Canadian Dollar To Be Dragged Lower By Its Big Neighbour: BNP Paribas

- Written by: Sam Coventry

Image © Adobe Images

The Dollar is "too heavy to hold" in 2024 and should decline noticeably, and this will weigh on the Canadian Dollar against the Euro and Pound.

This is according to currency analysts at BNP Paribas, the France-based global investment bank and financial services giant.

BNP Paribas maintains a "bearish lean for the CAD" in the year ahead, saying, "if the U.S. economy, Canada’s largest trading partner, continues to slow down, it would be sensible to think that Canadian growth could contract."

This assumption is pertinent given the Canadian economy can best be described as stagnant, even as its southern neighbour grows.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

Despite a strong start to the year for the U.S. Dollar, which has helped the Canadian Dollar, 2024 will see a strong downtrend emerge as the Fed cuts interest rates.

BNP Paribas reckons rate cuts can happen before a material economic slowdown as the Fed will choose to support the labour market under its 'dual mandate' to target inflation and employment.

Ishan Gurnani, FX Strategist for G10 at BNP Paribas, says a particular concern for the Canadian Dollar is the indebtedness of Canadian households, which makes them particularly vulnerable to the rise in interest rates seen over recent months.

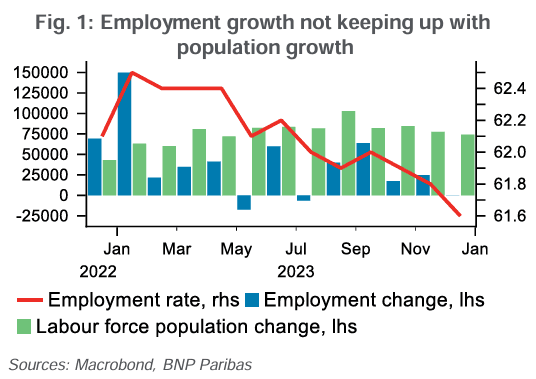

"We think the currency continues to appear vulnerable," says Gurani. "Recent hard data to some extent corroborate the lagged effects of monetary policy and leading survey-based indicators. Consumption has slowed, and the labour market shows signs of cooling."

BNP Paribas forecasts the Dollar-Canadian Dollar exchange rate at 1.35 in 2024 and 2025.

The bank forecasts the Euro-Canadian Dollar rate at 1.55 in 2024 and 1.59 in 2025.

Based on the bank's Pound-Dollar profile of 1.32 for 2024 and 1.36 for 2025, the Pound to Canadian Dollar cross is projected at 1.78 and 1.84, respectively.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes