Pound / Canadian Dollar Rate "Cheap" Near Late December Low

- Written by: James Skinner

- GBP/CAD still has scope to recover further

- But 1.6650 needs to hold, Scotiabank says

- GBP/CAD “cheap” near late December low

- Ukraine conflict key to short-term outlook

Image © Pound Sterling Live

The Pound to Canadian Dollar exchange rate charts still suggest that a medium-term recovery from late December’s low is likely and this would remain the case for as long as Sterling can hold above the 1.6650 level, according to technical analysis from Scotiabank.

Sterling had fallen close to the round number of 1.67 against the Canadian Dollar on Monday before bouncing with global markets over the course of Tuesday and Wednesday, although its recovery was tepid and fading already in the penultimate session of the week.

“The cross is showing some signs of renewed demand near the late 2021 lows which is consistent with the bullish, long-term technical signal that developed around the December rebound. The Dec low at 1.6650 must hold for that signal to remain valid,” says Juan Manuel Herrera, a strategist at Scotiabank

“We remain of the view that GBPCAD looks relatively “cheap” here, near the base of the sideways range that has persisted since 2020, and we look for GBP gains through 1.6950 to trigger additional strength back to the low 1.70s,” Herrera cautioned in a Tuesday review of GBP/CAD’s charts.

Above: Pound to Canadian Dollar rate shown at daily intervals.

- Reference rates at publication:

GBP to CAD spot: 1.6742 - High street bank rates (indicative): 1.6140 - 1.6256

- Payment specialist rates (indicative: 1.6573 - 1.6640

- Find out about specialist rates and service, here

- Set up an exchange rate alert, here

GBP/CAD’s recovery saw Sterling back above 1.69 on Tuesday although it never managed to get close to 1.6950 in Wednesday trading and was little changed for a second consecutive session on Thursday; with much about the outlook resting on developments in and around Ukraine.

A temporary ceasefire in some occupied parts of Ukraine and Thursday’s negotiations in Turkey were widely cited for the recovery in global markets that catalysed Sterling’s rebound, although some analysts have suggested the rally in risk assets was built on foundations of sand.

“In short - and this was all about shorts - ‘Merry Xmas, War is Over’ by John Lennon was in the air,” says Michael Every, global macro strategist at Rabobank, writing in a Thursday market commentary.

“Let’s be clear, the rally was about options hedging/short squeezes, not new developments in the war or energy markets. We are seeing a change in some of the rhetoric on both but delivering on it such that it matters on the ground (and, eventually, for markets) is another thing,” Every adds.

Above: Pound to Canadian Dollar rate shown at weekly intervals.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The above matters for GBP/CAD because last week’s global market turbulence led European currencies to underperform notably and especially in relation to those with economies that have either commodity linkages or are based far away from Europe.

Canada’s Dollar did not rise alongside commodity currencies like the Australian and New Zealand Dollars but instead ceded ground to the U.S. Dollar, with the influential USD/CAD pair rising back toward 1.29 in price action that was relevant for the performance of GBP/CAD.

“We spot USDCAD support at 1.2795/00 this morning while resistance remains 1.2900/10. A push under 1.2795 may see the USD edge back to 1.2740/50. Gains above 1.29 target a retest of the late 2022 high at 1.2950,” Herrera and colleagues said on Wednesday.

“The intraday high of 1.3181 is intermediate resistance ahead of the figure zone which is followed by the mid-1.32s. Support is limited after the 1.31 zone and the recent low of 1.3082, with losses liable to take the GBP to a test of 1.30,” they also said in reference to GBP/USD.

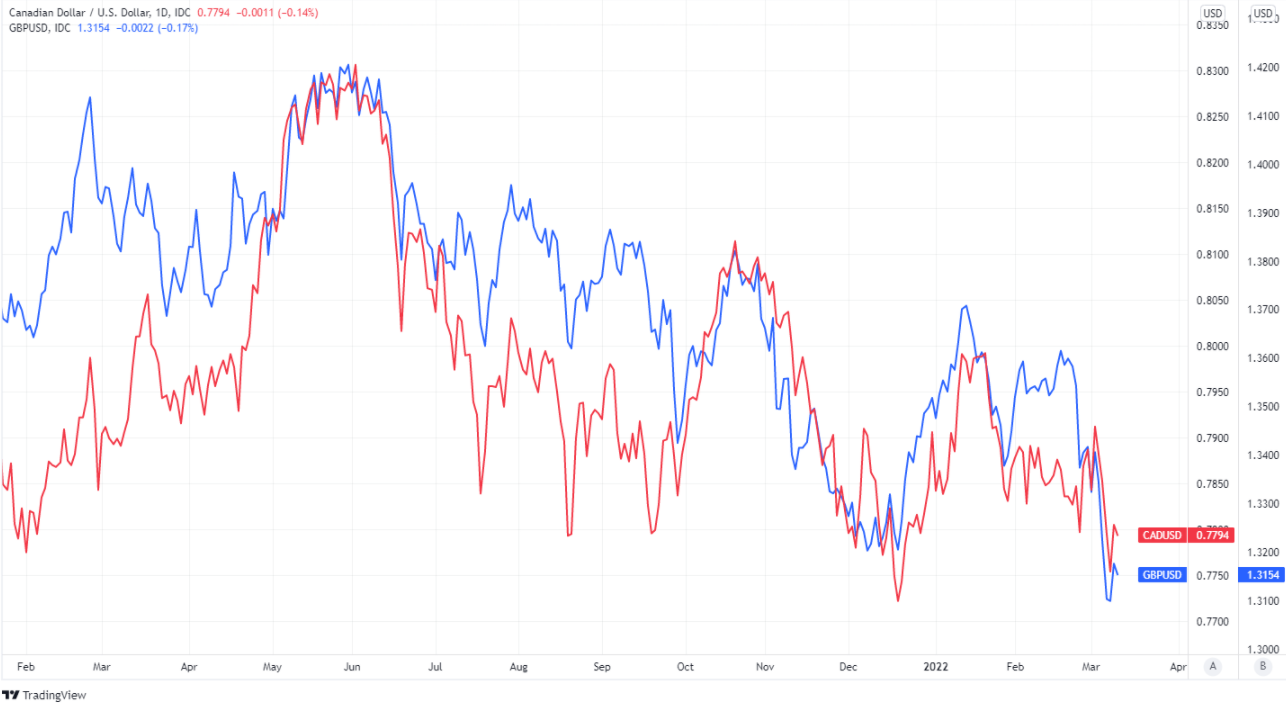

Above: USD/CAD shown at daily intervals alongside GBP/USD.

The Pound to Canadian Dollar exchange rate tends to closely reflect the relative performances of Sterling and the Loonie when each is measured against the U.S. Dollar, and Canada’s Dollar proved far more resilient than the Pound during late February and early March trade.

The rub for Sterling is that if USD/CAD trades within the range envisaged by Scotiabank over over the coming days, while the main Sterling exchange rate GBP/USD places the 1.31 handle under pressure again, this week’s tentative recovery in GBP/CAD would be liable to reverse somewhat.

Whether GBP/CAD reverses as far as its late December low around 1.6650 would depend heavily on the extent to which Sterling remains an underperformer during that time, which is itself likely to be a measure of remaining market concerns about Ukraine.

“Further optimism towards a diplomatic solution would continue to favour European currencies while hitting safe-havens and commodity prices. The dollar would likely give up some of its recent gains in this scenario,” says Chris Turner, global head of markets and regional head of research for UK & CEE at ING.

“We struggle to see markets turning decisively bearish on the dollar just yet given the still highly volatile geopolitical and market environment,” Turner and colleagues also said on Thursday.

Above: CAD/USD shown alongside GBP/USD.