Beware Squeeze Higher in GBP/CAD Exchange Rate

The Canadian Dollar could be at risk of falling against the Pound Sterling over the near-term.

This is the assessment of the currency pair in the wake of the Pound’s recent jump in response to hints that the Bank of England is seriously considering an interest rate rise.

Some analysts have suggested the 5-3 vote in the June MPC policy meeting hints at a rise coming as soon as August.

The Canadian Dollar has risen in value by about 3.5% against Sterling since the results of the UK’s June 8 election become known.

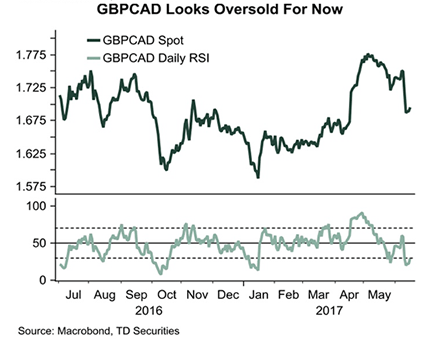

This leaves GBP/CAD looking rather vulnerable to a recovery.

“While political uncertainty continues to weigh, the BoE’s newfound hawkishness further reduces downside risks for GBP,” says James Rossiter at TD Securities. “We note that GBPCAD is the larges mover in the G10 since the 8 June election, with a decline of about 3.5%.

With oil prices trending lower over the last several weeks and the BoE now joining its Canadian counterpart in the hawk’s camp, TD Securities think shorts here might be vulnerable to a squeeze.

“A move above 1.7000 in this cross might spur an impulse to cover shorts over the next several days,” says Rossiter.