Pound-to-Canadian Dollar Outlook: Established Downtrend Losing Momentum

Image © Adobe Stock

- GBP/CAD to extend lower

- Major trendline at 1.6200 to provide hard floor

- Canadian Dollar to be impacted by retail sales and maybe oil prices

The GBP/CAD exchange rate is trading at around 1.6375 on Monday morning, little changed from a week ago and our latest studies of the market suggest the potential for a sideways-orientated trend evolving.

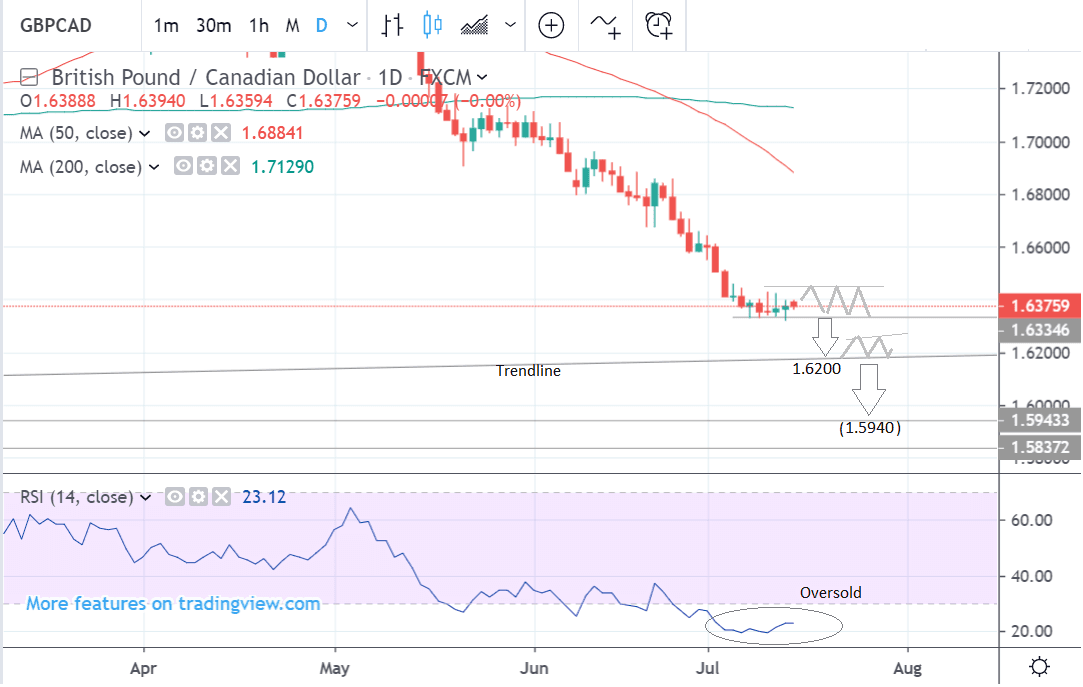

The 4-hour chart - used to determine the short-term outlook, which includes the coming week or next 5 days - shows the pair trading in a range after having hit a bottom last week.

But the trend prior to the start of this evolving sideways move was bearish so there is an overarching risk of a continuation lower restarting at any point.

The RSI momentum indicator in the lower pane, which tells us how momentum is evolving, is suggesting the possibility the sideways move will extend.

The RSI is converging bullishly with price: ‘convergence’ happens when price makes a new low but momentum does not follow.

The non-confirmation is a sign bearish enthusiasm is waning.

A break below the range lows and 1.6300 would provide confirmation of a continuation down to a target at 1.6175, at the level of a long-term trendline.

The daily chart shows the pair in an established downtrend which is expected to continue given the old adage that ‘the trend is your friend’.

The RSI momentum indicator is in the oversold zone below 30, however, and this indicates the trend may be a little overextended now and there is an increased risk it could stall or bounce.

Due to the oversold reading, the pair may also go sideways.

Nevertheless, it is expected to go lower eventually and a break below the 1.6300 would confirm a move down to the major trendline at around 1.6175-1.6200.

A clear break below the trendline could then also provide a green light for a breakout lower to a target at 1.5940.

The daily chart is used to determine the short-term outlook, which includes the next week to a month ahead.

