Pound / Canadian Dollar Rate a "Sell Overall"

Sterling is clawing back gains against the Canadian Dollar after the pair bottomed at 1.7190 before the weekend.

Since then the exchange rate has climbed back up reaching above 1.7300

On Monday, the Pound was boosted by weekend polls showing Theresa May’s conservatives enjoy a 10 point lead over their nearest rivals following last week's shock poll from YouGov that suggested the lead was down to only 5 points.

At one point, earlier in the campaign May had been over 20 points ahead which bouyed Sterling as traders believe a strong Conservative majority is ultimately good for Britain in upcoming Brexit negotiations.

There is a belief that with a large majority she can negotiate a softer Brexit stance which is more economically beneficial to the UK.

The Canadian Dollar is on track for a monthly gain of 2.28% against the Pound and 1.79% against the US Dollar.

"May has been a topsy turvy month for the Canadian dollar which had hit 14-month lows in early May only to bounce back to one-month highs last week as political risk dogged the big Dollar which put upward pressure on oil prices," says Joe Manimbo, an analyst with Western Union.

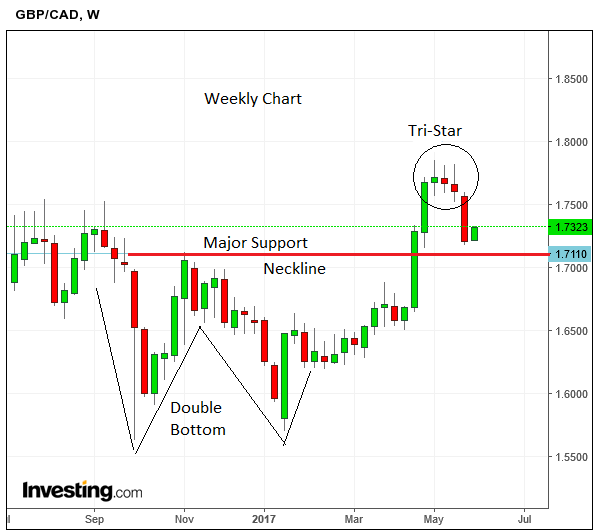

GBP/CAD Outlook:

Looking at the daily chart we see that after Friday’s long down-day the pair has rebounded in two smaller green up-days.

If today remains green (by closing higher than it opened) we will have a fairly high probability trading set-up.

This will signal that there is a roughly 66% chance Wednesday will be a bearish day closing lower than it opens.

In a downtrend when two small up days form after a strong sell-off there is an increased chance the next day will be a red down day.

Several strong support levels sit below the 1.7190 lows which could limit downside.

The first of these is the 50-day moving average (MA) at 1.7198 which is likely to be a major impediment to further downside.

This is followed by the 1.7127 former neckline of the double bottom pattern at the lows.

The pair may be trading higher on the day but it remains a sell overall says Scotiabank’s Strategist, Shaun Osborne.

“GBPCAD is marginally firmer on the day and despite the cross developing a bid around the 50% of the Apr/May rally, the near-term risks for the GBP are still for the market to trade lower,” said Osborne.

A compelling ‘tri-star’ topping pattern on the weekly chart at the recent highs is further evidence the pair is likely continue lower.

“Weekly patterns remain negative, as net losses on the week last week appear to confirm the bearish “tri star” turn lower on the weekly charts through late Apr/early May,” said the Scotia analyst.

The small uptrend over the last 36 hours is likely to be merely ‘corrective’.

“Intraday charts suggest a small bid for the GBP in the last day or so but the rebound looks merely corrective (minor bear flag) which might now be breaking down. We remain bearish and continue to look for 1.71/1.72 (at least). Fade minor GBP gains,” concluded Scotia’s Osborne.