Canadian Housing Boom: Latest Housing Data Sends CAD Higher Against Rivals

- Written by: Gary Howes

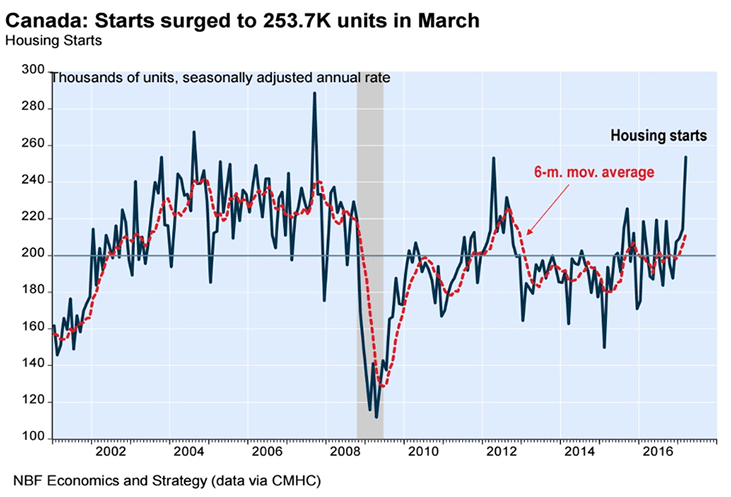

The Canadian Dollar was one of the better performing currencies at the start of the new week following data that showed Canadian housing starts surged to 253.7K in March, the highest level since September 2007.

Markets had forecast a figure of 253.7K

“The housing boom continues courtesy of low interest rates from the Bank of Canada,” says Marc Pinsonneault at National Bank of Canada in a brief to clients following the release.

This explanation explains in succinct fashion why the Canadian Dollar reacted by going higher - the Bank of Canada might have to consider raising interest rates in the future if it is deemed the property sector is at risk of overheating because of the availability of easy money.

And higher interest rates make for a more desirable Canadian Dollar.

“Clearly, the Canadian housing start level in March, the highest over a decade, is not sustainable,” says Pinsonneault. “The recent surge in house prices in Toronto and in most of Ontario urban areas should induce home builders to continue to start new dwellings at a high rate.”

All eyes now turn to the Bank of Canada's mid-week policy meeting for guidance on whether or not policy makers believe an interest rate rise is warranted in light of the data.

Market pricing would suggest that this is indeed the case and the currency could enjoy further gains into the mid-week session.

The Pound to Canadian Dollar exchange rate (GBP/CAD) is quoted at 1.6559 at the time of writing having been as high as 1.6639 earlier in the day.

The US to Canadian Dollar exchange rate (USD/CAD) is at 1.3338 having been as high as 1.3428.