Canadian Dollar Faces Historic Lows: ING

- Written by: Sam Coventry

Image © Adobe Stock

The Canadian dollar, long considered a stable commodity-linked currency, is facing historic lows as multiple factors converge to form what analysts are calling a "perfect storm."

The USD/CAD exchange rate has surged to levels last seen during the pandemic, reaching 1.43 and heading towards a potential high of 1.50.

According to Francesco Pesole, an FX strategist at ING, this dramatic depreciation reflects a combination of trade tensions, monetary policy shifts, and political instability.

"The Canadian dollar has lost its low-volatility, safer commodity currency status," Pesole stated, highlighting the multiple pressures facing the loonie.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

Political Instability Adds to Economic Uncertainty

Political turmoil has most recently shaken confidence in CAD. Finance Minister Chrystia Freeland's surprise resignation amid disagreements with Prime Minister Justin Trudeau has raised the likelihood of a snap election in 2025.

Current polling suggests a shift toward the opposition Conservative Party, led by Pierre Poilievre, whose policy agenda includes energy expansion and potential trade renegotiations with the U.S., Pesole highlights. "Political instability only adds another layer of complexity for the Canadian dollar," he stated.

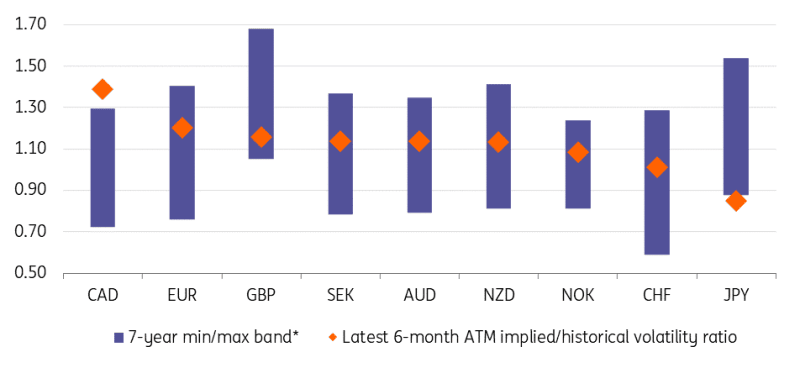

Above: The cost of hedging CAD has skyrocketed as investors see a more volatile and structurally insecure currency ahead.

U.S.-Canada Trade Tensions Escalate

A key driver of the loonie's decline is the heightened risk of a U.S.-Canada trade war. Former U.S. President Donald Trump, newly re-elected, has threatened to impose 25% tariffs on Canadian exports.

Such protectionist policies could severely impact Canada's economy, which is heavily reliant on U.S. trade. Pesole estimates this tariff threat has already added a 2% risk premium to the USD/CAD exchange rate, pushing it into "overvaluation territory." "This risk premium places the Canadian dollar in a very vulnerable position," he remarked.

📈 Q2 Investment Bank Forecasts for GBP vs. CAD. See the Median, Highest and Lowest Targets for the Coming Months. Request your copy now.

Bank of Canada Cuts and Oil Price Weakness

Canada's central bank, the Bank of Canada (BoC), has cut interest rates more aggressively than any other G10 central bank this year, reducing its benchmark rate by 175 basis points. Market expectations point to further cuts in 2025, which could exacerbate the loonie's decline, Pesole notes.

"The Bank of Canada has little room to manoeuvre as it tries to shield the economy from external shocks," he explained. Additionally, a softening oil market is undermining Canada's resource-driven economy. Lower oil prices reduce foreign investment and weaken the Canadian dollar's commodity-linked appeal. "Oil prices remain a critical factor for the loonie's stability," Pesole added.

Market Outlook

The USD/CAD pair could reach 1.50 if trade tensions worsen, pushing the Canadian economy into recession. The loonie's volatility is at its highest levels in a decade, reflecting investor uncertainty. However, a de-escalation of trade tensions or a halt in BoC rate cuts could provide some relief, potentially bringing the pair back to the 1.40 range, according to Pesole. "The market is watching closely for any signs of de-escalation, which could offer a temporary reprieve for the loonie," he commented.

A Binary Future for CAD

Pesole warns of "binary outcomes" for the Canadian dollar in the coming months. "The first few weeks of 2025 will be crucial in determining whether the loonie can stabilise or face further depreciation," he emphasised. The first weeks of 2025, coinciding with Trump's inauguration will be critical in determining the trajectory of U.S.-Canada relations and the loonie's recovery or further decline.

As Canada navigates this storm of economic, political, and trade challenges, the Canadian dollar faces an uncertain future. Its long-held status as a low-volatility commodity currency is seriously threatened.