Canadian Dollar Lags on Unexpectedly Weak Economic Data Print

- Written by: Gary Howes

The Canadian Dollar was weaker against all major peers after the release of an unexpectedly weak set of economic growth figures for June and the second quarter.

The Pound to Canadian Dollar exchange rate rallied to a daily high at 1.72048 after Statistics Canada reported GDP retreated 0.2% in the month to June, down on the 0.2% growth reported in May.

The second quarter saw growth come in flat on a quarter-on-quarter measure, disappointing against expectations for 0.3% growth and down on the first quarter's 0.6% expansion.

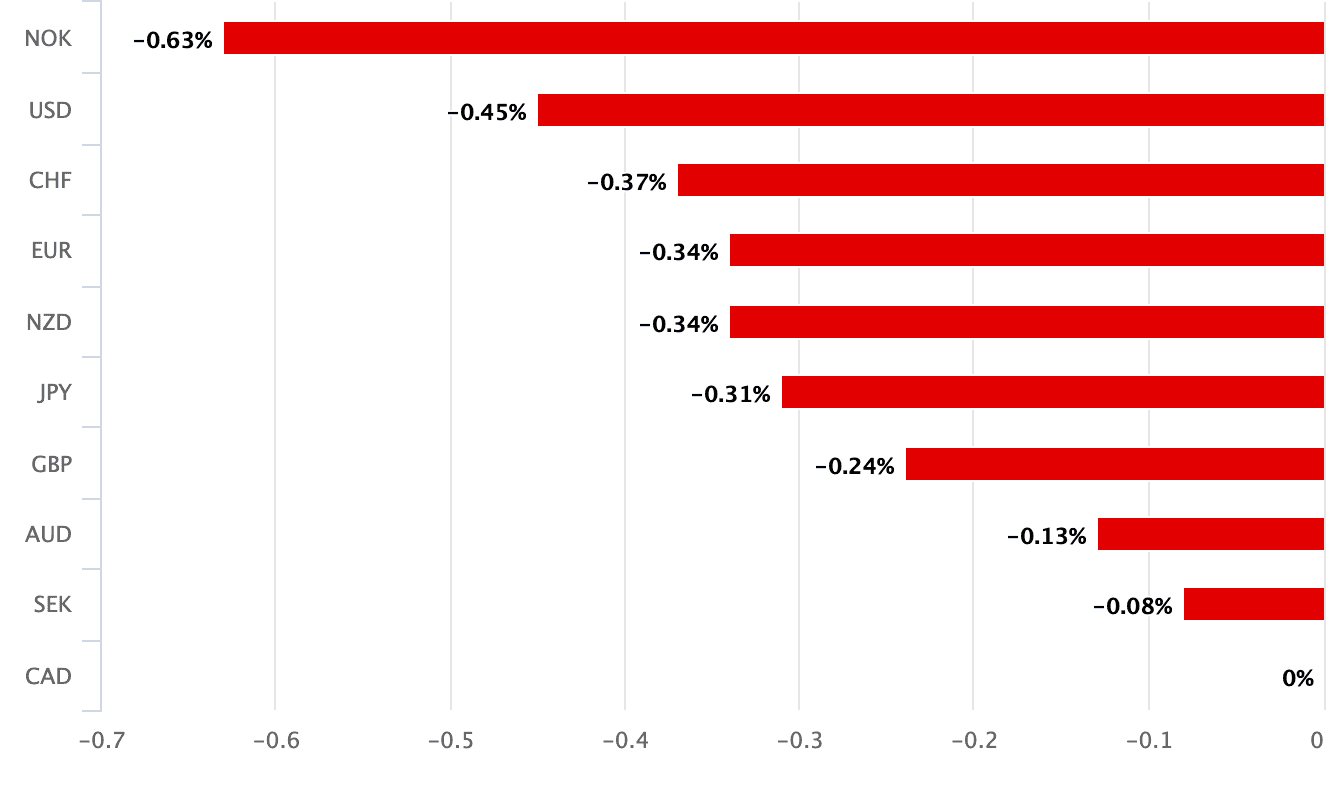

Above: CAD was weaker against all G10 peers following the release of Canadian GDP numbers.

"The small decline in Q2 GDP isn't entirely a surprise," says Nathan Janzen, Assistant Chief Economist at the Royal Bank of Canada. "Headwinds to economic growth from higher interest rates have been building under the surface."

Janzen says part of the second quarter's weakness is tied to 'temporary' factors like the federal workers' strike in April, but labour market data has also been looking softer with the unemployment rate up half a per cent over the last three months.

Consumer delinquency rates have also been edging higher, according to Statistics Canada.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

For Canadian Dollar exchange rates the data's potency lies with its impact on future Bank of Canada policy and gives rise to expectations that no further rate hikes will be required to bring inflation meaningfully lower.

"The GDP data should reinforce expectations that the BoC will move back to the sidelines and forego another interest hike next week," says Janzen.

On balance, this would prove to be a neutral to negative outcome for the CAD.

"The BoC won't put too much emphasis on one piece of data, and inflation is still 'stickier' at above-target rates than they would like. But evidence is building that the lagged impact of earlier rate hikes are beginning to work more significantly to cool GDP growth and labour markets," says Janzen.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes