Pound-to-Canadian Dollar Week Ahead Forecast: Exchange Rate to Continue Slow Burn Recovery

Image © Adobe Stock

- GBP/CAD appearing to base and mount recovery

- Longer-term charts also bullish

- Sterling moved by Brexit and Canadian Dollar by oil

The GBP/CAD exchange rate is trading at around 1.6153 at the start of the new week after falling a marginal -0.05% in the previous week. Despite declining overall, the charts are constructive and suggest the pair will probably move higher in the week ahead.

The 4 hour chart - used to determine the short-term outlook, which includes the coming week or next 5 days - shows how the pair has been rising since the August 9 lows, which probably marked a key bottom from which further upside is likely.

In the short-term, a break above the 1.6335 highs would probably give the green light to a continuation higher to a target at 1.6445 and the late July highs.

The daily chart shows how the pair may be in the process of rising in a bullish price pattern known as a ‘measured move’ which suggests more upside on the horizon.

Measured moves are three wave patterns in which the final C-D wave is usually of a similar length to the A-B wave. This gives a final target of 1.6445 which happens to, coincidentally, be at the level of the late July highs.

The RSI momentum indicator is rising strongly and is at the same level as it was when the exchange rate was in the 1.70s, which is a bullish sign.

The daily chart is used to give us an indication of the outlook for the medium-term, defined as the next week to a month ahead.

The weekly chart - used to give us an idea of the longer-term outlook, which includes the next few months - shows the pair having completed a larger ‘measured move’ which began at the 2018 highs.

The pattern is now probably complete as the final c-d leg has reached the same length as the a-b leg.

The fact the RSI momentum indicator has exited the oversold zone and is rising quite strongly provides further bullish evidence and suggests a rise up to a target at 1.6950, at the level of the 50-week MA, is not out of the question.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The Canadian Dollar: Oil in Focus

The Canadian Dollar is positively correlated to the price of oil which may fluctuate when OPEC has its meeting, at 11.00 BST, on Thursday.

Whilst no-one expects OPEC to change their official policy of limiting supply to keep oil prices elevated, recent data shows countries that belong to the organisation have in reality chosen to allow supply increases, and these could lead to softer prices in the future.

“OPEC’s crude oil production rose in August compared to July, another market survey found on Friday, despite OPEC’s continued calls for sticking to the cuts to achieve “market stability,” says Tsvetana Paraskova, a reporter for oilprice.com.

According to the latest S&P Global Platts survey, OPEC’s production increased by 50,000 bpd from July to reach 29.93 million bpd in August, with Iraq, Nigeria, and Saudi Arabia boosting output.

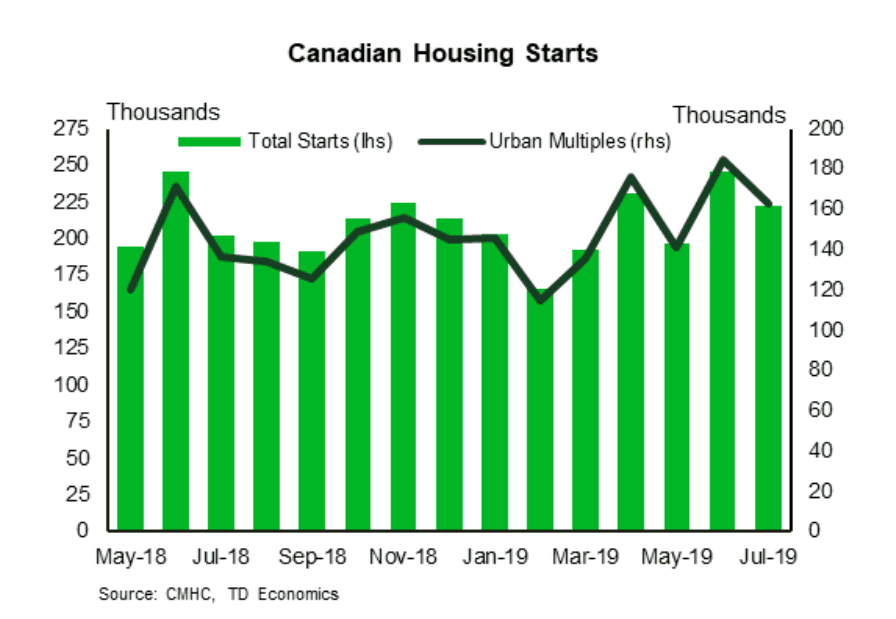

A quiet domestic data calendar leaves Canadian Housing Starts, out at 13.15 on Tuesday, as the main release.

The consensus estimate is for a 204.5k rise in August but some analysts are more optimistic.

“Housing starts are forecast to rebound to a 230k pace in August on a partial recovery in both multi-unit and single family construction. Weather conditions in August were more favourable for construction after heat waves in the prior month, and recent signs of life in the resale market along with lower rates should also help support development. Annualized starts of 230k in August would push the six-month trend back to 220k – the highest since June 2018 – and help to support residential construction over the coming quarters,” says TD Securities, a Toronto-based investment bank.

A strong housing market is normally a good sign for the economy. It is said ‘housing leads the economy’.

A good housing starts result, therefore, will help support the Canadian Dollar, even though it is unlikely to directly drive a move.

The Pound: What to Watch

Brexit is expected to continue to overshadow economic data as the main factor driving the Pound in the week ahead.

Boris Johnson will probably seek another vote of approval from Parliament for an early general election but he needs two-thirds of the vote to be successful and it seems highly unlikely he will get it.

If Johnson fails to secure an election before October 31 then we would suggest the chances of a 'no deal' Brexit in 2019 will have been materially reduced, and this development will surely provide support for Sterling.

What is certain, that while Brexit will have been delayed by recent developments, a 2019 General Election is almost a certainty, and it is here where market focus will fall.

Expect markets to try and weigh up the implications of the various outcomes: what would a Conservative majority mean, what would a Labour majority mean? What would the messy 'in-betweens' i.e. coalition and confidence-and-supply governments mean?

The range of potential outcomes are large in this time of Brexit, and therefore we would expect the uncertainty posed by the vote to keep a lid on Sterling and limit its full recovery potential.

On the data front, UK monthly GDP for July, industrial production, and employment data are the highlights.

GDP is expected to show a 0.0% rise in July like it did in June when it is released at 9.30 BST on Monday.

GDP showed a contraction of -0.2% in the second quarter of the year. Data out next week will show the 3-month rolling rate of GDP to July, which is expected to be -0.1%.

If the negative trend continues all through the 3rd quarter, i.e. in August and September, the country will have met the criteria for qualifying for being in a technical recession - two consecutive quarters of negative growth.

Although the Pound may decline if GDP comes out lower-than-expected next week loses may be short-lived if the Brexit news is positive for Sterling, as is widely expected.

“An overall expected downbeat set of data will not be able to stop the pound from bursting higher if Prime Minister Boris Johnson fails again in his bid to call a snap election,” says Raffi Boyadijian, an investment analyst at forex broker XM.com.

Employment data is expected to be broadly positive and show a continued rise in wages of 3.7%, an employment rate of 3.9%, and an increase in jobs of 43k in July, when the data is released at 9.30 on Tuesday.

Industrial and manufacturing production are forecast to show a -0.1% decline in growth in July when figures are released on Monday at 9.30.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement