Pound-to-Canadian Dollar Week Ahead Forecast: Drawing Down

- Written by: Gary Howes

Image © Adobe Stock

The Pound's uptrend faces a short-term setback against the Canadian Dollar.

We are entering a wait-and-see moment in global foreign exchange where increasing degrees of capacity will be absorbed by the April 02 tariff announcements from the White House.

The moment could be pivotal for global FX, and the coming week will likely see further consolidation in the Pound-to-Canadian Dollar exchange rate as a result.

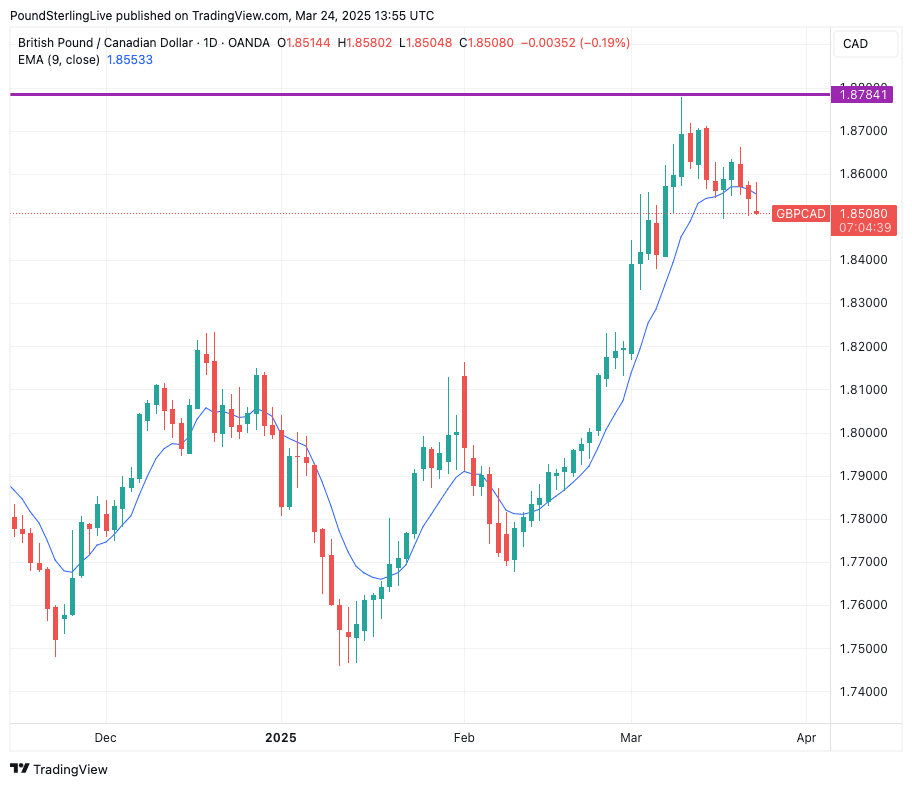

This consolidation takes form as a pullback from the recent multi-year highs, with profits being booked on a solid run higher from 1.7458 in early January to 1.8779 on March 11.

Above: GBP/CAD at daily intervals.

📈 Q2 Investment Bank Forecasts for GBP vs. CAD. See the Median, Highest and Lowest Targets for the Coming Months. Request your copy now.

That March 11 high was consistent with an extremely overbought exchange rate, with the Relative Strength Index (RSI) screaming of the need for a pullback and consolidation.

The subsequent decline to today's levels at 1.8532 are part and parcel of the unwind in overbought conditions.

The exchange rate has subsequently fallen below the nine-day exponential moving average (EMA), which tells us the coming hours and days are likely to see softer trade, with losses potentially drifting back to 1.84.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

Be in no doubt, though, that the broader setup remains to the upside, and a reboot of the trend remains preferred, with another test of 1.8784 on the cards for the coming weeks. But for now, the drift lower can continue as markets prepare for the April 02 decision.

We see significant two-way risk heading into the event.

On the one hand, the CAD has been one of the most at-risk currencies in G10 due to Trump tariffs, and a second round of tariffs might exacerbate the trade.

However, there is the chance that the CAD actually ends up outperforming peers as the spotlight falls on countries that have thus far not been targetted by Trump's White House.

For instance, will Trump surprise markets and hammer countries that charge VAT? If this is the case, then the UK could be in scope for import tariffs that might be as creative as the very notion that a VAT is a tariff.

📈 Q2 Investment Bank Forecasts for GBP vs. CAD. See the Median, Highest and Lowest Targets for the Coming Months. Request your copy now.

With much bad news 'in the price' of CAD the law of diminishing returns starts to apply to further weakness: it becomes harder to come by.

We note with interest that analysts at Citibank think Q2 will see the U.S. Dollar rebound, with analysts confirming they think tariffs will be a supportive factor for the USD, even if price action since February has defied the notion.

We think this has implications for the Loonie, as CAD and USD have both underperformed in 2025, meaning any USD rebound will bolster the Canadian unit.

Given this risk, we think the current setback in GBP/CAD can continue over the coming days.