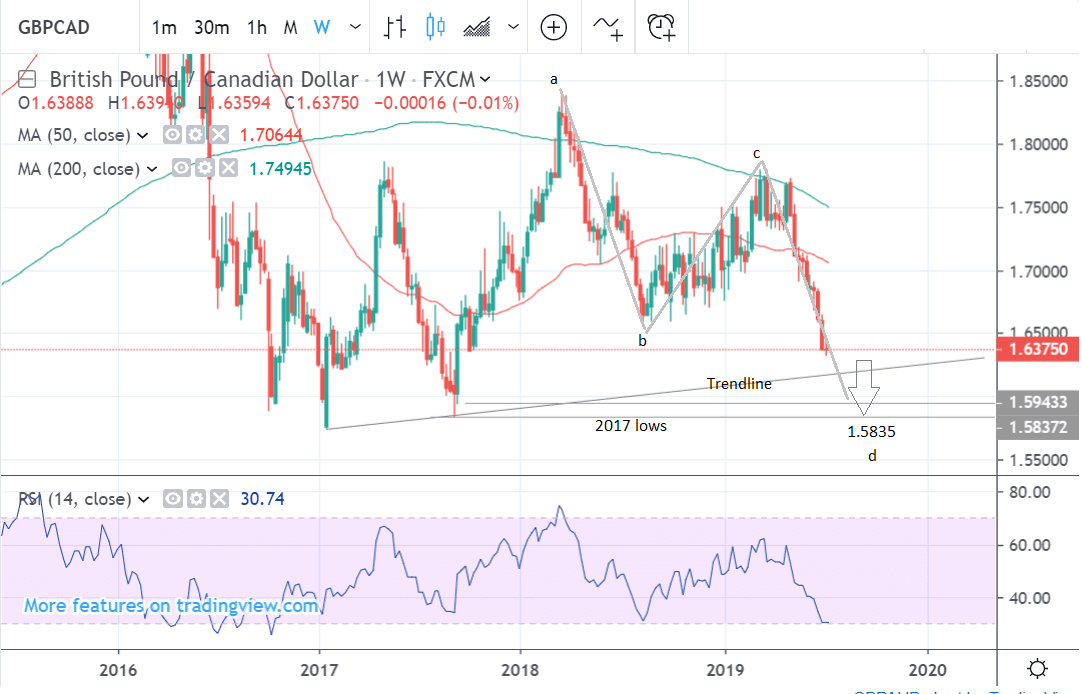

The weekly chart is showing the possibility of a bearish continuation down to a potential downside target at 1.6000 in the long-term.

The pair may have formed a ‘measured move’ price pattern since rolling over at the March highs.

If so, the final C-D leg is currently unfolding. The length of C-D is usually similar to A-B, which suggests an eventual downside target at 1.5835.

The weekly chart is used to determine the short-term outlook, which includes the next 1-3 months.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The Canadian Dollar: What to Watch this Week

The main events for the Canadian Dollar in the coming week are likely to be inflation data on Wednesday, retail sales on Friday and fluctuations in the price of oil.

The recent Bank of Canada (BoC) meeting reaffirmed market expectations that the BoC will be one of the few central banks in the world not to be considering lowering interest rates in 2019. Growth remains robust and inflation around target (which is 2.0%), so there is little reason to change anything. This should support the Canadian Dollar vis-a-vis other currencies where rates are expected to fall.

Interest rates are a major driver of currencies. If the rest of the world is cutting rates and the BoC is not it should support CAD, because relatively higher rates attract more foreign capital inflows.

So whilst inflation is forecast to slow to 1.9% in June from 2.4% previously this probably won’t materially affect the exchange rate since it will still be around the target level.

TD Securities - the investment bank arm of one of Canada's largest lenders - see a slightly better 2.1% result as more likely when data is released at 13.30 on Wednesday.

TD Securities looks for headline inflation to decelerate to 2.1% y/y in June, with prices down 0.2% from May.

"Lower gasoline prices will provide the main driver for the monthly print; gasoline prices fell by 8% for the month as a whole, which should shave 0.3pp off the headline print in June,” says TD Securities in a preview note. “Elsewhere, food prices should see modest gains following the recent strength in producer prices. Still, 3.5% is likely to mark the peak for food price inflation since FX passthrough from a stronger Canadian dollar should start to provide some relief in the coming months.”

Retail sales are expected to show rises in both core and broad gauges when they are released at 13.30 on Friday. Broad sales are forecast to rise by 0.3% in June and core by 0.4%, as they reflect an economy which is ticking along nicely.

“We expect another firm increase in sales in the key control group (+0.3% m/m) to be the main driver behind a 0.1% gain in headline retail sales, as consumer fundamentals remain sound (healthy labor market, steady real wages and high confidence levels),” says TD Securities.

Finally, the price of oil can sometimes impact on the Canadian Dollar. WTI crude oil remains above $60.00 at the time of writing after rising demand and geopolitical tensions drove it higher last week. Western Canadian Select trades at $48.56 after also rising.

Part of the gain was because the UK stopped an Iranian tanker in the straits of Gibraltar, which was said to be on its way to Syria in breach of international sanctions. The spat with Iran continues to lower future supply expectations.

API crude oil inventories could influence oil prices when they are released on Thursday at 21.30. If the trend in bigger draws continues it could push the price of oil higher as it will be reflective of high demand.

News related to the stalled opening of the Alberta pipelines in Canada, which would ease supply bottlenecks and open up markets in the east is likely to be the single biggest driver for Canadian oil prices, and therefore the currency.

In June work on the pipeline was finally approved after a federal court suspended the early decision to begin construction in 2016, due to environmental concerns.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement