Canadian Dollar Forecasts Raised at National Bank of Canada, See Further Gains Against Dollar and Pound Until Sept.

- Written by: Gary Howes

- GBP/CAD could go as low as 1.66

- USD/CAD could go as low as 1.17

- EUR/CAD could go as low as 1.44

Image © Bank of Canada

- GBP/CAD reference rates at publication:

- Spot: 1.7073

- Bank transfer rates (indicative guide): 1.6477-1.6597

- Money transfer specialist rates (indicative): 1.6620-1.6955

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

National Bank of Canada says further Canadian Dollar strength lies ahead and the currency is likely to take value off the Dollar, Euro and Pound over coming weeks as a result.

National's markets division, NBF, says in a regular monthly currency research note they expect a stronger Canadian Dollar in the third quarter of 2021 thanks to a combination of factors that include rising oil prices and a rapidly improving global economic recovery.

However, the third quarter might prove to be the high-water mark for the CAD, which will subsequently start shedding value from this point onwards.

In assessing the outlook analysts say they are not convinced that the Canadian Dollar's recent bout of outperformance can simply be laid at the door of a weakening U.S. Dollar alone as there are some genuine fundamentals supporting the Canadian unit, and these drivers are not yet exhausted.

"It would be easy to attribute most of its recent gains to the drop of the trade-weighted U.S. dollar. Case closed, pack it up, end of the story, right? Not even close," says Stéfane Marion, Chief Economist and Strategist at NBF.

"There is a slew of factors at play in the CAD moves we have seen," he adds.

Factors driving the Canadian Dollar include the strength of the global economy and an upgrade to NBF's oil price forecast – from $65 to $75.

This "implies a slightly stronger Canadian currency in Q3," says Marion.

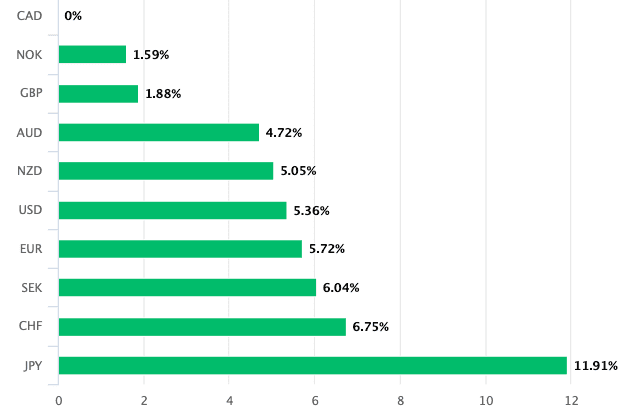

The Canadian Dollar is the best performing major currency of 2021 with gains coming on the back of an improving global economy and rising commodity prices, particularly oil prices:

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

In addition, Canada's geographic position makes its economy particularly geared towards that of the U.S. which has undergone a substantial recovery thanks to the extraordinary support being offered by the U.S. Federal Reserve and the new administration of Joe Biden.

"The last few months have been consequential for the Canadian currency. It has performed better than many of its peers, appreciating for four straight months," says Marion.

But Canada's economy has itself recovered as the Covid-19 crisis eases and the country rapidly vaccinates its population.

Canada was slow to commence vaccinations owing to acute supply shortages, but of late the rate of vaccination has accelerated to the extent that the country has now overtake the U.S. in terms of numbers receiving a first dose of a vaccine.

Vaccinations will allow the economy to reopen on a sustainable basis going forward while supplying much needed confidence to consumers and businesses alike.

"The vaccination campaign is shaping up as a success story. Canada has surpassed the U.S. to become a world leader in the share of its population that has received at least one dose," says Marion.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

"We expect growth to pick up sharply in the second half of the year, an acceleration that should be conducive to further QE tapering by the Bank of Canada over the coming months," says Marion.

The Bank of Canada (BoC) said in April it is willing to reduce the scale of support it is offering the economy in light of the economic recovery that is underway, a decision that lead to strong gains for the currency.

NBF raise their forecasts for Canadian Dollar via a downgrade to the U.S. Dollar-to-Canadian Dollar exchange rate to 1.17 by the end of September from 1.19 previously.

The rate is expected at 1.20 by the end of the year and 1.21 by the end of March 2022. The exchange rate is at 1.2087 at the time of publication.

The Pound-to-Canadian Dollar exchange rate is forecast at 1.66 by the end of September, 1.72 by the end of the year and 1.71 by the end of March 2022. The exchange rate is at 1.7085 at the time of publication.

The Euro-to-Canadian Dollar exchange rate is forecast at 1.44, 1.49 and 1.48 for the above timeframes. The exchange rate is presently seen at 1.4723.

We reported on Monday that analysts at Goldman Sachs have also upgraded their CAD profile, saying they see three factors guiding their more bullish stance on the currency:

1) Rising oil prices

2) A helpful basket of Canadian exports

3) Canada’s real effective exchange rate is not strong enough to warrant a pushback from the Bank of Canada

"Further oil price appreciation as economic demand recovers faster than supply should continue to provide the key pillar of support for CAD," says Zach Pandl, Economist at Goldman Sachs.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}