Canadian Dollar Rallies After Macklem Sets the Record Straight

- Written by: Gary Howes

Image © Adobe Stock

The Canadian Dollar rose after the Bank of Canada Governor sought to push back against a recent increase in expectations for interest rate cuts.

The Pound to Canada dropped in the minutes after newswires reported Governor Tiff Macklem as saying there's a limit to how far U.S. and Canadian interest rates can diverge.

The Bank of Canada could cut interest rates as soon as June following a spate of soft economic data releases, but investors think the Federal Reserve can only do so in December.

This divergence in policy can leave Canadian interest rates far lower than those of the U.S., which can weigh on the Canadian Dollar if money is borrowed in Canada and shipped south of the border into high-yielding debt.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

By saying there are limits to the divergence, Macklem wants to signal to markets that the Bank of Canada will keep an eye on the Fed. In short, this limits the scope of Canadian interest rate cuts, which can be a supportive outcome for the Canadian Dollar.

Macklem told Canadian lawmakers on Wednesday the Bank of Canada does not have to do whatever the Fed does. Today's comments appear to be something of a correction of yesterday's comments which markets might have interpreted as a green light signalling rate cuts are incoming.

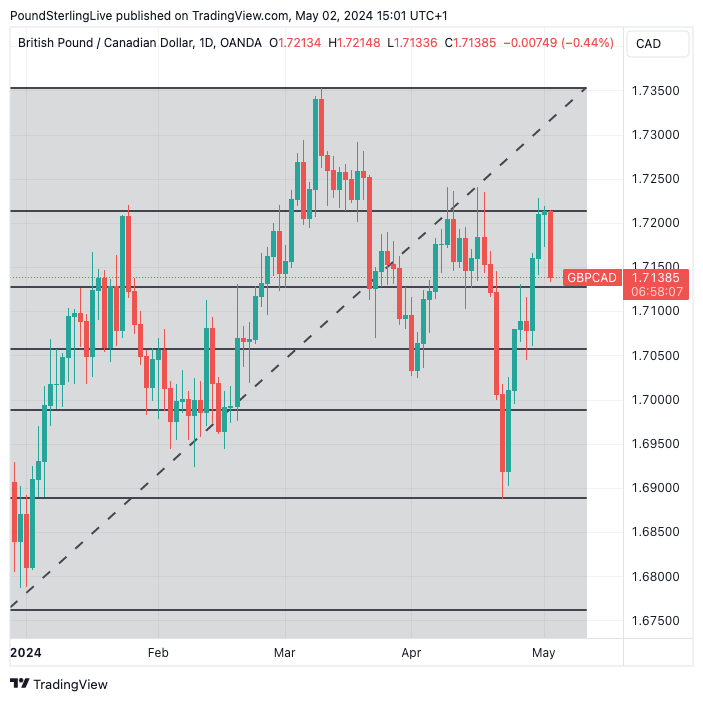

Above: GBP/CAD, a picture-perfect failure at the 23.6% Fibonacci retracement of the 2024 rally has occurred, reinforcing the resistance level we highlighted in our Week Ahead Forecast. Track GBP/CAD with your own custom rate alerts. Set Up Here

When asked when Canadian interest rates are coming down, he said today that the Bank is looking for reassurance that the recent fall in underlying inflation will be sustained.

This is an amber light signal to markets, which have been increasingly confident the Bank of Canada is close to cutting rates.

On Wednesday Macklem told Canadian lawmakers that the Bank is getting close to being able to cut rates. He said data since January has increased the Bank's confidence that inflation will continue to come back down.

In testimony to the Senate banking committee, Macklem said inflation was coming down and Canadians wanted to know when the central bank would start cutting interest rates. "The short answer is we are getting closer," he said.

He added that monetary policy appears to be working.