Canadian Dollar Boosted By Uptick in Core Inflation and a Rise in USD and Oil Prices

- Written by: Gary Howes

Image © Adobe Stock

The Canadian Dollar has been boosted by a sizeable U.S. Dollar rally, an uptick in domestic core inflation rates and further gains for oil prices.

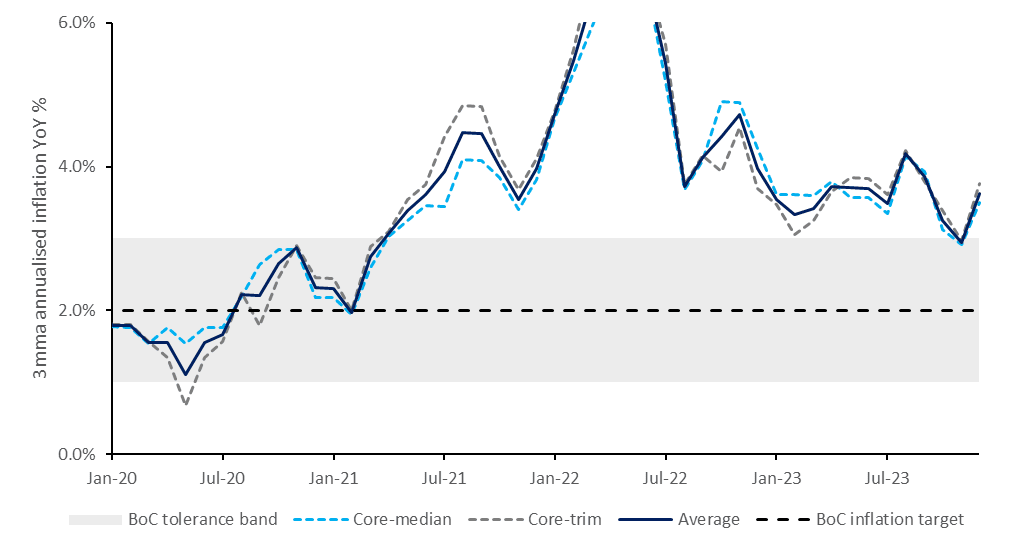

Canada's headline CPI inflation printed in line with analyst expectations but the Bank of Canada's preferred core measures, CPI-trim and CPI-median, failed to fall.

Trim accelerated by two ticks to 3.7% and the median remained at 3.6% from an upwardly revised prior month reading that was previously 3.4%.

"Those measures also accelerated in three-month and six-month annualised change terms, measures that the Bank of Canada will need to see more progress in before considering rate cuts," says Katherine Judge, an economist at CIBC Bank.

The Dollar to U.S. Dollar exchange rate is up a third of one per cent at 1.3461, the Pound to Canadian Dollar exchange rate is lower by 0.26% at 1.7032, and the Euro to Canadian Dollar rate is down 0.36% at 1.4643.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

"The BoC's preferred measure of core price growth now lies above their tolerance band, a fact that will likely support a continuation in hawkish rhetoric from policy makers come next week, something we suspect was already their preference," says Nick Rees, FX Market Analyst at Monex Europe.

Image courtesy of Monex Europe.

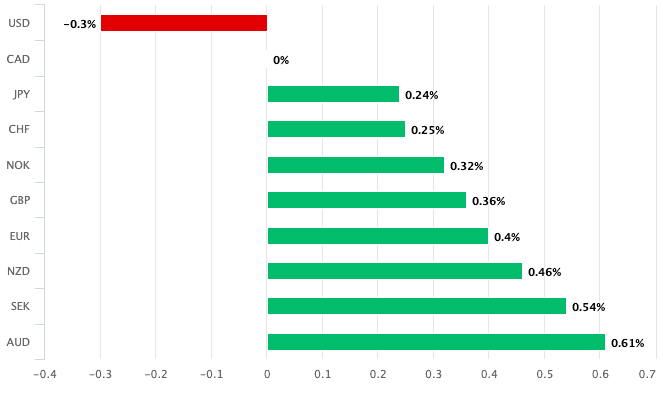

The Canadian Dollar was already an outperformer in the G10 space ahead of the Canadian inflation release, tracking a strong gain in the U.S. Dollar, creating a North American FX outperformance.

