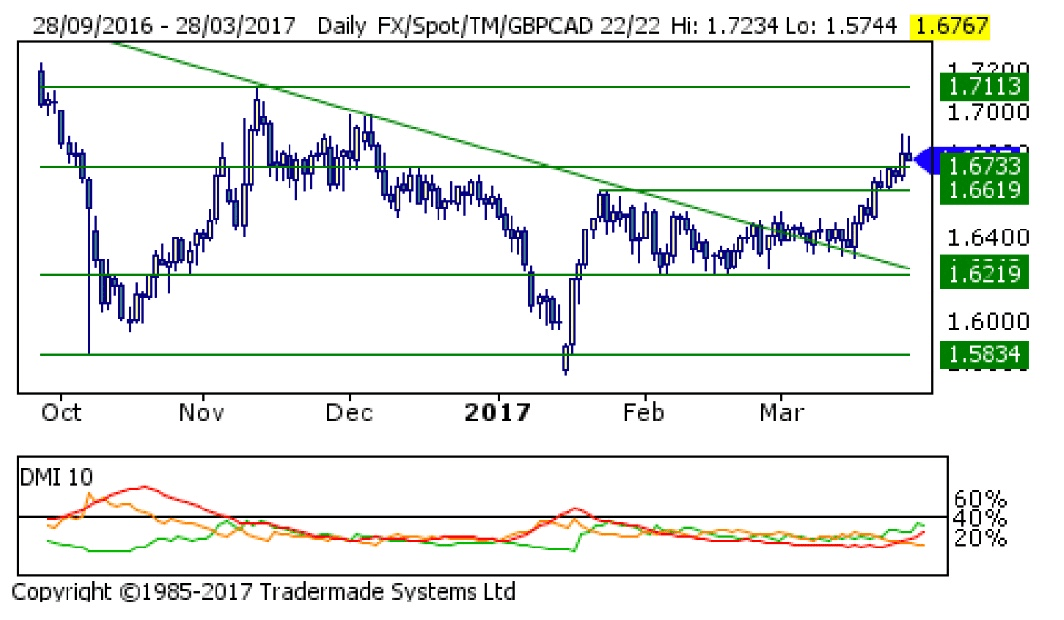

GBP/CAD Sees Growing Downside Risks

Short-term downside risks for the Pound to Canadian Dollar exchange rate (GBP/CAD) are rising sharply we are told.

Intraday patterns show two tests of 1.6885 over recent days and a drop below the intervening low at 1.6790.

At the time of writing the exchange rate is now at 1.6589.

“A minor double top suggests near-term risks are tilting to a drop back to 1.6695/00,” says technical analyst Shaun Osborne at TD Securities, the Canadian investment bank.

For Osborne, who is a specialist at reading charts and projecting potential future moves, the overall feel of the GBP/CAD set up looks, “a little more negative”.

Osborne says this assessment of the charts comes as the Pound closed Monday’s session well off the high reached that day.

Then, Tuesday’s daily chart candle reflects bearish pressure via the formation of a potential “shooting star” formation.

“Broader trends are still GBP-supportive but the directional risk for the cross seems to be tilting back a little more to the downside again from a short-term point of view,” says Osborne.