GBP/CAD Week Ahead Forecast: Turning More Positive

- Written by: James Skinner and Gary Howes

- GBP/CAD could find support near last week's low at 1.62

- But upside potentially limited to beneath last week's high

- BoE speeches & minor UK economic data points in focus

- Canadian GDP a likely sideshow without any big surprise

Image © Adobe Stock

The Pound to Canadian Dollar exchange rate has drawn a line under its new year setback, and while it could consolidate between last week's highs and lows in the days ahead, the longer-lived outlook has potentially turned more positive for Pound Sterling.

Sterling outperformed last week following a sharp bounce in S&P Global PMI survey indices for February as well as hawkish economic and monetary policy commentary from Catherine Mann at the Bank of England (BoE).

Meanwhile, the Loonie also climbed against G10 counterparts with the sole exceptions being Sterling and the U.S. Dollar even after official data suggested that Canadian inflation softened during January in a favourable outcome for the Bank of Canada (BoC).

"For USDCAD, this [first major resistance] point is 1.37 though we think this may could push higher if stocks fail to hold key supports (we think the key level here will be 3950 in the S&P 500)," says Mazen Issa, a senior FX strategist at TD Securities.

"In the cross space, AUDCAD is vulnerable to move to 0.90 if the aforementioned equity support does not hold as AUD displays a much higher correlation compared to the CAD," Issa writes in a Friday research briefing.

Above: Pound to Canadian Dollar rate at hourly intervals with selected moving averages and shown alongside USD/CAD.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

For Sterling, official data has indicated a 'less bleak' picture of the public finances just weeks out from the March budget and at a point when inflation risks are still very much alive and kicking in the UK, suggesting upside risks for the Bank of England's Bank Rate ahead.

These risks will be in focus again this week when around half of the nine members of the Bank of England Monetary Policy Committee are scheduled to speak publicly about topics relevant to their policy stances in what is a relatively quiet period for UK economic data.

One important effect of the upside risks to Bank Rate is that they could enable GBP/CAD to remain well supported during the week ahead even in the face of recently increased expectations for Federal Reserve (Fed) interest rates.

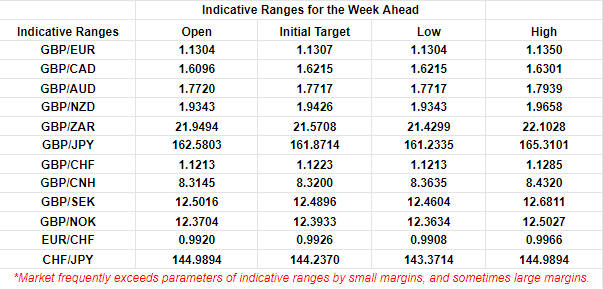

Above: Financial model-derived estimates of probable trading ranges for selected currency pairs this week. Source Pound Sterling Live. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Expectations were lifted last week when January's reading of the Fed's prefered measure of U.S. inflation indicated clearly that directional risks remain tilted very much to the upside, keeping as an open question the matter of how high the Federal Open Market Committee (FOMC) will ultimately lift the Fed Funds rate.

This question will remain in focus for the U.S. Dollar and North American currencies more generally over the coming days as multiple FOMC members hit the speaking circuit while both official and private sector indicators offer further insight into the performance and outlook of the economy.

"CAD is likely to ignore Canada’s GDP for December 2022 unless there is a large miss (Wednesday)," says Joseph Capurso, head of international economics at Commonwealth Bank of Australia.

"The next resistance for USD/CAD can be found at 1.3685 (year to date high). AUD/CADcan find support at 0.9185 (61.8% Fibbo). Signs the Chinese government will significantly step up its infrastructure spending will likely help AUD/CAD unwind some of its recent losses," he adds in Monday commentary.

Above: Pound to Canadian Dollar rate at daily intervals with selected moving averages. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes