Pound / Canadian Dollar Rate Clutches for Support after BoC Stalls Loonie

- Written by: James Skinner

- GBP/CAD attempting to stabilise after BoC stands pat

- Reiterates guidance for steady rates until April at least

- But GBP weakness, CAD strength risk more loses ahead

- GBP/CAD risks slide to 1.6250 as curtain closes on 2021

Above: BoC Governor Macklem. Image © Bank of Canada, Reproduced Under CC Licensing.

The Pound to Canadian Dollar rate was attempting to stabilise in the mid-week session after the December monetary policy decision from the Bank of Canada (BoC) stalled an advance by the Loonie that had previously pushed GBP/CAD to its lowest level since the onset of the coronavirus crisis.

Sterling had been under increasing pressure due to a combination of weakness in British exchange rates and an almost relentless advance by the Loonie before the Pound to Canadian Dollar rate attempted to stabilise above 1.6650 on Wednesday.

This was after the Bank of Canada left its cash rate unchanged at 0.25% and reiterated forward guidance suggesting the benchmark for borrowing costs is unlikely to go anywhere before the second quarter of next year.

“The new Omicron COVID-19 variant has prompted a tightening of travel restrictions in many countries and a decline in oil prices, and has injected renewed uncertainty,” the BoC said in part of December’s statement.

“We remain committed to holding the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved. In the Bank’s October projection, this happens sometime in the middle quarters of 2022,” the BoC added.

Wednesday’s reiterated guidance suggests the BoC could begin reversing its pandemic-inspired interest rate cuts at any point between April and September next year, although this was not enough to sustain the recent advance by the Canadian Dollar.

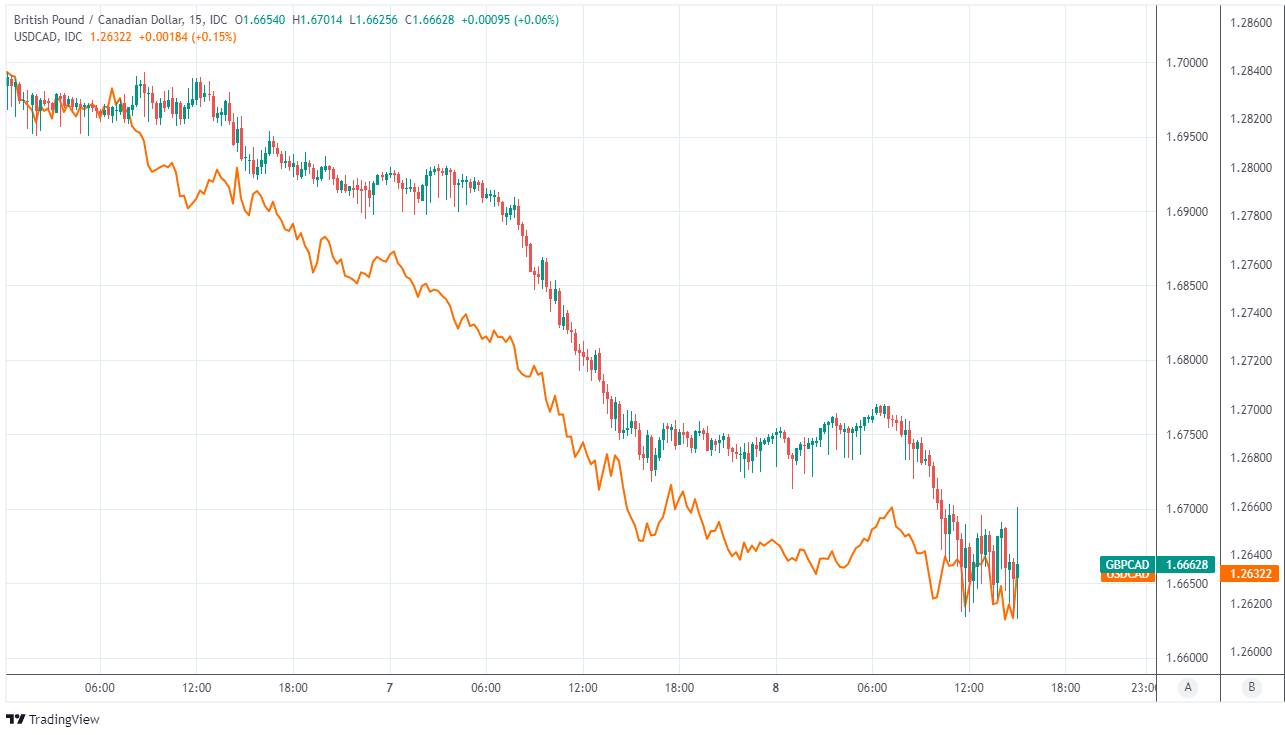

Above: Pound-to-Canadian Dollar rate shown at 15-minute intervals alongside USD/CAD.

- Reference rates at publication:

GBP to CAD spot: 1.6710 - High street bank rates (indicative): 1.6125 - 1.6242

- Payment specialist rates (indicative: 1.6560 - 1.6626

- Find out about specialist rates, here

- Set up an exchange rate alert, here

- Book your ideal rate, here

USD/CAD had fallen back to its lowest since late November ahead of the announcement, helping to pull the Pound-to-Canadian Dollar exchange rate to new lows for the year and a rising tide of market expectations for the BoC’s cash rate was one factor fomenting the rally.

