GBP LIVE: Euro / Sterling Under Pressure - BUT Positives Seen in BoE Minutes

The pound sterling (GBP) completely ignored the release of this month's minutes from the Bank of England Monetary Policy Committee meeting. The key concern for sterling watchers is the pressure being placed on the currency by the powerful euro which appears to be on a one-way mission higher; this theme dominated much of Wednesday's trading action. The British pound could be in for further weakness ahead of Friday's GDP release. For Thursday's live coverage please see here.

Wednesday's rates:

The pound euro exchange rate is at 1.1747.

The pound dollar exchange rate is at 1.6152.

For a full list of rates please see here.

Note: The above are spot market inter-bank quotes; your bank will add a spread to the figures at their own discretion. However, an independent FX provider will guarantee to undercut your bank's offer, thus delivering more currency. Please find out more.

16:04: Is this just profit taking?

With the UK currency still under pressure as we approach the end of the London session we note relief may only be offered on Friday.

Omer Esiner at Commonwealth Foreign Exchange says:

"The British pound pared some recent gains against the dollar as weaker global stocks and commodities prompted investors to take some profits on its recent rise.

"More hawkish than expected minutes from the BOE’s early October monetary policy meeting helped lift the pound off of overnight lows.

"Bank of England officials were increasingly encouraged by the apparent momentum of the U.K. economy and played down the risks associated with a rising pound. A strong U.K. GDP report on Friday could set the pound up for another test of its recent nine-month high against the dollar."

14:50: The real reason GBP is lower today

Forget the Bank of England MPC Minutes. Boris Schlossberg gives an interesting reason for today's GBP weakness:

Forget the Bank of England MPC Minutes. Boris Schlossberg gives an interesting reason for today's GBP weakness:

"Currency markets were rattled by a newswire report that Chinese banks have had to triple the bad debt write offs preparing for a fresh wave of defaults in the world's second largest economy.

"The news which swept through the market in midday Asia trade kept pressure on all the high beta currencies and triggered a wave of selling in AUD/USD and GBP/USD in particular."

13:37: Concerns of a big move lower for GBP

Shaun Osborne at TD Securities warns that the GBP/USD could lurch yet lower:

"GBPUSD was more concerned with the broader moves in the FX space today, which resulted in a sharp retracement lower for the pair. On the charts, the move is notable in that it topped out at the high set earlier in October—at 1.6257—marking a potential double top on the short term charts. A bearish sign that suggests the potential for a move of at least two more big figures lower."

11:45: Two key points currency watchers should take away from today's Bank of England event

Kathleen Brooks at Forex.com: says the market is likely to concentrate on two points in the wake of today's MPC Minutes:

Kathleen Brooks at Forex.com: says the market is likely to concentrate on two points in the wake of today's MPC Minutes:

1. It’s good news that Gilt yields have moderated (the 10-year yield is nearly 40 basis points lower than its September peak), which suggests that a recalibration of global rates is doing the BOE’s work for it, and for the foreseeable future it may not need to add any more stimulus.

2. The BOE isn’t worried about the strength of sterling and actually sees the benefits of a stronger pound as it weakens inflation pressures and boosts real consumer incomes. Thus, the BOE could tolerate GBP strength in the medium-term.

11:12: Don't write off the UK currency just yet!

Ipek Ozkardeskaya at Swissquote Bank warns the GBP/USD could yet make a comeback:

Ipek Ozkardeskaya at Swissquote Bank warns the GBP/USD could yet make a comeback:

"GBPUSD has sold-off in the Asian session giving back all of yesterday’s gains. While the pair is contained between 1.6130 to 1.6260, indicators are marginally bullish.

"With MACD steady above the zeroline we anticipate fresh demand to challenge 1.6260 resistance. Watch for next resistance to come into play at 1.6260 (1st Oct high) then 1.6343 (2013 high). The support levels from here are 1.6130 (9th Oct high), 1.6063 (16th oct pivot high), 1.5884 (13th Sept high), 1.5759 (17th June high), 1.5726 (65 dma), 1.5600 (resistance turned support) then 1.5471 (200 dma)."

10:02: BBA Mortgage Approvals confirm a robust housing market

UK Mortgage Approvals grew to 43K in September, following 38.2K registered the previous month, the British Bankers' Association informed today. The result exceeds forecasts of an increase to 39.4K.

09:59: Further reactions to Bank of England decision

Forex.com:

"Key takeaways from BOE minutes: No member thought policy tightening was necessary, they seem fine with pound strength."

Markit Economics:

"BoE minutes show MPC voted 9-0 to keep both rates and QE unchanged. Probable that unemployment will be lower and output will grow faster in 2Q13."

09:45: Sterling under pressure as BoE Minutes fail to provide support

GBP remains under selling pressure on Wednesday morning as markets see no evidence that the Bank of England will consider raising interest rates before 2016.

08:49: GBP needs help

The UK currency is coming under selling pressure, those hoping for higher rates will be hoping the MPC minutes at 09:30 can stem the blood-letting. Unlikely though.

08:13: Bank of England MPC Minutes at 09:30

The only real possibility of a surprise that could come out of today's headline event concerns the possibility of any changes to forward guidance.

We, and the markets, don't believe this is likely thanks to the prominence of various MPC Minutes in the press lately. The message remains the same: There will be no changes to policy until the economy has improved materially.

Meanwhile, any changes to the asset purchase programme or the interest rate are highly unlikely.

08:08: Euro to advance further against GBP

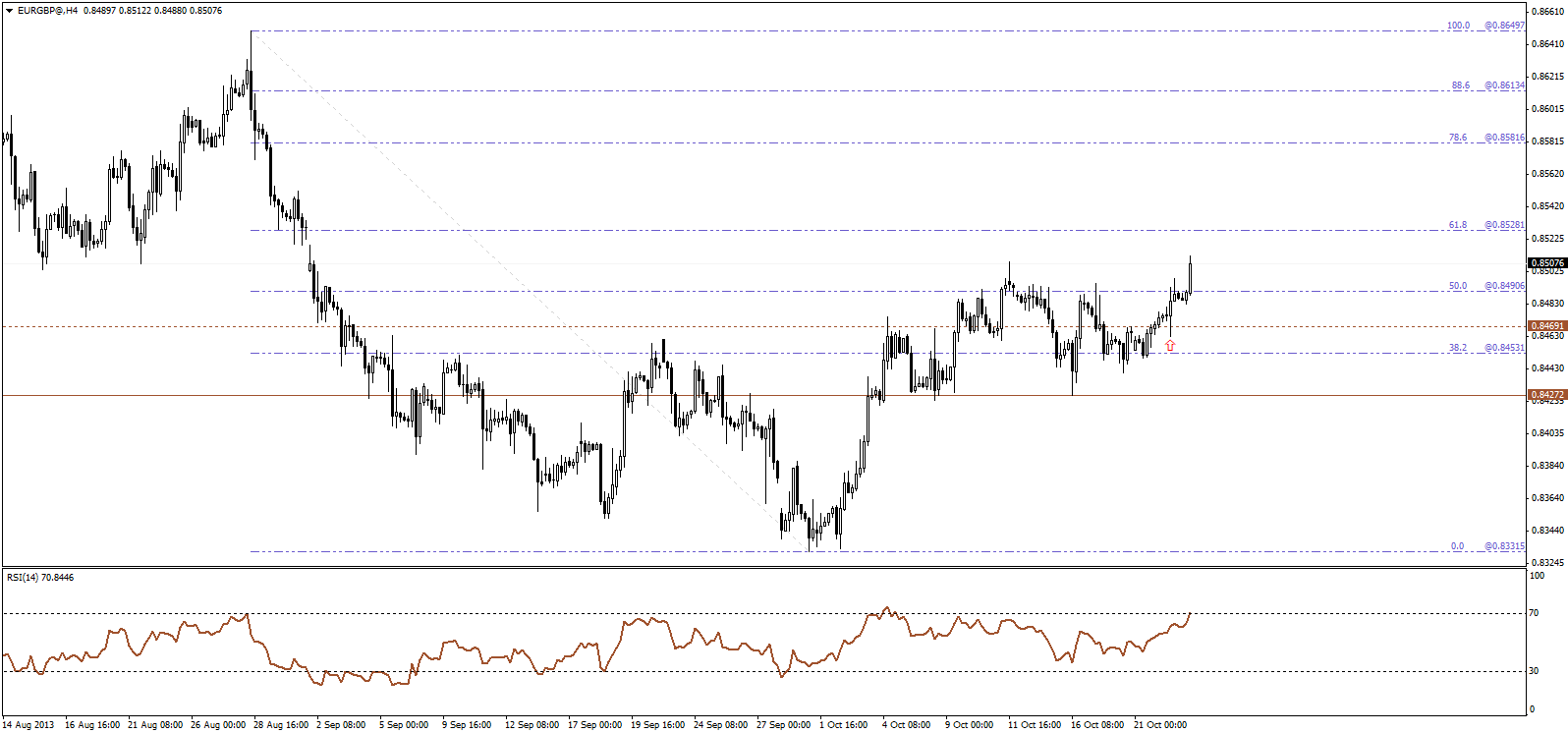

ICN Financial Markets on why they are backing the euro over the pound:

"The price extended the upside move, to settle above 0.8500 level, and the 50 percent retracement level, accordingly, further upside is seen towards the 61.8 percent retracement at 0.8530. and probably higher."

08:00: GBP up vs USD, down vs EUR today?

UniCredit Bank on their predicted exchange rate price action for today:

"The BoE’s minutes this morning are not expected to offer any big surprise and thus cable is likely to again mostly depend on the underlying USD weakness, with charts now requiring a break of 1.6260 to retest January’s peak close at 1.64.

"Meanwhile, the renewed EUR strength may help EUR-GBP break towards 0.8525."

07:58: US dollar down, British pound up

The greenback tanked against other currencies yesterday due to the weaker-than-expected U.S. non-farm payrolls, which came in at 148K vs the expectation of 180K, adding speculation that the Fed may delay tapering bond purchases.

The British pound (GBP) meanwhile rose; "Bank of England Deputy Governor

Charlie Bean said the policy provided ample stimulus while headwinds from Europe have eased," say Citibank Wealth Management in a morning note to clients.