Pound-Canadian Dollar Range Break Unimpeded by Canada’s Jobs Surprise

- Written by: James Skinner

- GBP/CAD builds gains further despite CA jobs surprise

- With 231k job surprise mostly composed of part-time

- GBP/CAD tests multi-month highs in range breakout

Image © Adobe Stock

- GBP/CAD reference rates at publication:

- Spot: 1.7292

- Bank transfer rates (indicative guide): 1.6687-1.6808

- Money transfer specialist rates (indicative): 1.7136-1.7171

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Pound-to-Canadian Dollar exchange rate edged higher in the final session of the week as the Loonie appeared to overlook better-than-expected June employment data from Statistics Canada, leaving GBP/CAD’s break higher from a two-month range to continue unimpeded.

Canadian job growth far overshot economist expectations for the month of June when announced as 231k on Friday, which was higher than the 172.5k indicated as likely by consensus estimates and more-than enough to reverse the -68k decline seen in the prior month.

“Public health restrictions had been significantly eased in several jurisdictions by the end of the June reference week. Most indoor and outdoor dining, recreation and cultural activities, retail shopping, and personal care services had resumed or continued in eight provinces,” Statistics Canada says. “Ontario's stay-at-home order was lifted on June 2, and outdoor dining and some in-person non-essential shopping resumed on June 11.”

Total employment was up 1.2% to 18.79 million during the period, which pushed the official unemployment rate down in line with expectations from 8.2% to 7.8%, although all of the new jobs created or recovered from the coronavirus last month were part-time positions.

Full-time employment was “little changed” last month, taking some shine off of the data as part-time positions generally add less to GDP and so are worth less to the economy overall than full-time counterparts.

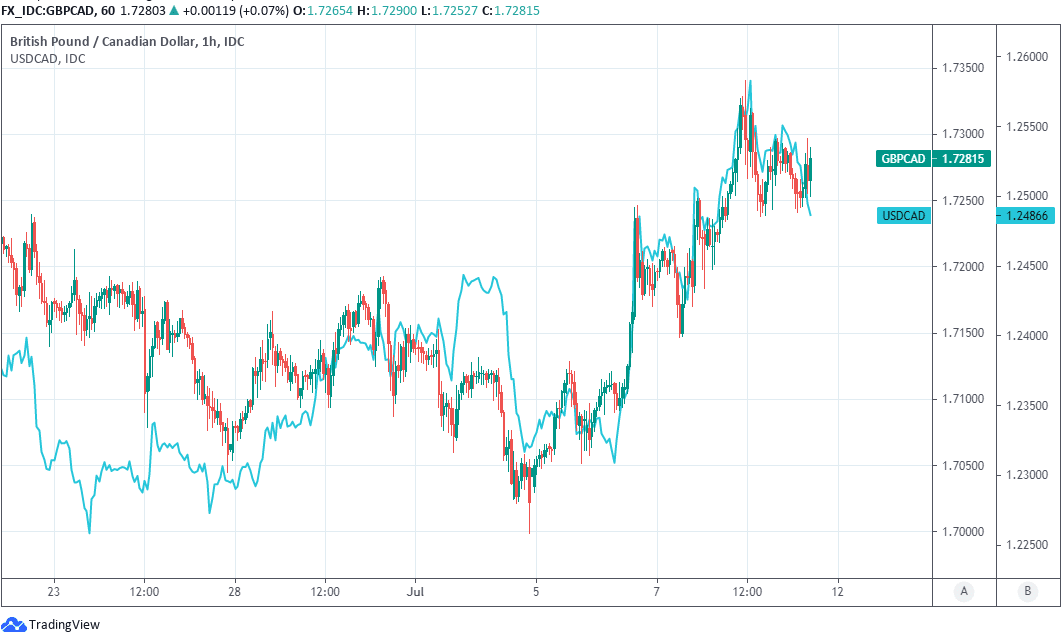

Above: Pound-to-Canadian Dollar rate shown at hourly intervals with USD/CAD.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

“We expect the BoC to taper bond purchases again at its meeting next week. The rebound in USDCAD makes that move considerably easier than it was when USDCAD was flirting with a break below 1.2000,” says Greg Anderson, global head of FX strategy at BMO Capital Markets.

It’s not clear if this explains the Canadian Dollar’s limited, if-not lack of response or if this is better explained by the fact that optimism about the outlook for Canada’s economy may have peaked already with investors and traders having wagered for weeks now that the Bank of Canada (BoC) could be likely to lift its interest rate from the current record low of 0.25% as soon as April next year as a result of Canada’s strong economic performance.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Friday’s report was the last major data point to come before the July monetary policy decision of the BoC, which is widely expected to see Canadian policymakers further winding down the quantitative easing programme that has kept government bond yields pinned to the floor since the onset of the pandemic, with analysts and economists anticipating that weekly purchases will be cut from C$3bn to C$2bn per week.

“We continue to cautiously favor the downside in USDCAD, with our model showing fair value based on correlated financial prices at 1.2355. However, given underlying momentum, our model would also buy a dip to that level. We suspect technical support lies somewhere between 1.2310 and 1.2350. It's much harder to identify a resistance level at this stage, but 1.2650 was resistance back in April,” BMO’s Anderson says.

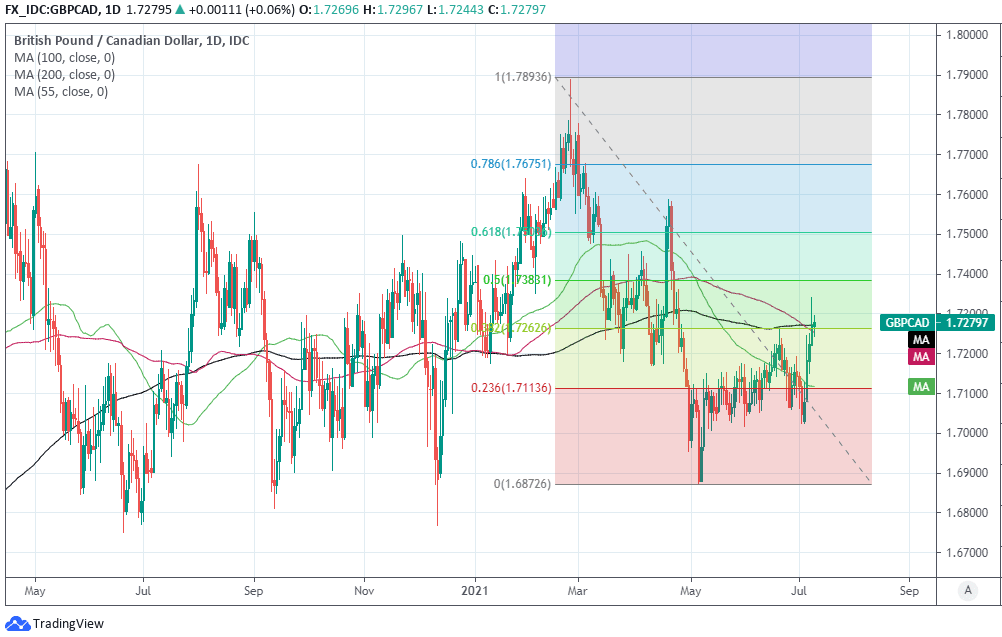

Above: Pound-to-Canadian Dollar rate shown at daily intervals with Fibonacci retracements of late March decline and key moving-averages.

The main Canadian exchange rate USD/CAD declined following Friday’s data, denoting a strengthening of the Loonie as well as renewed weakness in the U.S. Dollar, although neither move was enough to stop the Pound-to-Canadian Dollar rate from edging higher.

The GBP/CAD rate, which always closely reflects the relative performance of USD/CAD and the main Sterling exchange rate GBP/USD, reached its highest level since late April on Friday when trading close to 1.73.

This was after decisively overcoming the 1.72 handle earlier in the week, a level that had barred its path higher for months, in what appeared at the time like a response to tumbling oil prices and has quickly evolved into an evident range breakout to the upside.

“We fielded a few questions this week on the extent to which crude is to blame for CAD weakness. WTI sold off 8% peak to trough (though only -2% on the week). USD/CAD rallied from 1.23 to just shy of 1.26 in 48hrs,” says Elsa Lignos, global head of FX strategy at RBC Capital Markets.

“On any given day, crude ‘contributes’ on average 0.1% to daily returns in USD/CAD. This week’s moves are in line with that average (slightly higher on Tuesday/Wednesday as crude sold off, slightly lower in the rest of the week) and crude alone has a limited role in explaining CAD,” Lignos says.