Pound's Long-Term Decline vs. Canadian Dollar Coming to an End: Scotiabank

Image © Adobe Stock

- GBP/CAD progresses higher as uptrend evolves

- Long-term bottom may also be in place

- Trading course provider offers alternative view

The GBP/CAD exchange rate is looking constructive in the short-term and may even be forming a longer-term bottom, say analysts at Scotiabank, suggesting it is more likely to rise than fall in the future.

Price action since the middle of September has been choppy and the pair has pulled back and started trading in a sideways range between 1.67 and 1.64, however, this short-term "noise" doesn’t detract from the fact the pair has made substantial progress already and is likely to continue.

“There is a fair bit of 'noise' around the short term price action but the Pound’s push through noted resistance in the 1.63 range has delivered the expected extension to the 1.66/1.68 range as shorter-term trend dynamics turn more constructive,” say Shaun Osborne, chief FX strategist at Scotiabank.

There is a chance the pair could continue to sell-off in the short-term, but it is likely to find substantial support at 1.6220, at the lower end of the rising channel, from where there is an increased chance it will ‘turn things round’ and mount a more concerted recovery.

A major bottom could also be forming, says Scotia.

“GBP/CAD is doing a good impression of a market that is trying to base and reverse in the longer run,” says Osborne.

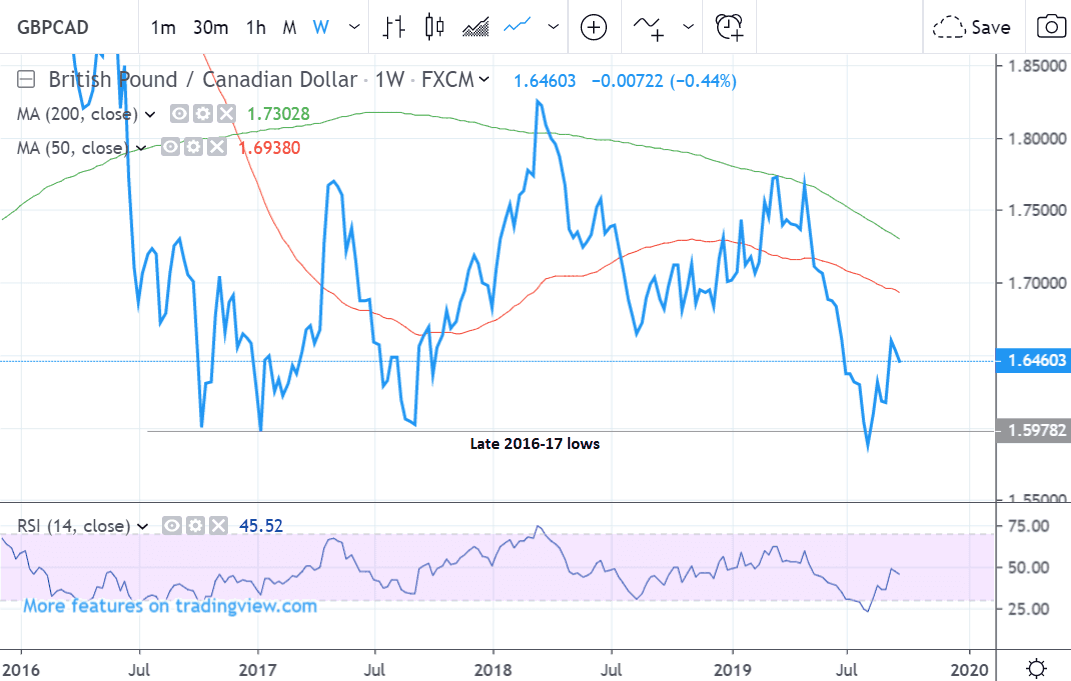

The pair has rejected the important historic low at circa 1.58 and bounced. The fact the floor held, indicates the possibility that it could provide the basis for a long-term bottom and, therefore, an eventual trend-evolution higher.

“More broadly, however, the longer run price signals suggest a major low in development, with the GBP handily rejecting the series of lows made in late 2016/2017 below 1.58 (via bullish monthly and - possibly/likely - quarterly) signals,” say Osborne.

Yet a recent note by CPD accredited trading course provider Lazy Trader comes to broadly the opposite conclusion.

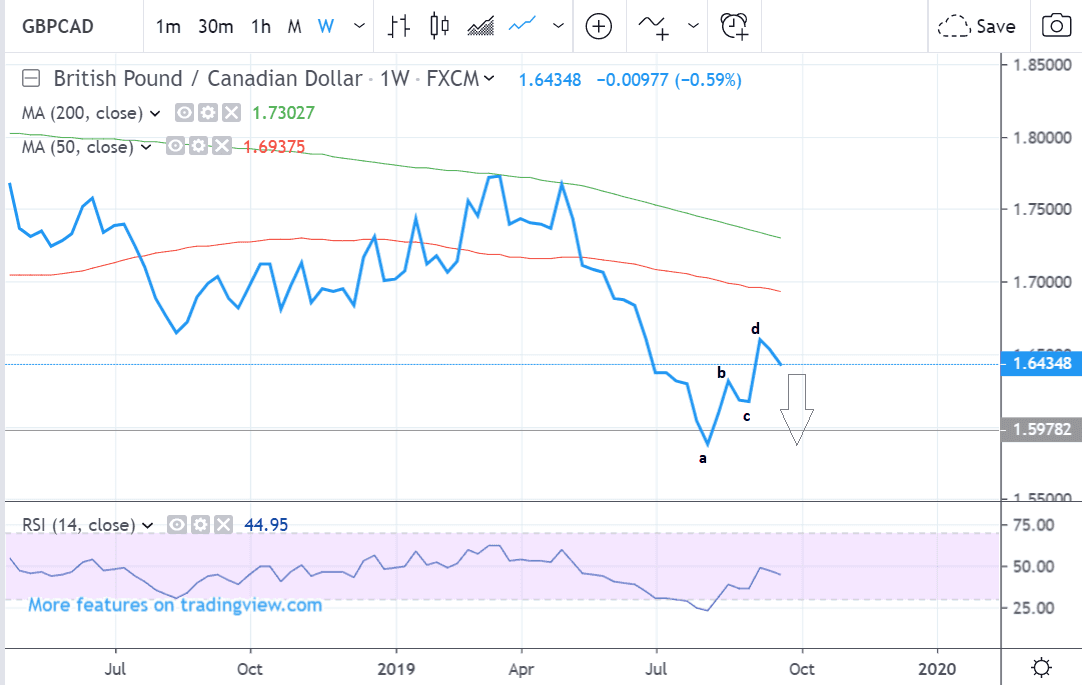

Lazy Trader sees a more bearish environment forming for the pair, arguing GBP/CAD could be in the process of finishing an ‘abcd’ correction pattern of the longer-term downtrend.

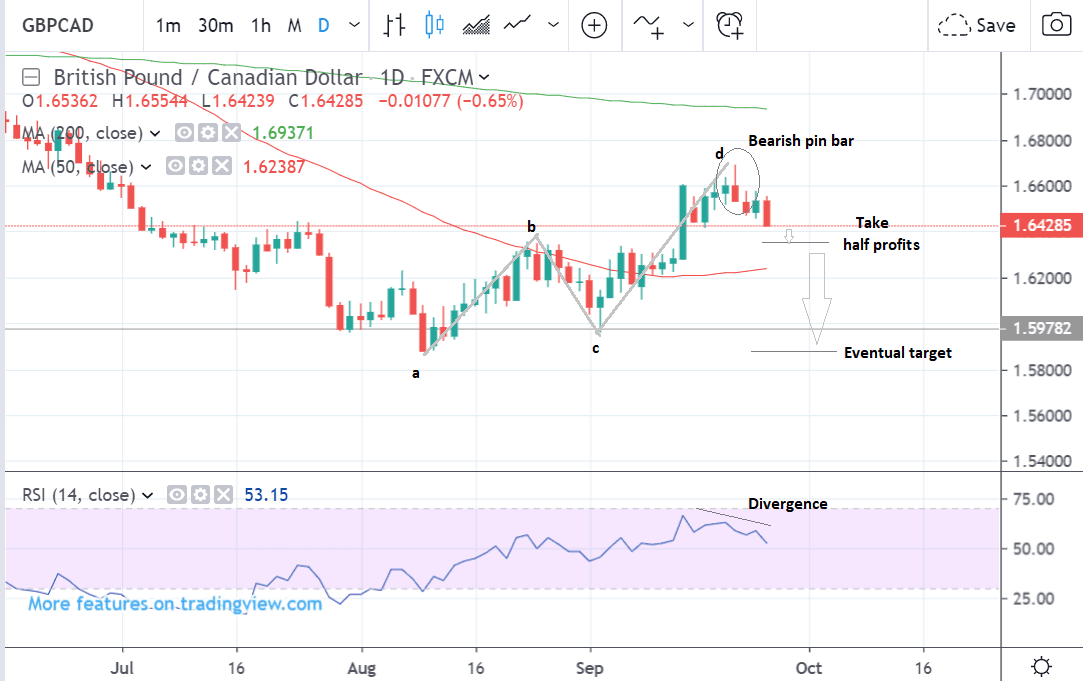

“If we go down to the daily timeframe we have a potential sell opportunity based on a classic abcd completion,” says Rob Colville the founder of Lazy Trader. “These are one of my favourites for trading reversals.”

ABCD patterns, also known as ‘measured moves’ are composed of three waves and look like a zig-zags.

Normally waves a-b and c-d tend to be of equal length or related by the Fibonacci ratio of 0.618.

In the case of GBP/CAD, the c-d leg actually extended well beyond the normal 100% of a-b usually achieved, but it did reach a length that was an exact multiple of the Fibonacci ratio of 1.618 of a-b, at the peak of the September 20 highs.

This is a sign the pattern has finished and will probably start selling off. GBP/CAD also formed a ‘bearish pin bar reversal’ day on september 20 after making a long range and ending the day at the lows. This is another bearish indicator, says Colville.

Finally, the RSI momentum indicator has diverged bearishly with price, meaning it failed to make new highs when price did, and this too is a bearish indication.

All in all this suggests lower prices for GBP/CAD. Lazy Trader’s Colville recommends taking half profits and lowering a stop loss if the pair reaches 1.6380.

Although his final recommended target is at the 1.58 lows he accepts it is possible the trade may not reach that far.

As such the views are not entirely incompatible since Scotia see a possible sell-off down to support at 1.6220 in the short-term before the uptrend revives.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement