Pound-Canadian Dollar Rate Loses Momentum at November High as Multi-month Range Holds

- Written by: James Skinner

- GBP/CAD rallies as Sterling strengthens and Loonie weakens.

- But loses steam at Nov high, multi-month range tipped to hold.

- 1.70-to-1.73 range confines GBP/CAD pending Brexit progress.

Image © Adobe Stock

- GBP/CAD spot rate at time of writing: 1.7270

- Bank transfer rate (indicative guide): 1.6665-1.6785

- FX specialist providers (indicative guide): 1.7010-1.7114

- More information on FX specialist rates here

The Pound-to-Canadian Dollar rate was losing steam Tuesday after rallying to November highs, although technical analysis from Scotiabank suggests the nearby ceiling of Sterling's multi-month range will remain intact, keeping GBP/CAD confined within a 1.70-to-1.73 multi-month range.

Pound Sterling outperformed on Tuesday after the UK government's Internal Market bill was defeated in the House of Lords and has hopes of a Brexit trade deal being delivered by mid-month remained elevated, contributing to a sharp rally in the Pound-to-Canadian Dollar rate.

Speculation suggesting a UK compromise on fisheries access could be afoot in the Brexit negotiations may have aided Sterling's outperformance on Tuesday, which came as investors also celebrated reports of progress in the search for a coronavirus vaccine from Pfizer.

But in the absence of an agreed trade accord and with the mid-November deadline drawing closer by the day, the Pound might now struggle to advance beyond the levels reached on Tuesday. The Pound-to-Canadian Dollar rate has been unable to rise above 1.73 since late August when the trade talks were thrown into disarray by the introduction of the Internal Market Bill, Brussels says breaches the terms of the EU withdrawal agreement.

"GBPCAD is maintaining its 8-week trading range and retains a generally trendless undertone between 1.69/1.73. Short-term price action looks mildly negative and daily trend signals are tilting a little more negatively for the GBP but the cross needs to clearly push below 1.70 and challenge the Sep/Oct lows to really start to carve out a stronger sense of direction— to the downside at least," says Juan Manuel Herrera, a strategist at Scotiabank. "We are neutral here and look for more range trading."

Above: Pound-to-Canadian Dollar rate shown at hourly intervals with USD/CAD rate (black line, left axis).

Brexit talks continued in London this week after UK negotiator David Frost said at the weekend that differences over so-called level playing field terms demanded by the EU and fisheries were still holding up an agreement.

A deal is crucial to averting a 'no deal' exit from the transition on January 01, 2021 and necessary if GBP/CAD is to make it back above the 1.73 level and into the top half of a wider and longer-term range. The Pound has traded between 1.6850 and 1.7880 since March but became trapped below 1.73 when the Internal Market Bill threatened to sink the talks with the EU in September.

"The risk rally was enough to push USD/CAD below double bottom support at 1.3029 on a daily closing basis. While the resulting bearish breakout shifts the focus down to 1.2952 & 1.2917 next, some caution is warranted as the formation of a hammer pattern, along price patterns in other instruments (a bullish outside day for the DXY, bearish outside day in EUR/USD, a shooting star pattern in the SPX) all warn of potential short-term reversals," says Daria Parkhomenko, a strategist at RBC Capital Markets.

GBP/CAD also partly reflect weakness in the Loonie, which underperformed after having rallied strongly on Monday when Pfizer said its vaccine candidate was found to be more than 90% effective in preventing COVID-19 in participants without evidence of prior SARS-CoV-2 infection.

Above: Pound-to-Canadian Dollar rate shown at daily intervals with USD/CAD rate (black line, left axis).

High effectiveness and safety could enable governments to see an alternative to the renewed 'lockdown' that's thought to have swept away the European recovery this quarter. However, and on the downside, a vaccine could take months or longer to roll out globally due to production constraints.

"The Canadian government has signed pre-order deals with several other companies that are developing other kinds of vaccines as well (Oxford/AZ, Novavax, Sanofi, Johnson & Johnson). That kind of access, availability, and diversity will be helpful and could underpin some residual strength for CAD assets," says Bipan Rai, North American head of FX strategy at CIBC Capital Markets. "The CAD should outperform on the crosses."

The Canadian Dollar has so-far drawn little benefit from this week's burst of vaccine optimism, potentially because major U.S. equity benchmarks also softened on Tuesday with the two having risen strongly in the prior week. However, some strategists say an immunisation treatment could be balm for the lockdown stricken Canadian economy and a catalyst for outperformance in Canadian exchange rates over the coming months.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

The Loonie still screens as one of the most sensitive to U.S. stocks so will be susceptible to any further profit-taking in those over the coming days, which would support to the Pound, although its medium-term prospects have been buttressed by vaccine progress as well as an election victory for opposition candidate Joe Biden that likely sees other countries like Canada face less trade hostility in the years ahead than they did under President Donald Trump.

"We think the market’s near term focus will be the trend-line extension support level in the 1.2920-40s; to see if traders can bounce prices off it. Everything seems a little too priced for perfection at this hour," says Eric Bregar, head of FX strategy at Exchange Bank of Canada, of USD/CAD. "One has to imagine that the leveraged funds are bailing at this point, because they actually added to their net long USDCAD position during the week ending on November 3; US election day (according to the latest COT report released on Friday). "

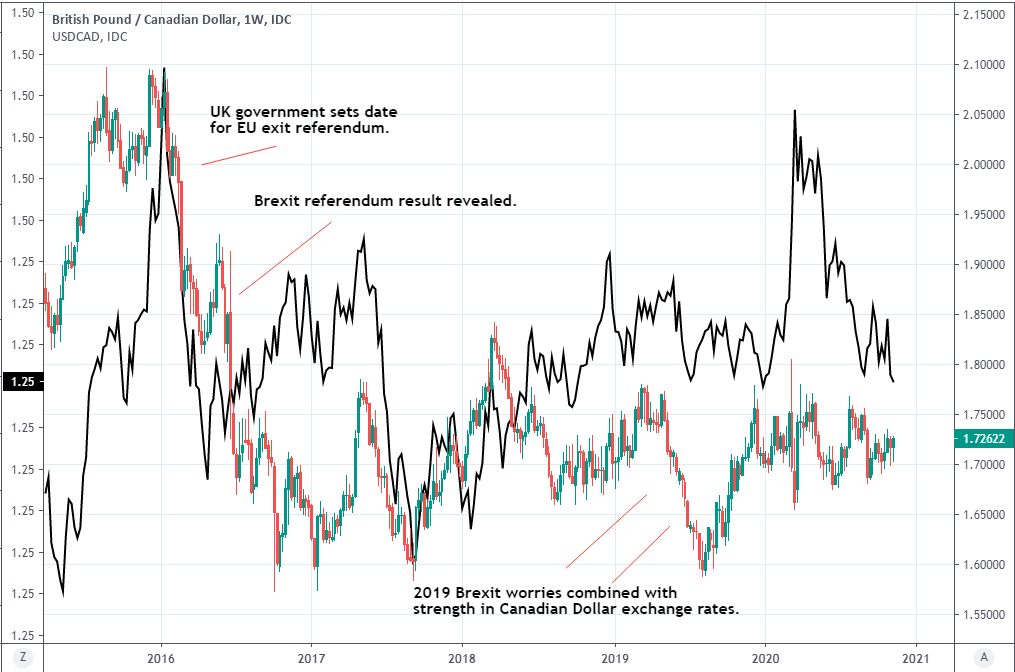

Above: Pound-to-Canadian Dollar rate shown at weekly intervals with USD/CAD rate (black line, left axis).