Australian Dollar vs US Dollar: Downtrend Channel Intact

Analysts ponder the next moves in AUD/USD as its 2017 uptrend stalls - just how deep will the retracement lower be?

The Australian Dollar is steadily channeling lower against the US Dollar argues analyst Yann Quelenn of Swiss broker Swissquote.

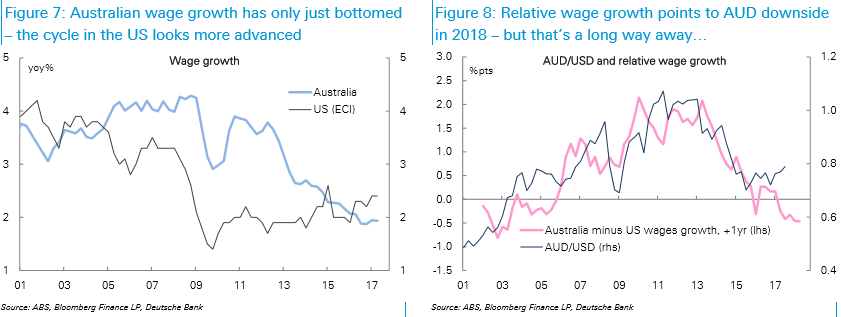

"AUD/USD's short-term technical structure is reversing," he notes, saying that a break below hourly support at 0.7786 could open the floodgates lower.

Longer-term he is bearish, with only a, "break of the key resistance at 0.8295 (15/01/2015 high),” leading to him changing his mind about, "our long-term bearish view."

Other analysts are however a little more constructive medium- to longer-term.

Commerzbank's technical analyst Karen Jones is also bearish - although only in the short-term, saying:

"AUD/USD once more failed below last week’s high at 0.7963 and the July 20 high at 0.7991," adding, "another down leg should soon be seen."

Jones is bullish longer-term, however, based on the fact the exchange rate has not yet reached the target at 0.8715 which was generated when it broke out of a large triangle it was in between 2016 and 2017.

A recent note from Deutsche Bank takes the view that the AUD/USD could follow a 'middle way' without major moves in either direction on the horizon.

AUD/USD was previously propelled higher on the back of elevated global sentiment and a weakening USD from Trump disilusionment.

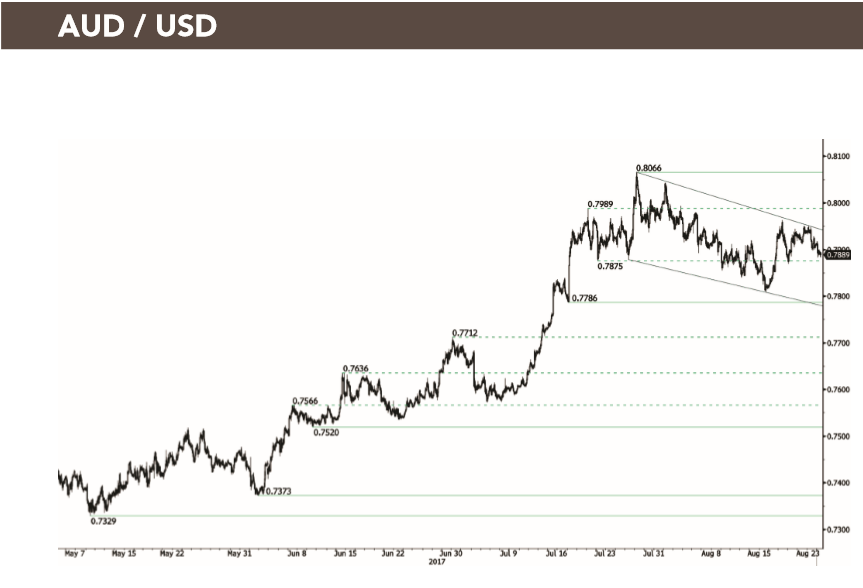

These drivers, however, have been replaced by two new factors including rising Iron Ore prices, Australia's premier export, and interest rate differentials.

"Support from iron ore/China is likely to continue. While last week’s IP and FAI data (global derivative market data) was on the soft side, lead indicators sit at six-year highs," said Deutsche's Tim Baker.

Credit growth remains strong in China - against prevailing expectations of a crunch, and this is likely to continue to fuel demand for Australian exports, supporting the Aussie.

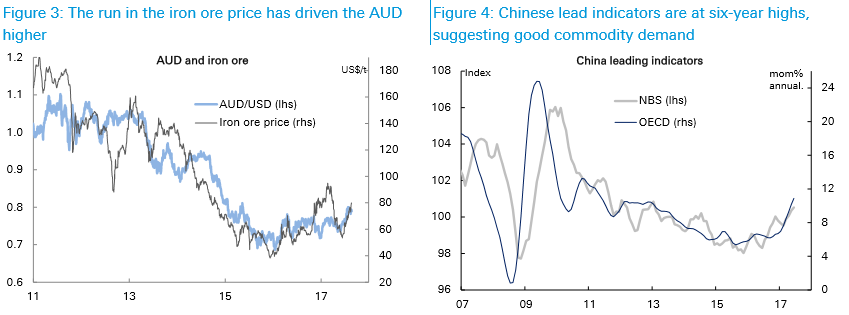

"Moves in rate differentials have helped the AUD as well – RBA pricing has swung from a cut to a hike on the back of RBA’s neutral rate talk and strong jobs data (as well as the familiar story of elusive US inflation US)," said Baker.

A rate hike from the RBA would be positive for the Aussie as it would attract more carry flow from investors seeking higher returns from parking their money in relatively high interest Australian accounts.

Wages are likely to 'let the side down', however, as Baker sees them lacking the necessary upside momentum to materially impact on inflation and lead to an RBA interest rate hike.

Baker sees this dampening effect from wages subduing the exchange rate, "next year", however, and not "anytime soon".

Overall the pair is likely to go sideways within a range above 0.78 and below 0.80, he concludes:

"Where does that leave us? As dull as it sounds, it’s a currency that likely stays in the recent range. The 80c level could easily be breached again (perhaps on US debt ceiling fears), but we’d fade that move given the drag it exerts on the economy (noting the RBA has expressed concern). On the downside, it’s hard to see a break below 78c until there’s a meaningful change in the commodity/China story."