“We’re looking for 150 bps in total hikes over 2022-23, divided equally between those two years. Markets went into this announcement already priced for an even faster run-up in policy rates in 2022 with fewer pauses than we expect,” says Avery Shenfeld, chief economist at CIBC Capital Markets.

Investors had come to anticipate that there was as much as a 36% chance of the BoC lifting its cash rate to 0.50% in January if pricing in the overnight-indexed-swap market is any guide, and were still taking a March 2022 interest rate rise for granted ahead of Wednesday’s BoC decision.

Those wagers were evidently disappointed mid-week, leading the USD/CAD and GBP/CAD exchange rates to find at least momentary support.

“The Bank does have 2 major speeches on the docket, though,” says Greg Anderson, global head of FX strategy at BMO Capital Markets.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

“We still think USDCAD has the scope to run down to 1.2500 by the end of the year. However, we think the BoC's contribution to that move would more likely come from Macklem's speech next week than today's Interest Rate Announcement,” Anderson said in a Wednesday note to clients.

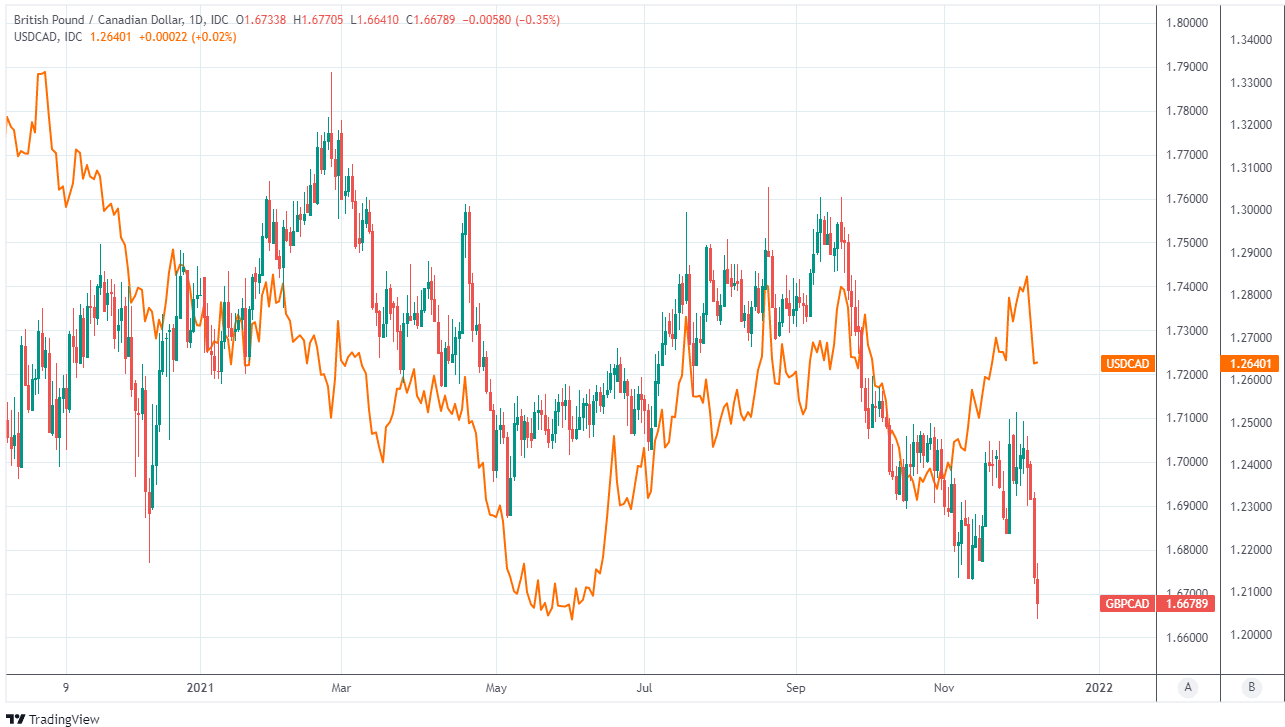

While GBP/CAD has been weighed down by losses in Sterling this week, around two thirds of its decline have been driven by losses in USD/CAD and if the BMO team is right in its outlook for the latter exchange rate, GBP/CAD could face further losses into year-end.

GBP/CAD could fall as far as 1.6250 over the coming weeks should BMO be right about USD/CAD heading to 1.25 and if at the same time Scotiabank is on money about the main Sterling exchange rate GBP/USD being at risk of falling to 1.30 next week.

“The imposition of these restrictions— which are, we think, only a relatively small tightening of limits—is likely enough to keep the BoE from hiking next week as they will prefer to wait until the February meeting. A BoE hold following a hawkish Fed the previous day (and political blunders at home) could see the GBP test the 1.30 level next week,” warns Shaun Osborne, chief FX strategist at Scotiabank.

Pound Sterling came under across the board pressure in the mid-week session amid speculation that the UK government will attempt to reimpose some form of coronavirus-inspired restrictions and that it's likely to cite the newest mutated strain of the virus for decision.

Above: Pound-to-Canadian Dollar exchange rate shown at daily intervals alongside USD/CAD.