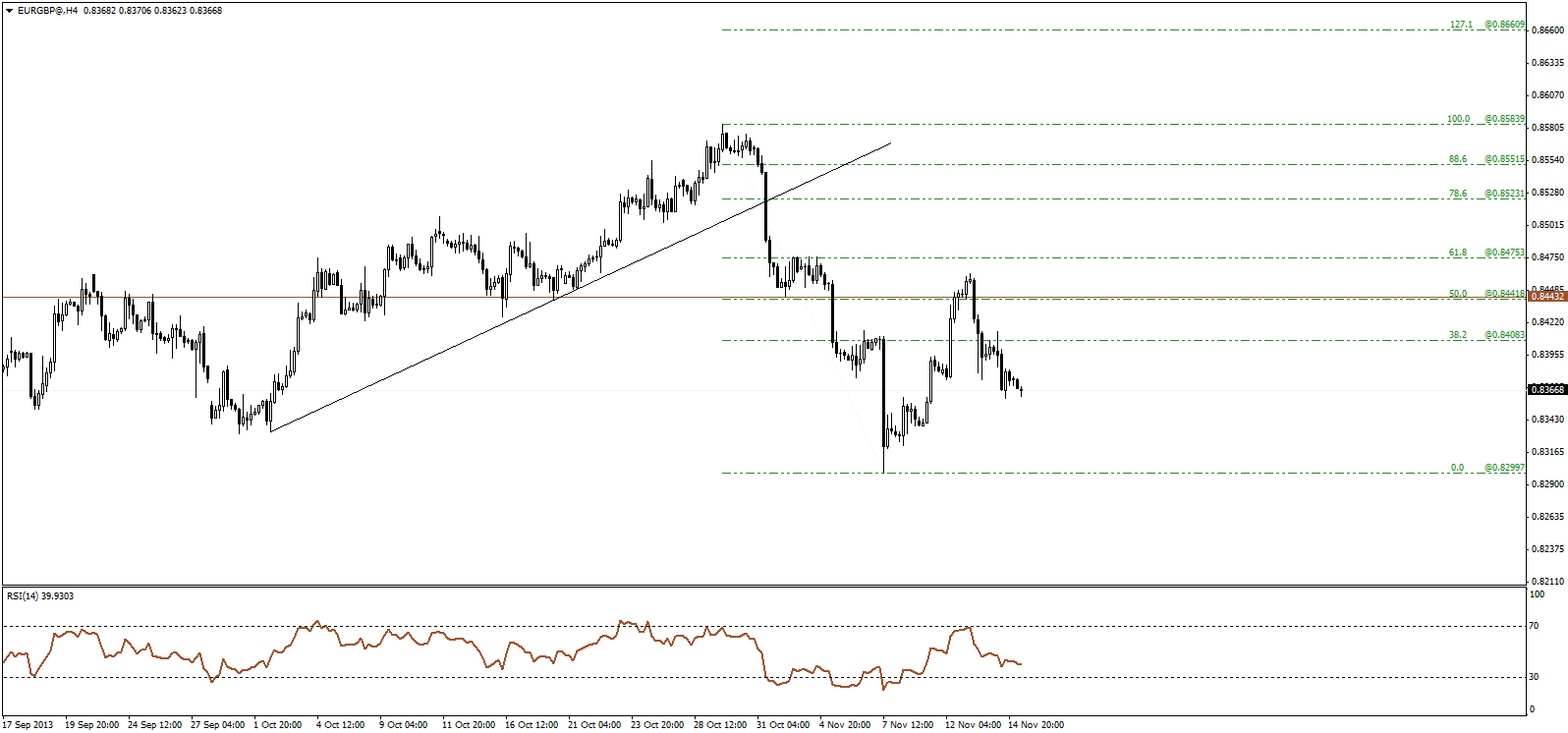

Euro Sterling: EUR/GBP could test previous major low at 0.8300

A look at the forex markets shows the euro sterling exchange rate is trading 0.12 pct in the red at 0.8370. There is a real risk that the EUR/GBP could break below the psychologically important 0.8333 level (GBP/EUR's 1.2) in coming sessions.

At the very least we could see a retest of early November and late September lows according to an analysis of the euro sterling exchange rate at ICN Financial:

"The price extended the downside move below our first target at 0.8375, where the downside pressure continues to be dominant. We maintain our bearish scenario, as price currently settles below 0.8375 broken support, looking for a retest of the previous major low at 0.8300."

Please keep in mind all quotations here are inter-bank spot rates. Your retail rate will be delivered with a spread being subtracted by your bank at their discretion. This is a competitive market though and the good news is that an independent FX provider will seek to beat your bank's rate, thus delivering up to 5% more FX. Please learn more here.

Analyst Luc Luyet at MIG Bank believes the recent relief rally in the euro sterling could finally have run its course:

"EUR/GBP has likely ended its short-term bounce. A test of the recent low at 0.8301 is favoured. An hourly resistance can be found at 0.8416 (14/11/2013 high). Another resistance stands at 0.8477 (04/11/2013 high).

"The medium-term declining channel, in place since the February 2013 top, calls for a mild bearish bias. We favour further declines below the support at 0.8333. Other supports can be found at 0.8225 (28/12/2012 high) and 0.8082 (01/01/2013 low)."

Euro dollar exchange rate could correct lower

Adding further pressure to the EUR/GBP exchange rate will be the headline EUR/USD rate which has also turned heavy.

From a technical point of view, the EUR/USD rally ran into resistance and the pair finally fell prey to profit taking at the end of last week, unwinding overbought conditions.

The pair tested a first support at 1.3462 early last week, but it was only when the ECB cut rates on Thursday that the pair went sharply south.

"The break below the 1.3462 support called off the short-term euro positive momentum and opens the way for a bigger correction with the 1.3105 correction low as the next obvious target. On the topside the correction top at 1.3832 is the new line in the sand," says Piet Lammens at KBC Markets.

The only news of note concerning the euro today is the release of inflation data.

Consumer Price Index (YoY) (Oct) remains at 0.7% while Consumer Price Index - Core (YoY) (Oct) moved down from a previous 1% to 0.8%.