The Pound-to-Australian Dollar Forecast for the Week Ahead: Compression, but Sterling Still Favoured

- Technicals suggest Sterling likely to continue rally

- Watch Australian labour market data on Thursday

- Three big data events out of the UK could sway GBP/AUD this week

Pound Sterling remains below its 2018 high against the Australian Dollar, recorded at 1.8506 on March 28, with the market set to open the new week quoted at 1.8337. The GBP/AUD exchange rate has been in a consolidate pattern since April 1, with Sterling's strong performance being matched by a simultaneous recovery in the Aussie Dollar complex.

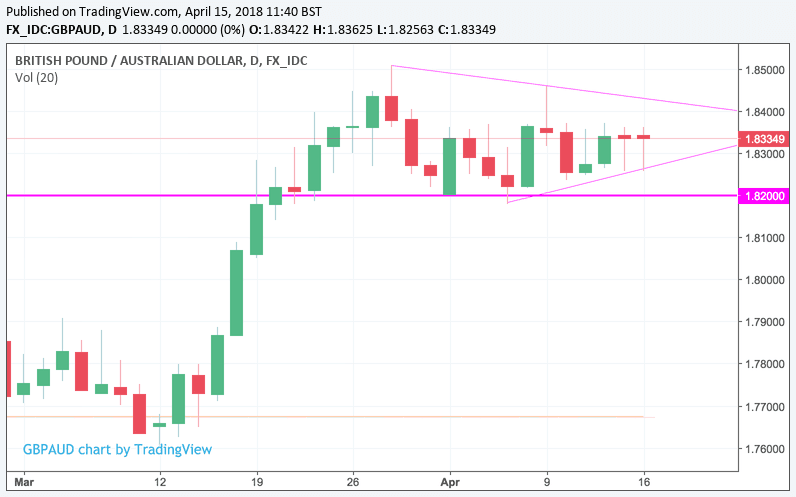

Our first call would be that we should probably expect the exchange rate to bob around in the confines of the narrowing range, best illustrated in the below:

On balance though, Sterling is preferred once this period of compression resolves, the Pound remains one of the best performing global currencies in 2018 and is still 6.23% up on the Australian Dollar since the start of the year.

Momentum does therefore appear to reside with Sterling from a technical standpoint and we would therefore suggest further advances are likely.

Support to any near-term potential weakness in Sterling is seen at the 1.82 round number where the month's lows were rejected on April 2 and 5. Prior to that buying interest in this region was recorded on March 21 and 22 and we therefore expect Sterling to find a solid base here which will likely minimise any damage.

The obvious near-term target lies at that March 28 high at 1.85 and would look for any strength to be tested here.

"Bullish outlook this week, trendline support holding nicely. Moving averages crossing over & price rejected off both of them as well, watching for a break of resistance for entry," says a technical strategy note on the pair from TradingView who have a longer-term price target at 1.8554 on the charts:

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

Australian Week Ahead: RBA and Employment

The minutes of the RBA meeting held on April 3 will be released on Tuesday, April 17, and foreign exchange traders will be looking for details concerning how the RBA is thinking about the path of Australian interest rates.

Be aware that if the market walks away with the view that the minutes contain hints that the timing of the next interest rate rise at the RBA has been brought closer, the Aussie Dollar will likely rise.

"The minutes of the RBA’s April board meeting are unlikely to deliver surprises given updates since that meeting. We’ll look out for informative commentary on trade tensions, market volatility, and funding costs," says a note from ANZ.

The next major event on the calendar will be the release of employment market data on Thursday, April 19 where markets will be expecting 20.3K jobs to have been added in March, up from 17.5K in the previous month.

The participation rate is forecast to be at 65.6% and the unemployment rate is forecast to have shrunk to 5.5% from 5.6%.

Should employment numbers beat expectations it would likely signal that underlying wage pressures will continue to grow - the thinking goes that employers start to raise wages in order to hold onto, or attract, talent in an economy where the labour pool is shrinking.

And wages matter for the RBA and Aussie Dollar:

The RBA is likely to only move on interest rates if it believes Australian wages are accelerating, as rising wages tend to boost inflation. By raising rates the RBA can keep a lid on inflation, and higher interest rates are in turn likely to attract inflows of foreign capital seeking higher yields - this in turn pushes the value of the Aussie Dollar up.

"Ongoing solid business conditions, including strong profitability and hiring intentions, suggest that employment should have continued to rise in March. Job ads are still trending higher, although growth has slowed a little. We look for a rise of 18k and a tick lower in the unemployment rate to 5.5%," says Felicity Emmett with ANZ Bank.

Sterling's Week Ahead

A big week in terms of data for the UK in the coming week with labour market, inflation and retail sales numbers all on tap.

The Pound has enjoyed a strong start to 2018 as concerns and uncertainties relating to Brexit fade. As a result, analyst Viraj Patel at ING Bank N.V. believes Sterling will now start to pay more attention to data. "It appears that we’re back to good old-fashioned UK data watching to determine the short-term direction for the currency," says the analyst. "The week ahead shouldn’t disappoint here given the array of key data releases to watch out for."

On Tuesday, April 17 we have labour market data with markets looking for employment to increase by 13.3K in the quarter to March.

The Unemployment rate is forecast to stick at 4.3%.

Most important for the Pound will be wage data; as it is wage data that the Bank of England will be watching when it comes to raising intent rates with the rule of thumb being that higher wages should prompt interest rate wages which are in turn supportive of Sterling.

The average earnings index, with bonuses, is forecast to have risen 3% in February. If this number is missed, expect the Pound to struggle.

"We think signs of firming wage growth next week may seal the deal for a May BoE rate hike," says Patel.

Inflation data on Wednesday, April 18 will also be key with economists forecasting the headline CPI rate to be at 2.7%, unchanged from the previous month.

Calling Sterling's reaction to this is tricky as the traditional rule of thumb is higher inflation = a positive reaction in the Pound as it should mean the Bank of England will need to deliver more interest rates. This should still be true.

However, falling inflation also means the squeeze on consumers is fading as pay growth starts to finally creep ahead of inflation - and this is good for the economy. And what is good for the economy is good for the Pound.

The inflation data could therefore offer a win-win for Sterling.

Finally, markets will be watching retail sales on Thursday, April 19 with economists forecasting a reading of -0.5% thanks to the inclement weather seen in March.

"Retail sales figures (Thursday) should reveal that the heavy snowfall in March hit the sector hard, with sales volumes contracting sharply on the month says Liam Peach, an economist with Capital Economics.

We therefore reckon markets are likely to discount seasonality into this month's data and instead look for next month's data for direction.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.