GBP/CAD Rate Week Ahead Forecast: Cooling After a Hot Run

- Written by: Gary Howes

Image © Bank of Canada

The Canadian Dollar has endured a widespread selloff against many of its G10 peers in recent days amidst heightened expectations that the Bank of Canada will cut interest rates next month, but selling pressure can ease this week.

CAD has lost a per cent of its value against the Pound over the course of the past month and 0.80% against the Euro.

The selloff gathered pace in recent days, but this has left it looking oversold against some currencies in the near term, opening the door to the prospect of consolidation.

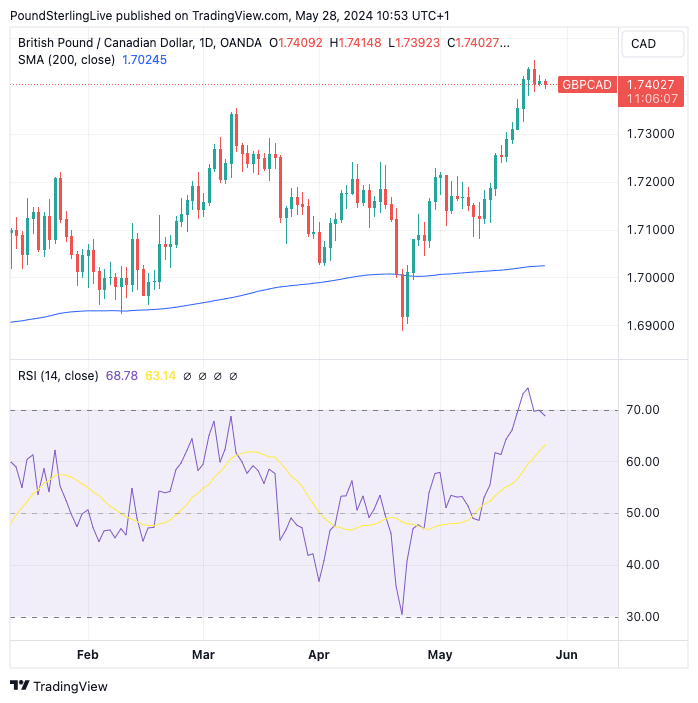

The Pound to Canadian dollar exchange rate (GBP/CAD) rose to 1.7453 last week and pushed the RSI above the 70 level that signals an exchange rate has entered overbought territory:

Above: GBP/CAD at daily intervals with the RSI in the lower panel. Track GBP/CAD with your own custom rate alerts. Set Up Here

The subsequent pullback - to 1.7407 at the time of writing - undoes some of those overbought conditions and the pair can pull back further if the unwinding process extends over the coming days.

It won't require a significant pullback for the RSI to unwind these overbought conditions and we look at weakness as being limited in scope from here, particularly given the Bank of Canada looks set to cut interest rates ahead of the Bank of England.

Any doubts that the Bank of Canada would cut rates next month dissipated after Statistics Canada said last week that the country's inflation rate fell to 2.7% year-on-year in April, down from 2.9% in March and undershooting estimates for 2.8%.

The Canadian Dollar fell against its G10 peers and was bracing for a new three-year low against the Pound after these inflation numbers effectively pulled the trigger on a June interest rate cut.

"Inflation in Canada has recently been falling sharply... the Bank of Canada's turnaround in rates is now likely to be imminent," says Michael Pfister, FX Analyst at Commerzbank.

Pfister says he sees evidence that now "would be a good time to bet" on a weaker Canadian Dollar, particularly against the U.S. Dollar.

He explains Canada's falling interest rate can weigh on CAD against the likes of USD, where interest rates are unlikely to fall soon.

The same argument could be extended to GBP, where the Bank of England is unlikely to cut interest rates until August/September at the earliest.

The divergence in fortunes between the central banks can provide a fundamental basis for further near-term GBP/CAD appreciation.