Canadian Dollar Benefits as Employment Rally Weighs On GBP/CAD and USD/CAD

- Written by: James Skinner

"Governor Macklem and DepGov Kozicki made it very clear that the next move would be informed by data and their discussions and forecasts into the January decision and so this batch of readings will determine whether another hike is on offer this month" - Scotiabank.

Image © Adobe Stock

The Canadian Dollar rallied against most counterparts in the final session of the week after Statistics Canada reported another surge in employment that led the jobless rate back down near to the record low recorded last summer with possible implications for Bank of Canada (BoC) policy.

Canadian Dollars were bought widely after Statistics Canada said employment grew by 105k or 0.5% in December and when economists had been looking on average for a meagre 5k increase in payrolls to end an otherwise strong year.

Employment was steady in the public sector, leaving the private sector as the source of year-end job gains in which the youngest and eldest age groups benefited most as the labour market swelled to 19.77 million and the unemployment rate fell back to 5%.

"The big gain in employment was once again not reflected in working hours, which Statistics Canada stated were little changed compared to the prior month. That divergence is due to a further increase in staff absenteeism due to illness," says Andrew Grantham, an economist at CIBC Capital Markets.

"The strength in hiring therefore partly appears to be a reflection of companies having to retain more staff in order to obtain the same level of supply. Still, the strong headline readings raises the probability of another 25bp hike at the January meeting, and is a clear risk to our forecast for a hold," Grantham adds.

Above: Pound to Canadian Dollar rate shown at 15-minute intervals alongside USD/CAD. Click image for closer inspection.

Above: Pound to Canadian Dollar rate shown at 15-minute intervals alongside USD/CAD. Click image for closer inspection.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

Job growth helped drive an average hourly wage increase of 5.1%, marking a seventh month in which pay rose by more than 5% in what could be perceived as an inflation risk by the Bank of Canada.

The BoC is set to announce its next interest rate decision on January 25 but indicated back in December that any further increase is no longer a foregone conclusion after raising the cash rate from 0.25% to 4.25% last year.

"This is part of the hat trick of reports to watch over the next dozen days including the BoC surveys on the 16th and CPI the next day," says Derek Holt, head of capital markets economics at Scotiabank.

"Governor Macklem and DepGov Kozicki made it very clear that the next move would be informed by data and their discussions and forecasts into the January decision and so this batch of readings will determine whether another hike is on offer this month," Holt writes in a Friday research briefing.

December's policy statement said the Governing Council would be "considering whether the policy interest rate needs to rise further to bring supply and demand back into balance and return inflation to target" and Friday's data might have made another rate rise a bit more likely.

Much about this month's decision still likely depends, however, on Canada's December inflation numbers for December due out on January 17 and whether they show recent declines evolving into a convincing enough turn lower.

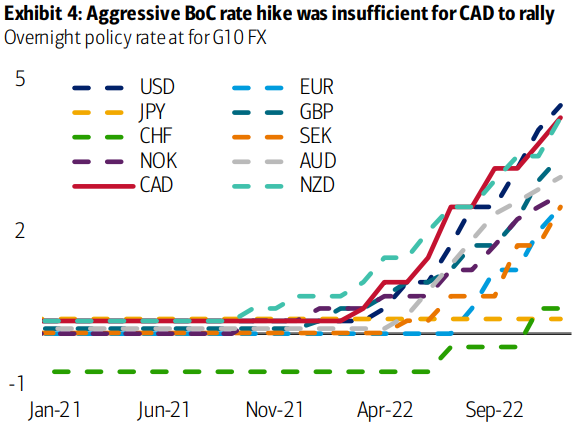

"In 2022, USD/CAD was driven more by the widened US-CA rate differentials as investors focused on central bank rate hikes, and expectation of an earlier rate hike pause for the BoC led to CAD sell-off in Q4 2022," says Howard Du, CFA and an FX strategist at BofA Global Research.

"In 2023, with policy rates anchored for both BoC and the Fed, we expect investors to shift focus from rate differential to relative growth. We find Canada would likely have a shallower recession than the US," Du writes in a Wednesday research briefing.

Above: Pound to Canadian Dollar rate shown at daily intervals alongside USD/CAD. Click image for closer inspection. If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.

Above: Pound to Canadian Dollar rate shown at daily intervals alongside USD/CAD. Click image for closer inspection. If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.