA's, are often the locus of market turns.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Previously bullish momentum indicators are "softening to neutral" says Osborne, and the DMI indicator is suggesting a shift to a more bearish balance of risk.

"The hourly chart has delivered a clear bearish reversal signal (evening star) off of Friday’s short-lived multi-month high just below 1.68. The 9 day MA has been broken and we highlight the risk of near-term weakness toward the 21 and 50 day MA’s in the mid-upper 1.63 area. We are bearish GBPCAD," concludes the analyst.

Our own view it is maybe a little early to be confident the pair will fall, and we would be looking for a break below the 1.6528 lows for confirmation.

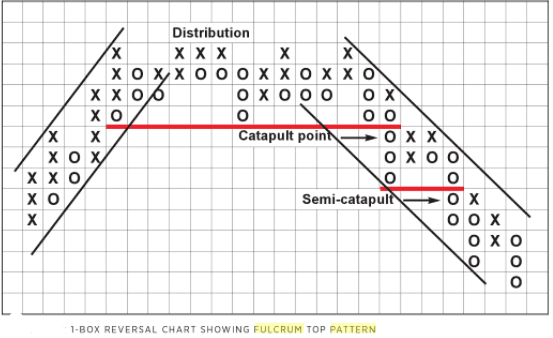

However we acknowledge the pair has formed what looks vaguely redolent of a fulcrum topping pattern from point and figure charting, around the level of the 200-day MA (an example of which is shown below).

Fulcrums are strong reversal signals and if the top is one, it further enhances the chances of a reversal and further bearish price action on the horizon.

The Pound's recent weakness coincides with the release of much lower than expected construction sector activity data, which shows the sector in contraction.

The currency came further under attack after MEPs in Brussels voted that insufficient progress had been made in Brexit negotiations for them to move onto phase two and discussions about trade.

Concerns about Theresa May's leadership have also weighed on the Pound as she comes under attack from the hard Brexit wing of the party, during the Conservative party conference this week.

Sterling bulls are hoping her speech on Wednesday (tomorrow) will reinvigorate the Pound's trend with new energy, particularly if she makes concessions to the EU in an effort to make more shared ground for negotiators.

It is a quiet week for the Canadian Dollar, meanwhile, the main event on Friday when the Canadian Labour report is released at the same time as US Non-Farm Payrolls.

The currency was rising strongly on the back of several interest rate hikes by the Bank of Canada (BOC) earlier in the year, however, recent commentary from Governor Poloz poured cold water on further rate hike expectations after he highlighted sluggish wage growth an inflation.

High frequency fair-value models which are used by currency dealers to determine the appropriate value for a currency pair, and therefore whether it is relatively overvalued (above) or undervalued (below) its fair value, suggest the Canadian Dollar is undervalued against the US Dollar, and therefore possibly also versus the Pound.

"We prefer to fade rallies on moves back towards 1.2560 with our high-frequency fair value models suggesting a move back below 1.24," said Canadian investment bank, TD Securities.