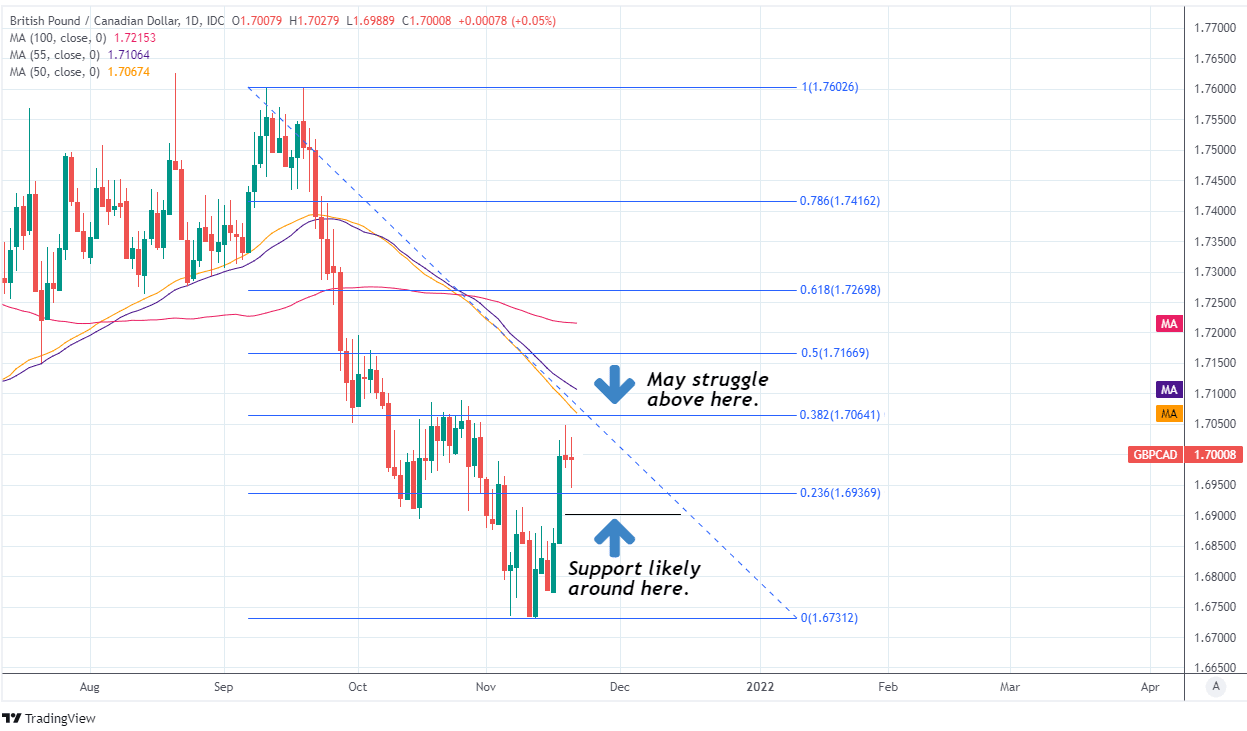

Pound / Canadian Dollar Week Ahead Forecast: 1.6912 to 1.7080 Range in Play

- Written by: James Skinner

- GBP/CAD consolidating two-month run of losses

- Range trades between 1.6912, 1.7080 short-term

- But risks still exist, GBP/CAD yet to exit the woods

- Europe virus restrictions & USD direction in focus

Image © Adobe Stock

The Pound to Canadian Dollar rate has attempted to draw a line under a two-month run of losses and could find itself well supported above 1.6912 this week, although Sterling may struggle to advance beyond 1.7080 and still faces a number of downside risks over a multi-week horizon.

Pound Sterling was the best performing major currency last week and alongside China’s Renminbi it featured as one of only two that managed to eke out gains over the Dollar, which has itself advanced broadly in recent trading.

Risk aversion was evident across global markets ahead of the weekend, helping to keep the Pound-to-Canadian Dollar exchange rate afloat near the 1.70 level that had been recaptured in the wake of last Wednesday’s inflation figures from the UK and Canada.

UK inflation reached a decade high in October and gave confidence to those in the market wagering that the Bank of England (BoE) could be likely to lift its interest rate in December, while Canadian inflation figures were not enough to boost perceived odds of an equivalent move coming from the Bank of Canada (BoC) any time soon.

But it was the return to ‘lockdown’ and announcement of other new draconian restrictions including an attempt to make vaccination a legal requirement that spooked global markets and helped to keep GBP/CAD buoyant near the 1.70 handle on Friday and in time for the opening of the new week.

“Given the possibility that more virus lockdowns are announced in the coming days and weeks, risk-sensitive currencies like the CAD may trade on the defensive while declining oil prices exert an additional drag,” warns Shaun Osborne, chief FX strategist at Scotiabank.

