Pound-Canadian Dollar Uptrend Favoured To Extend: Scotiabank

- Written by: Gary Howes

Image © Adobe Stock

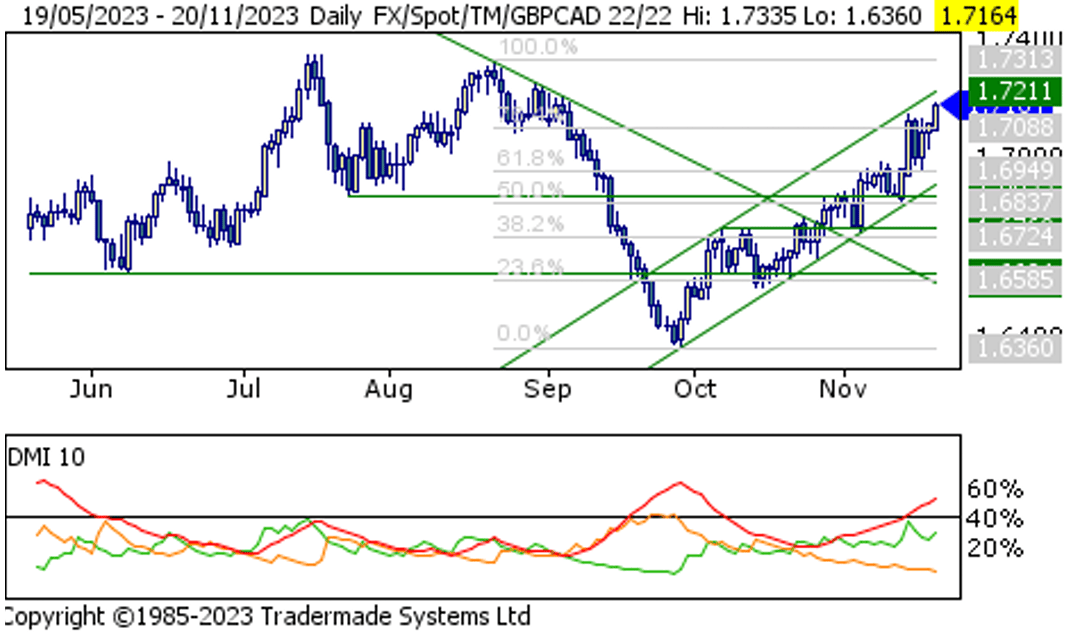

The Pound to Canadian Dollar has cemented itself above the 1.71 area, and a new analysis from one of Canada's most recognisable banks says the uptrend should be favoured to extend.

Scotiabank's foreign exchange strategy team notes the GBPCAD exchange rate's bull trend channel remains intact, supported by bullishly aligned, short-, medium– and long-term DMI oscillators.

"Price action looks solid and a full retracement of the GBP’s drop from the 1.73 area now looks likely," says Shaun Osborne, Chief FX Strategist at Scotiabank.

Image courtesy of Scotiabank. Track CAD with your own custom rate alerts. Set Up Here.

"There are no obvious signs of weakness in price action but there are some potential warning signs from the oscillator studies," adds Osborne.

Of note are some hints that the trend might be reaching an overextended status, which is conformed "somewhat" by the daily DMI.

Furthermore, "a weekly slow stochastic signal that is not fully confirming the GBP’s rise to new highs," adds Osborne. However, he adds that these sorts of concerns are more relevant when there are clear signs of weakness in the price action "and that is not the clear case now".

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

The British Pound advanced against the Canadian Dollar and other major currencies after the UK's PMI survey for November revealed the economy performed better than was expected.

The services PMI rose from 49.5 to 50.5, when economists expected it to remain unchanged, ensuring the UK's largest sector returned to growth in November.

This represents a solid upside surprise in a much-watched monthly data series, and the Pound has responded by advancing

Meanwhile, the Canadian dollar has been undermined by a slew of disappointing economic readings and a continued downtrend in global oil prices, which remain one of the more significant drivers of its value.

"There are a few ways to interpret the CAD’s move over the past several weeks. For one, its simply reflecting the data of late – which continues to highlight sluggish activity and is another marker that current monetary policy settings are restrictive enough," says Bipan Rai, Head of North America FX Strategy at CIBC Bank.

CIBC says the market is becoming more attuned to the idiosyncratic risks developing in Canada.

"These include the considerable degree of household debt and the sheer stock of mortgages that will need to be refinanced over the coming years," explains Rai.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes