Pound-Canadian Dollar Rate Back above 1.70 but May Struggle Again Soon

- Written by: James Skinner

- GBP/CAD back above 1.70 after test below 1.69

- As GBP recovers late Sept loss, CAD rally stalls

- But could struggle on approach toward 1.7050

- May slide as far as 1.6764 if CAD renews rally

Image © Adobe Images

- GBP/CAD reference rates at publication:

- Spot: 1.7021

- Bank transfer rates (indicative guide): 1.6425-1.6544

- Money transfer specialist rates (indicative): 1.6868-1.6936

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Pound-to-Canadian Dollar rate was drawing a line under a hat-trick of weekly losses on Friday after climbing tentatively back above 1.70, but it would be susceptible to fresh declines that could drag it as far as 1.6764 if the Loonie continues to push USD/CAD lower over the coming weeks.

Pound Sterling was close to the best performer in the G10 segment of the currency market barrel in the final session of the week having given Norway’s Krone a run for its money in tough competition for the top spot, helping to lift GBP/CAD around 100 points on the day.

Price action lifted the Pound-to-Canadian Dollar rate from intraday lows around 1.6891 and back up above 1.70.

“GBPCAD’s slump through 1.70 reflects the broader strengthening in the CAD seen through late September and early October and, like the other CAD crosses, there is little sign of the CAD rally slowing,” says Juan Manuel Herrera, a strategist at Scotiabank, in a Tuesday research note.

“There is, however, a strong band of support below the market between 1.6775/1.6875 which has acted as a steady floor for the GBP since early 2020 and a break below the 1.6775 point may be a stretch for the cross at this point,” Herrera had also said.

Friday’s rally from support beneath 1.69 lifted GBP/CAD by almost half a percent and had Sterling on course to post its first weekly gain inside of three.

Above: Pound-Canadian Dollar rate shown at daily intervals alongside U.S. Dollar Index and USD/CAD.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The Pound had risen against most major counterparts for the week and appeared undeterred from its upward trajectory when Monetary Policy Committee (MPC) members Sylvana Tenreyro and Catherine Mann made clear in public engagements this Thursday that they aren’t among the Bank of England (BoE) policymakers who’re becoming more open to the idea of reversing 2020’ coronavirus-inspired cuts to Bank Rate.

“BoE officials have signalled greater concern recently that the current surge in inflation could lead to second-round effects and a persistent increase in inflation expectations in the UK. Governor Bailey, for example, recently stressed that the MPC stands ready to hike Bank Rate to counteract any knock-on effects,” writes Stefan Ball, chief UK economist at Goldman Sachs.

“Our estimated statistical model points to a substantial probability of further increases in long-term inflation expectations in response to current rising inflation, especially if the labour market turns out stronger than expected,” Ball and colleagues wrote in summary of recent research on Thursday.

Above: Goldman Sachs’ composite measure of various indicators of inflation expectations, and modeled forecast.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Sterling has prospered after remarks from Governor Andrew Bailey, MPC member Michael Saunders and others previously each cast the BoE as becoming hesitant to continue providing emergency room monetary stimulus to the UK economy now its recovery is underway and expectations of future inflation levels have begun to edge higher on the coattails of this year’s high and rising rates of price growth.

The message has been that if these trends continue into the New Year the BoE could begin reversing the two March 2002 cuts that took Bank Rate from 0.75% to 0.10% as the coronavirus threatened unprecedented disruption of the economy, which has led financial markets to wager on the BoE’s benchmark interest rate returning to 0.75% by August 2022.

Sterling’s rally helped to put a floor under the Pound-to-Canadian Dollar rate this week despite the fact that Canada’s Loonie also staged a break higher against the U.S. Dollar when pushing USD/CAD decisively beneath the 1.25 handle and as far as 1.2337 on Friday before paring gains.

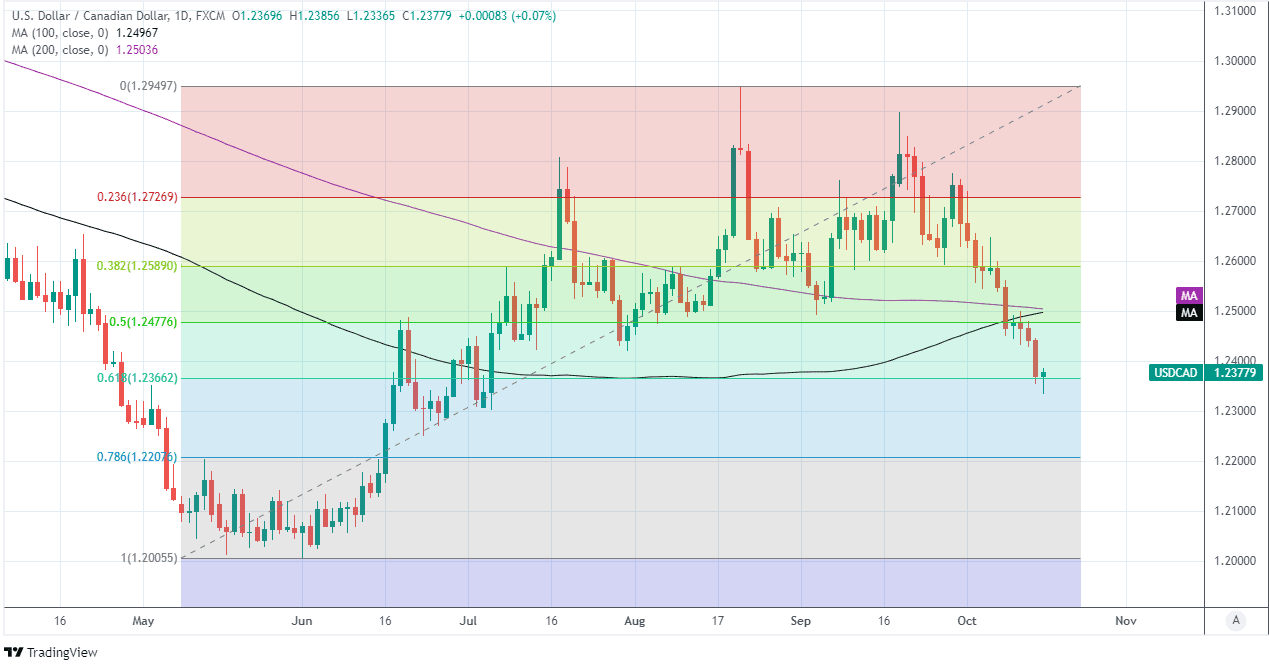

Above: USD/CAD shown at daily intervals with major moving-averages denoting possible areas of resistance and Fibonacci retracements of May to August rally indicating possible areas of support.

“For context, the last time that prompt WTI crude was at $80, and front-end spreads were at 40bps was in October 2014. USD/CAD was at around 1.12-1.13 back then,” says Bipan Rai, North American head of FX strategy at CIBC Capital Markets.

“The USD is far stronger now than it was in 2013, and our outlook is still for continued strength in 2022. In fact, our long-term factor model suggests that the equilibrium value right now for USD/CAD is at the 1.22 mark,” Rai told clients in a recent note on Friday.

GBP/CAD is sensitive to the twists and turns of USD/CAD as well as those GBP/USD, tending at all times to reflect the net performance of the two but with greater sensitivity to the trajectory of USD/CAD, which makes the outlook for Canada’s main exchange rate an important indicator for GBP/CAD.

The Pound-to-Canadian Dollar rate would fall to 1.6776 if USD/CAD unravels down to CIBC’s equilibrium estimate at 1.22 and if at the same time GBP/USD is unable to advance beyond Friday’s 1.3750, while losses would be limited if advances further.

“We continue to forecast 1.22 for year-end but feel the USDCAD risks hitting that point in the next few weeks before perhaps rebounding somewhat in December. The pro-risk mood is CAD-supportive alongside high energy prices,” says Shaun Osborne, chief FX strategist at Scotiabank.

“There is little, obvious support for the USD until the low 1.22s (76.4% Fibonacci support at 1.2229) but we can see some potential congestion in the 1.2275/1.2325 range that may slow USD losses,” Osborne also said.