Above: Pound-to-Canadian Dollar exchange rate with Fibonacci retracements of October decline indicating possible areas of technical resistance.

- Reference rates at publication:

GBP to CAD spot: 1.6980 - High street bank rates (indicative): 1.6386 - 1.6505

- Payment specialist rates (indicative: 1.6827 - 1.6895

- Find out about specialist rates, here

- Or, set up an exchange rate alert, here

Speculation is that new restrictions in Austria, the Netherlands and a handful of other European countries will also soon be implemented elsewhere on the continent including in Germany, which has stoked fears for the Eurozone recovery outlook and helped lift the U.S. Dollar.

U.S. Dollar gains have been most problematic for currencies that are sensitive to changes in investor risk appetite like the Canadian Dollar and other commodity currencies, while expectations of ongoing strength and resilience in the greenback are one reason why GBP/CAD could remain well supported over the coming week.

“While CAD fundamentals are positive, technical factors are aligned for further losses ahead. USDCAD found some resistance in the mid-1.26s zone reached this morning with solid support in the upper 1.25s/low 1.26s that will likely see the dollar bought on dips for the moment at least. The 1.27 zone stands as next resistance as the 61.8% Fib retracement of the Aug-Oct move,” Scotiabank’s Osborne and colleagues said on Friday.

Source: Scotiabank.

Osborne and the Scotiabank team cited the ongoing risk of further coronavirus related restrictions in Europe as a likely source of support for the greenback and the all-important USD/CAD exchange over the coming week, which means they’re also likely to be supportive of GBP/CAD.

The Pound-Canadian Dollar rate always closely reflects the relative performance of the main Sterling currency pair GBP/USD and USD/CAD, the latter of which is likely to trade in a range spanning the distance between 1.2492 and 1.2791 this week if Scotiabank’s financial models are on the money.

“Yesterday’s bullish trend reversal above 1.2583 shifts the focus up to 1.2618 (50% retracement of the August-October decline) and 1.2648 as the next resistance levels of note,” says George Davis, chief technical strategist at RBC Capital Markets, referring to the USD/CAD rate.

Source: RBC Capital Markets.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

“Support @ 1.2575 and 1.2494 is expected to attract buying interest based on the uptrend in place, with the trendline @1.2421 serving as the pivot for the current uptrend and our still bullish view,” Davis wrote in a research presentation last week.

Any continuation of last week’s losses for the Loonie would supportive of GBP/CAD and USD/CAD goes so far as to reach 1.2791, which would be it’s highest level since the end of September, then the Pound to Canadian Dollar rate would be likely to trade up to 1.7080 or above.

This would be the case even if in the meantime the main Sterling exchange rate GBP/USD sank back toward its 2021 low at 1.3355.

In the meantime and so long as USD/CAD holds above the rough 1.2492 area flagged as a likely area of support by Scotiabank and RBC then GBP/CAD would be likely to remain buoyant above 1.6912 over the coming week.

The rub for Sterling is that many in the market still anticipate an unravelling of USD/CAD over the coming weeks and months, with Credit Suisse and others tipping a fall to 1.2360 or below in the medium-term.

Above: USD/CAD with major moving-averages indicating areas of possible technical support while Fibonacci retracements of August-to-October decline indicated likely areas of technical resistance to upward moves in USD/CAD.

“The wider U.S.-Canada oil price differential has emerged as a new headwind: we acknowledge it as an issue with uncertain timing, and we account for it by slightly raising our USDCAD target from 1.2200 to 1.2360,” says Alvise Marino, a trading strategist at Credit Suisse.

Any USD/CAD decline to those kinds of levels would likely have bearish implications for the Pound-Canadian Dollar rate and would at the least constrain any recovery in the exchange rate, which is why it's not yet out of the woods despite last week’s effort at drawing a line under two months of losses.

However and in the meantime the risk is that the greenback remains on its front foot in what is a quiet week for the UK and Canadian economic calendars, but a busy one for newsflow from the U.S. where further inflation figures are set to be released ahead of minutes from the latest Federal Reserve meeting.

This would be supportive of the Pound-to-Canadian Dollar rate over the coming week.

It’s also possible if not likely that the White House will announce its nomination for the top job at the Federal Reserve this week, which could be taken by the market as a negative for the U.S. Dollar and so also USD/CAD and GBP/CAD if the decision is to replace the incumbent Jerome Powell.

“If the USD were to turn south (perhaps due to Brainard being nominated as Fed Chair), then USDCAD has a lot of room to run lower between now and the end of the year. We continue to think that USDCAD will end the year somewhere around 1.22,” says Greg Anderson, global head of FX strategy at BMO Capital Markets, writing in a research note last Wednesday.