Friday's Coverage: Where is the Euro to Pound exchange rate going next?

The British pound sterling (Currency:GBP) is firmer against the USD on Friday morning as key support levels continue to hold. The currency also remains at critical levels against the Euro, we will continue to update on this rate as fresh views are made available.

There are no major economic releases due today so we fixate on the US political situation and technical forecasts.

Wholesale exchange rates at time of last update:

- The pound sterling converts into 1.1808 euro; pretty much unchanged on Thursday's close.

- The pound converts into 15989 US dollars; up 0.13 pct on last night's close.

- The pound converts into 1.6881 Australian dollars; down 0.09 pct.

- The pound converts into 1.9197 New Zealand dollars; down 0.44 pct.

Please note: The above are inter-bank wholesale rates. Your bank will affix a discretionary spread when passing on their retail rate. However, an independent FX provider will guarantee to undercut your banks offer, thus delivering more currency. Please learn more here.

14:54: Pound sterling gains to remain limited

We hear from Omer Esiner at Commonwealth Foreign Exchange on the outlook for GBP:

"Sterling bounced off of a three-week low against the dollar but remained near the lower end of its recent ranges. This week’s dismal U.K. manufacturing output data dented some of the market’s recent optimism surrounding Britain’s economic recovery and underscored the view that the Bank of England will likely remain sidelined for the foreseeable future.

"While the pound should remain generally well supported amid still high uncertainly in the U.S., its gains may prove limited as investor see little reason to push the unit well beyond a recent nine-month peak against the greenback."

10:12: Why sterling is having trouble vs the Aus, NZ dollars

Boris Schlossberg at BK Asset Management points out that events in the US are favouring the high-beta currencies (ie. the likes of NZ dollar, Aus dollar, SA Rand):

Boris Schlossberg at BK Asset Management points out that events in the US are favouring the high-beta currencies (ie. the likes of NZ dollar, Aus dollar, SA Rand):

"High beta FX was mildly higher in Asian and early European trade today as risk appetite improved on hopes of a resolution to the US government shutdown and debt limit ceiling crisis. Yesterday Republican lawmakers and President Obama had their first meeting on the matter and although no compromise was reached both parties are continuing to work on a negotiated solution.

"With little economic news on the docket, currencies took their cue from the equity markets and strong performance in Asia where both Nikkei and Shanghai were up by more than 1% helped to boost high beta FX."

10:09: The near-term outlook for the pound is not too pretty

We have just done our own analysis of the outlook for the British pound against the euro, dollar and Australian dollar. The 2-6 week timeframe does not look too pretty! Read it here.

08:25: Critical levels for Euro Pound exchange rate, view 2.

Matt Weller at GFT adds to our morning 'mini-focus' on the euro pound exchange rate:

"As we go to press, rates continue to consolidate just below major previous-support-turned-resistance at .8480. The pair sits at a major tipping point: a break above today’s high could open the door for a run toward the mid-.8500s ahead of the weekend, whereas a reversal off this ceiling could see the unit return to the weekly lows tomorrow."

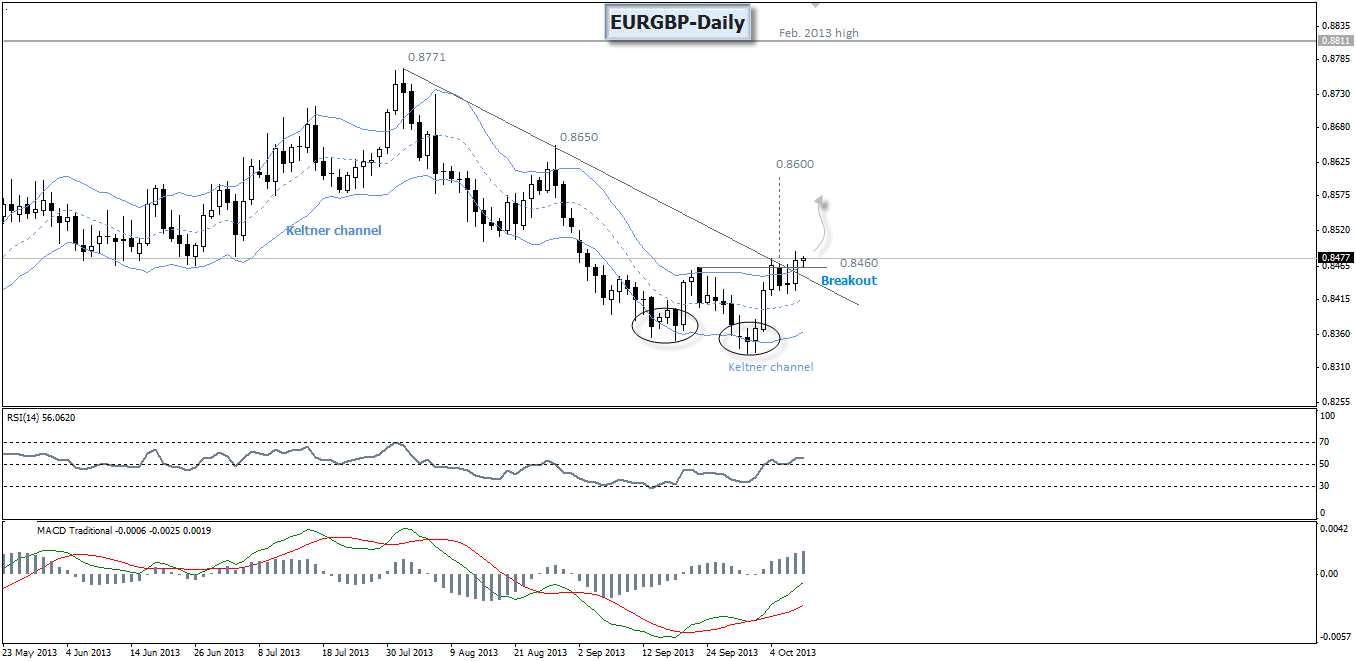

(click to enlarge)

08:15: Critical levels for Euro Pound exchange rate, view 1.

ICN Financial Markets are predicting a break yet higher for the euro against the pound:

"We can see how prices have adopted a favourable reaction to the positive divergence formed on RSI 14 and MACD indicators as seen on the provided daily graph. (See chart below).

"Bulls succeeded in surpassing the neckline of the previous caught double bottom pattern as anticipated on October 04 and succeeded in achieving a convenient closing above the falling trend line, which connected the movements from the significant peak of 0.8771 to the short-term bottom recorded in the 0.8325 regions.

"Meanwhile, RSI14 continued to stabilise above the value of 50.00, while MACD is definitely positive solidifying the breakout above the upper line of Keltner channel.

Risk Management:

"We will move our stop loss level from 0.8325 to 0.8395 levels in order to limit the risk."