Potential 4% Decline in Pound-to-Australian Dollar Exchange Rate: Westpac

- Written by: James Skinner

“Into year-end, however, we see prospects for AUD to recapture some lost ground” - Sean Callow, Westpac.

The Pound-to-Australian-Dollar's ascent could be nearing an end according to analysts at Westpac who suggest the GBP/AUD rate could shed close to 4% as a “fairly valued” Aussie Dollar rounds on a Pound Sterling that remains vulnerable to adverse Brexit-related developments.

“The Australian dollar’s weakness against USD over the past 3 months is second only to the kiwi, while the British pound has been best in the G10 in that time, boosted by the Bank of England’s first interest rate increase in 10 years,” says Sean Callow, a senior currency strategist at Westpac.

The Australian Dollar has spent much of the fourth-quarter on the back-foot against the Dollar, Sterling and the remainder of the major currencies. The Pound-to-Australian-Dollar rate has risen by 7.4% during the last three months and by 4.4% during the one month to mid-November.

Above: Pound-to-Australian-Dollar at daily intervals. Captures three-month performance.

“The BoE’s Nov rate hike has reduced AUD’s yield premium somewhat, helping weigh on AUD against the Pound,” says Callow. “AUD’s yield advantage remains low in historical context.”

Australian Dollar losses have meanwhile been realised after a run of weak inflation and wage growth numbers that prompted traders to rethink earlier bets the Reserve Bank of Australia might be tempted to raise interest rates in 2018. Wednesday’s wage price index showed Aussie wage growth chuntering along at a steady 0.7% during the third quarter. But this was below the 0.7% growth expected by economists and the number had been flattered by a rise in the minimum wage during the survey period.

Nevertheless, the Australian Dollar now "seems to be about fairly valued given yield spreads and commodity prices," argues Callow, which on a relative basis will allow GBP/AUD to benefit on any bouts of Sterling weakness.

“Into year-end, however, we see prospects for AUD to recapture some lost ground,” Callow adds.

Above: AUD/USD at daily intervals. Captures three-month performance.

“Expectations of higher UK rates and debate over the pace of tightening should maintain a degree of support for Sterling,” says Callow. “But we view Brexit negotiations as a weight on the Pound multi-month, with a distinct lack of progress to date.”

Prime Minister Theresa May could be closer to a “Brexit deal” than the market currently expects, although the idea of talks moving along to the subjects of trade and transition was far from a done-deal Friday.

“If UK PM May’s government struggles with fiscal policy and Brexit into year end, then GBP/USD could slip to 1.28,” Callow adds. “The Aussie in contrast seems to be about fairly valued given yield spreads and commodity prices.”

However, we have been reporting that a number of institutional analysts believe the risks of a positive development in the Brexit negotiation front are high; something currency markets might be unprepared for.

"Investors don’t want to be positioned aggressively sterling short as more constructive Brexit news remains possible," says Kit Juckes, an analyst with Société Générale in London.

"We see increased upside risks for the Pound due to clear signs of progress being made toward a financial settlement that could result in transition and trade talks beginning in January. We will get a better sense of any progress that has been made when PM May meets with European Council President Donald Tusk at the EU summit in Sweden later today," says Derek Halpenny at MUFG.

How Low Could GBP/AUD Go on Brexit Talk Stresses

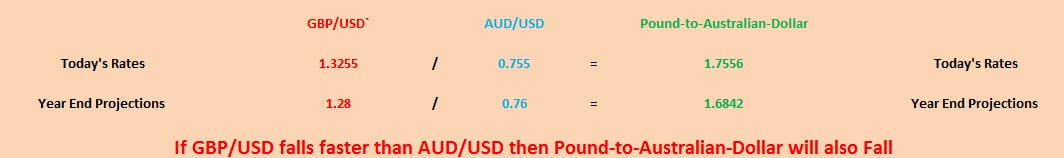

Westpac's calculations for potential GBP/AUD targets rely on the separate performances of the British Pound and the Australian Dollar, relative to the US Dollar.

As such, the Pound-to-Australian-Dollar is known as a foreign exchange cross rate.

“No major change in these fundamentals should leave AUD/USD around 0.76 by year-end. This would push AUD/GBP back to around 0.5950, GBP/AUD to 1.6800/50,” says Callow.

In order to calculate the GBP/AUD rate, in its simplest form, interbank dealers take the GBP/USD rate and divide it by the AUD/USD rate to get a conversion price. The table below highlights this.

The Pound-to-Australian-Dollar rate was quoted 0.59% higher at 1.7509 during early trading in London Friday. The AUD/USD rate was marked 0.57% lower at 0.7544 while the Pound-to-Dollar rate was quoted 0.10% higher at 1.3216.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.