The tight economic, trade and financial ties between Canada and the U.S. are useful in explaining the CAD's positive correlation with USD.

The Dollar's 2024 uptrend extended amidst a selloff in global equity markets that spoke of deteriorating risk sentiment.

A key driver of that deteriorating sentiment is expectations that the first rate cut at the Federal Reserve is receding into the distance, which in turn pushes Canadian interest rate cut expectations back and aids the CAD.

Above: CAD outperforms on Jan. 16. Track CAD with your custom rate alerts. Set Up Here.

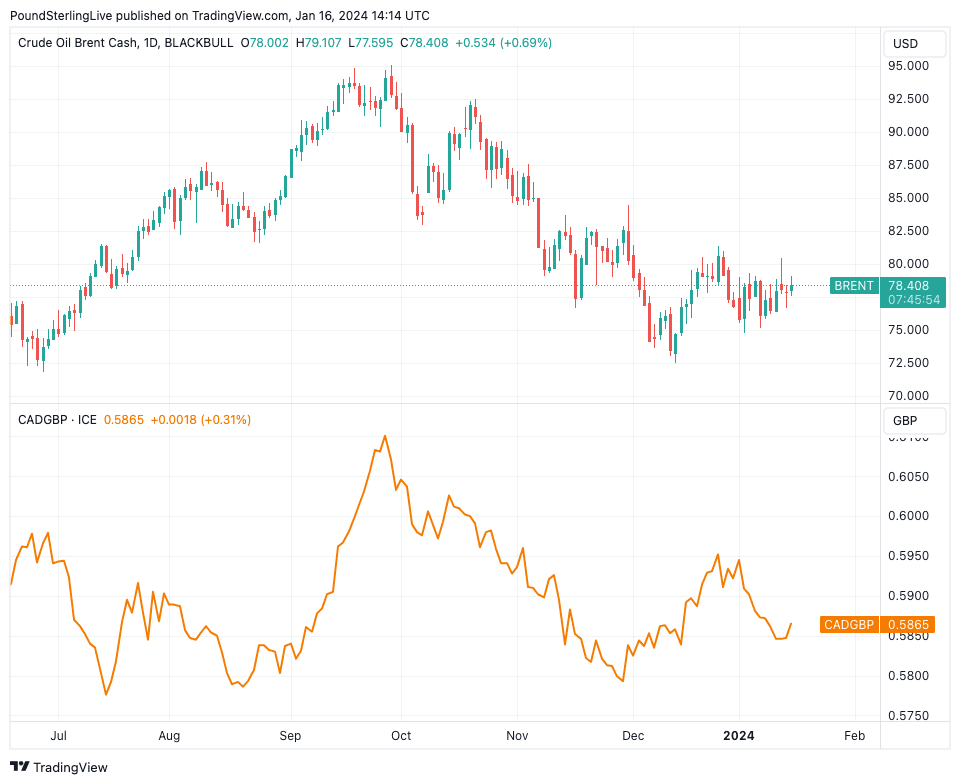

The Canadian currency is also responding to a rise in oil prices amidst ongoing concerns about global supply disruptions caused by attacks by Houthi rebels on international shipping off the coast of Yemen.

The Canadian Dollar is considered a commodity currency owing to Canada's oil export sector, which is a notable source of foreign currency earnings for the country.

"The brief spikes we've seen have highlighted the sensitivity in the market to events around the Red Sea," said Craig Erlam of OANDA.

Yemen's Houthi rebels said on Monday it would expand its targets in the Red Sea region to include U.S. ships and that it would keep up attacks after U.S.-led strikes in Yemen.

A Malta-flagged bulk carrier was struck by a missile off Yemen on Tuesday.

Should oil prices extend and risk sentiment remain poor, the Canadian Dollar can remain supported on the crosses. The correlation between Brent crude oil prices and the Pound-Canadian Dollar exchange rate is shown in the below chart:

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes