Australian Dollar Poised to Break Below Major Support After MACD goes Sub-Zero

Image © Andrey Popov, Adobe Stock

- Aussie is sitting on long-term trendline

- Weak momentum suggests a break lower is possible, ushering in further declines

- 0.7000 an initial downside target

The Australian Dollar is threatening to break below a major support level against the US Dollar and touch 0.7000 suggests research from OUB.

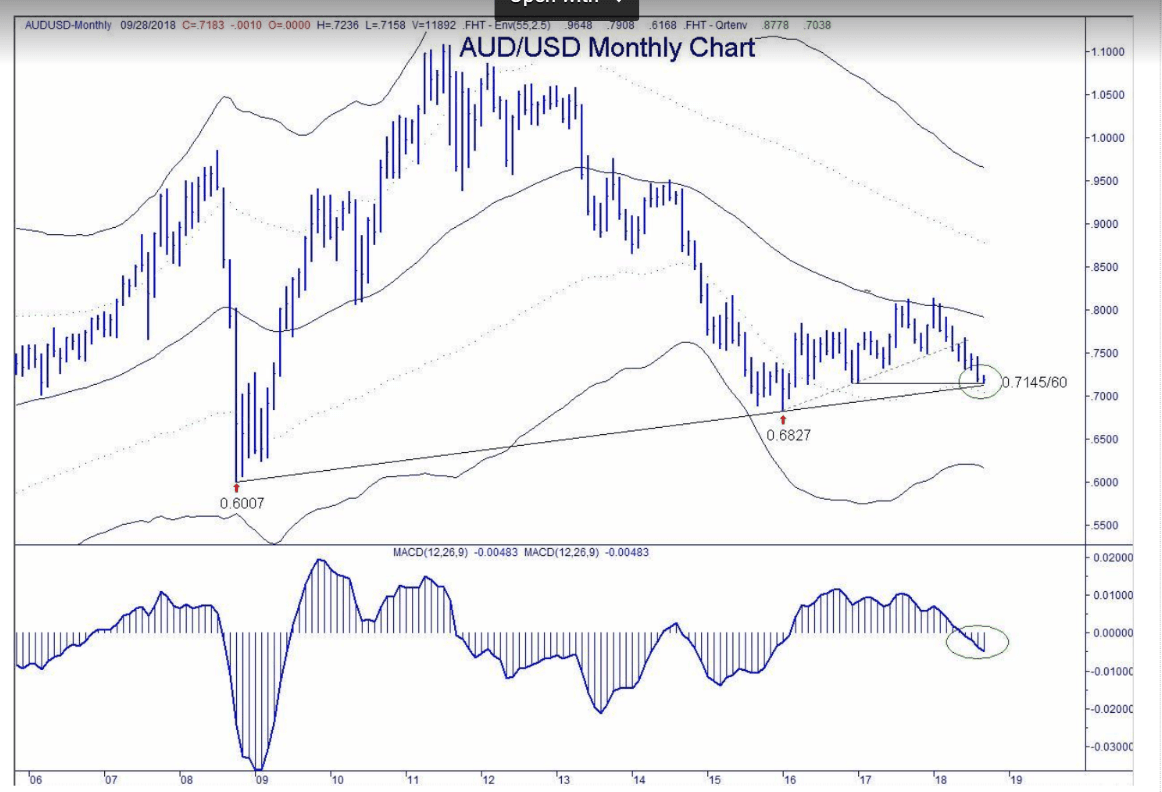

According to the Singapore-based lender, the exchange rate, which is currently trading at 0.7172, is sitting just above a 10-year rising trendline at 0.7145 connecting the 2008 and 2016 lows - trendlines are key game-changing levels which if broken often lead to deeper declines.

Further support is provided by the minor December 2016 low at 0.7160 - historic lows often provide support to falling prices and if broken can usher in deeper declines.

Whilst normally tough support levels such as these would be expected to hold and lead to a bounce higher, in this particular case, weak momentum is biasing the chart to a more bearish interpretation.

Momentum, as measured by the MACD indicator in the lower pane has provided a sell-signal, after crossing below its zero-line, and this suggests the above support lines are vulnerable to penetration.

"Monthly MACD has crossed into negative territory in June and past instances of a cross-over suggest that AUD could stay under pressure for several more months," says Quek Ser Leang, an analyst at OUB.

"From here, 0.7145/60 appears to be vulnerable and a break this major support zone could lead to further weakness towards the round-number support of 0.7000," adds the analyst.

First stop on the way down is an initial target at 0.7000 but further weakness below that level to the 0.68s is also possible.

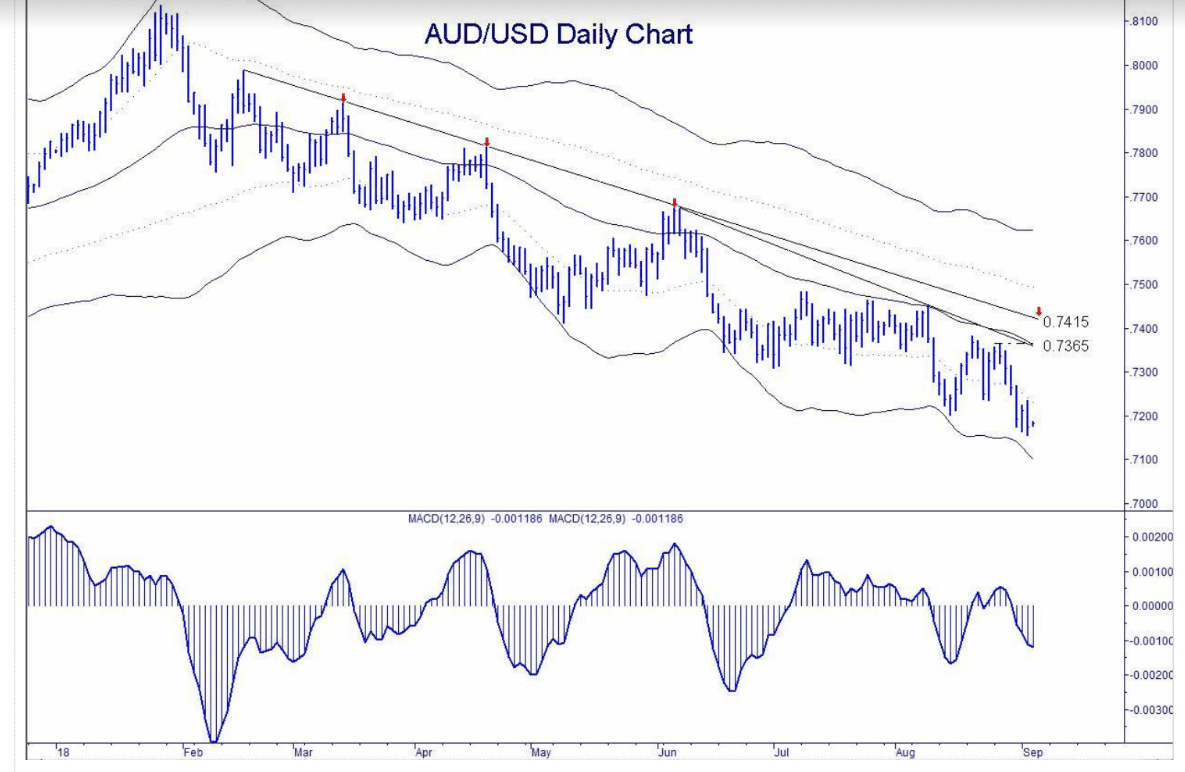

Whilst odds of such a deep decline remain low at this stage they will increase as long as AUD/USD remains below 0.7415; only a move above would turn the tables back in bulls' favour.

"The odds for AUD to weaken to the 2016 low of 0.6827 are not that high but the probability would continue to increase unless AUD/USD can reclaim the strong declining trend-line resistance on the daily chart," says Leang.

The trendline on the daily chart has held since the beginning of the year; other resistance sits just below it, however, at 0.7365, "and this level is likely strong enough to contain any AUD strength, at least for the coming one month or so," concludes the analyst.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here