Pound Sterling (GBP) LIVE on 30/10: GBP Under Renewed Assault From EUR + USD, BUT gains seen vs AUD and NZD

The British pound sterling (Currency:GBP) is under pressure on Tuesday with losses being witnessed against both the euro and US dollar. Meanwhile gains are being seen against the Aus dollar but GBP certainly could be doing better. We analyse where the potential support levels for the UK currency lie and try and ascertain where the bottom is.

Rates @ Last Update:

- The pound / euro exchange rate is 0.38 pct lower at 1.1662.

- The pound / US dollar exchange rate is 0.25 pct lower at 1.6099.

- The pound / Aus dollar rate is 0.41 pct higher at 1.6934.

- The pound / NZ dollar is 0.1 pct higher at 1.9479.

Note: The above quotes are from the wholesale markets; your bank will subtract a discretionary spread from when passing on their retail rate. However, an independent FX provider will guarantee to undercut your bank's offer, thus delivering up to 5% more currency. Please learn more here.

16:45: The mystery of the sterling sell-off

Another interesting perspective into today's selling, this time from Moneycorp:

"The pound took an unexpected and unusual hit early this morning in the Far East. At around midnight it slumped by three quarters of a cent against the dollar and the knock-on effect took it lower cross the board.

"There was nothing on the newswires to provoke the move. The assumption is that it was the work of an adventurer who thought that by taking Cable below $1.61 he ( and you can bet it was a he) could provoke a technical selloff."

16:30: Are investors tired of the pro-GBP story?

A 'goodish' explanation for today's GBP weakness vs USD and EUR from Omer Esiner at Commonwealth Foreign Exchange:

"Investors, who have bid the pound broadly higher in recent weeks, are unwinding some long sterling positions on the view that its upside may be somewhat limited going forward. Indeed, recent data has shown an impressive turnaround in the U.K. economy. Still, the pound’s near 10% appreciation against the dollar since July may be somewhat overdone."

15:21: Hard to explain the GBP/EUR selloff

Finding an explanation from the commentators we follow for this aggressive selling of the GBP vs the EUR is hard.

One thing that is becoming increasingly prevalent is the view that the ECB may have to act on the strengthening currency.

"The worry for policymakers is that a strong currency could risk spoiling the bloc’s nascent recovery by increasing the cost of exports, a leading growth engine. Consequently, currency players may decide to increasingly tread carefully with the euro ahead of next week’s ECB meeting." - Joe Manimbo at Western Union.

14:35: GBP in fresh slump vs EUR

The pound to euro has taken a fresh slump. Could it be that we are racing through the 1.16's and into the late 1.15's. This is rediculous if we consider just how advanced the UK recovery is to that of the Eurozone.

14:03: GBP to test key support at 1.60

Matt Weller at GFT says more aggressive traders should now consider selling the pound against the dollar:

Matt Weller at GFT says more aggressive traders should now consider selling the pound against the dollar:

"The GBP/USD fell over the last 24 hours, breaking below the bottom of the recent 1.6115-1.6250 range. The pair may now have room to fall further toward the central Monthly Pivot Point around 1.60 over the coming days. More aggressive traders should consider intraday sell opportunities on the pair, but with a sell trade already in place on the correlated EUR/USD, we will stay on the sidelines for now."

12:19: Month-end flows impacted by UK storm, volumes capped

Stephen Gallow at BMO Capital:

"The bulk of the London session thus far was rather on the ‘noisy’ side, and we suspect that recent weather events in the UK may have concentrated two days’ worth of month-end flows into one.

Commenting on the options market, Gallo says:

"GBP and AUD spots headed lower on stop-loss moves, but 1mth GBP is still languishing at 6.9%, lower than where it opened yesterday. As is so often the case with the GBP, there seems to be plenty of supply of optionality which keeps a cap on vols even if we do see decent overnight ranges."

11:54: Watch 1.6170 - important for anticipating further downside

ICN Financial give an ominous forecast:

"The pair dropped yesterday affected by the bearish harmonic Crab Pattern pushing the pair to trade below Linear Regression Indicators. Stability below 1.6170 supports extending negativity, as we think that the pair will move further to the downside. Breaking 1.5985 might support our expectations."

11:43: It's not over yet!

"GBPUSD has now dropped below 1.61 whilst GBPEUR is now below 1.17. This is partly a result of disappointing CBI data released yesterday, which gave investors an excuse to sell sterling further. It’s not over yet, and although UK net lending to individuals were below estimates, higher mortgage approvals can provide sterling with the boost needed to reverse yesterday’s losses. With no data from the eurozone, focus turns to the US where retail sales and CB consumer confidence are due. Poor numbers here would help boost EUR/USD and GBP/USD ahead of the Federal Reserve’s monetary policy announcement tomorrow." - Sasha Nugent at Caxton FX.

11:14: GBP trapped for now, BUT configuration remains bullish

Ipek Ozkardeskaya reminds us that even though the British pound is being hampered by some formidable resistance, it remains technically configured:

Ipek Ozkardeskaya reminds us that even though the British pound is being hampered by some formidable resistance, it remains technically configured:

GBPUSD has sold-off to 1.6063. GBPUSD remains trapped beneath 1.6260 despite indicators being marginally bullish. Yet with MACD still above the zeroline (RSI pointing lower) anticipate fresh demand to challenge 1.6260 resistance (preference to buy on dips) before an extension of strength to 1.6343."

Will the breakout above 1.6260 open the floodgates to GBP gains?

10:47: Technicals favour the Euro over Sterling again

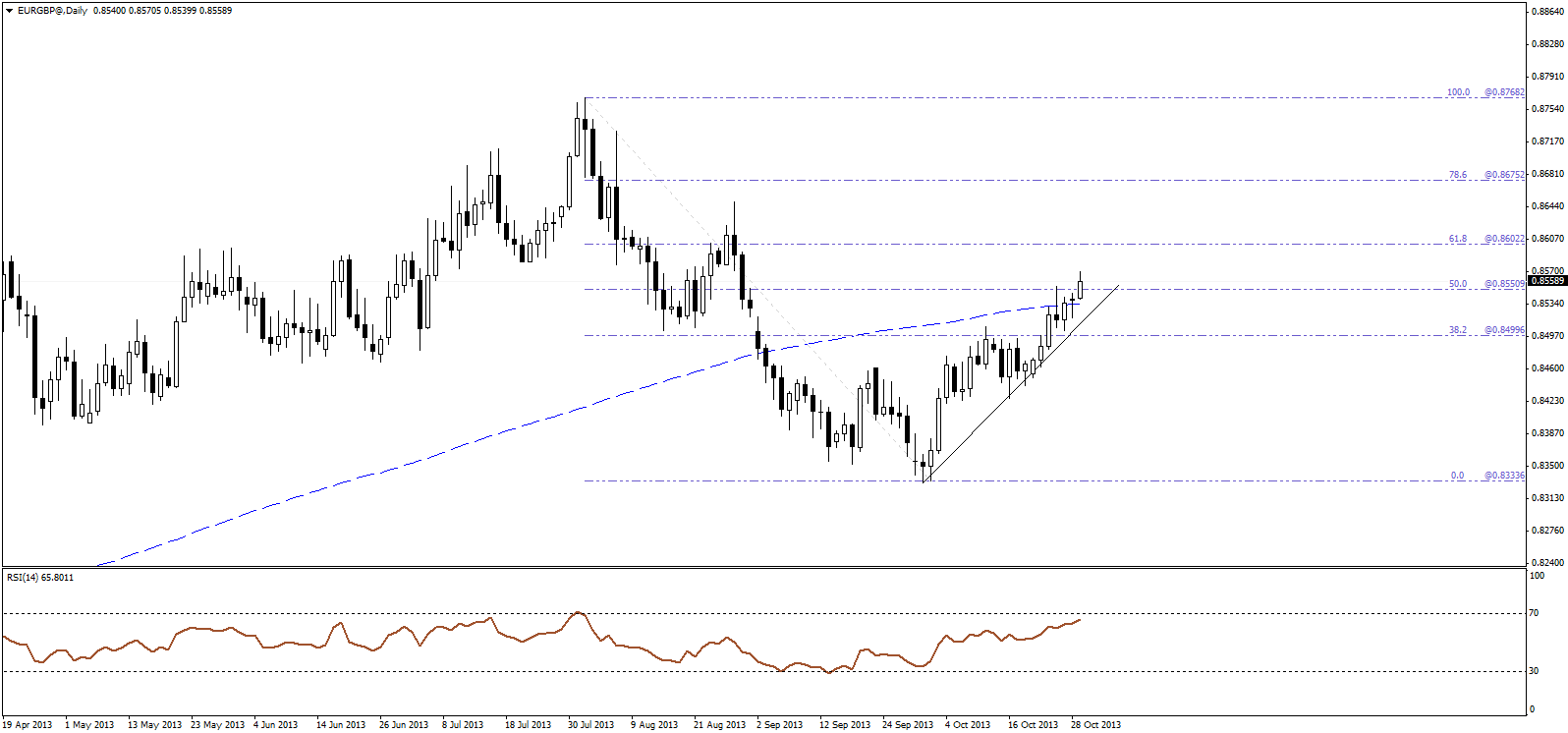

ICN Financial warn that the technical setup behind EUR/GBP are turning positive again:

"The price extended the bullish move invalidating yesterdays earlier bearish scenario, breaking above the 200-days SMA and 50 retracement level. Holding above 0.8550 should keep the bullish bias dominant."

10:12: GBP continues to struggle

Lloyds Bank Research on the struggling UK currency:

"GBP/USD continues to struggle. The lack of follow through on the upside in GBP/USD following some positive UK data releases of late (Q3 GDP and a relatively hawkish tone in the October MPC minutes) suggests that the market will need either even better UK data or a broad USD sell-off to trigger a test of the 1.6260 level in GBP/USD.

"Key releases from the US tomorrow could potentially be a trigger ahead of October UK PMI and US ISM (manufacturing) released on Friday. For GBP/USD the 1.6034 is likely to provide some initial support."

09:44: Digesting the Bank lending data

There has been no noticeable reaction to this morning's Bank of England lending data; a scenario that we called well ahead of the data release.

M4 Money Supply (MoM) (Sep): In line with expectations at 0.6%.

Consumer Credit (Sep): Came in below expectations at 0.411BN. Analysts predicted 0.700 BN.

M4 Money Supply (YoY) (Sep): Grew at 2.6%, up from 2.1% last month.

Mortgage Approvals (Sep): This confirms just how robust the housing market currently is. The figure came in at 66.735K, analysts predicted 66.000K.

08:33: Expect Sterling to struggle

UniCredit Bank is not confident on sterling's prospects in the near-term:

"Cable is likely to continue to have difficulty holding gains above 1.62, with EUR-GBP rebounding above 0.8550 representing a drag."

08:24: Australian dollar hit by Stevens comments

The pound sterling may be one of the dogs on global FX on Tuesday morning; but spare a thought for the Aussie dollar.

The pound sterling may be one of the dogs on global FX on Tuesday morning; but spare a thought for the Aussie dollar.

RBA Governor Stevens stated the current Aussie level is not supported by costs and productivity trends, claiming also that Australia’s terms of trade are more likely to fall than rise.

He expects to see the Aussie “materially lower than it is today” at some point in the future.

08:00: Today's data

Today we have money lending figures, but don't expect currency markets to take any notice. The flavour of the moment is selling GBP.

If you are interested, at 09:30 the Bank of England announces the following:

Consumer Credit (Sep): £0.7B expected, £0.6B last month.

M4 Money Supply (MoM) (Sep): 0.6% expected, 0.7% last month.

Mortgage Approvals (Sep): 66.000K expected, 62.226K last month.

Net Lending to Individuals (MoM) (Aug): £2.5B expected, £1.6B last month.