GBP/AUD Outlook: Bullish Tenor to Short-Term Chart

The Pound to Australian Dollar exchange rate continues to rise and build on the gains it made after breaking above a key trendline on March 21.

Whilst it pulled back following an initial rally to 1.6571 and has not been able to surpass that peak yet, we expect it to return to that level and probably go even higher in the end.

Momentum is constructive on the daily chart, also favouring a continuation of the bullish ‘green shoots’.

Drilling down to the four-hour chart enables us to view the up-move that led to the break above the trendline in more detail.

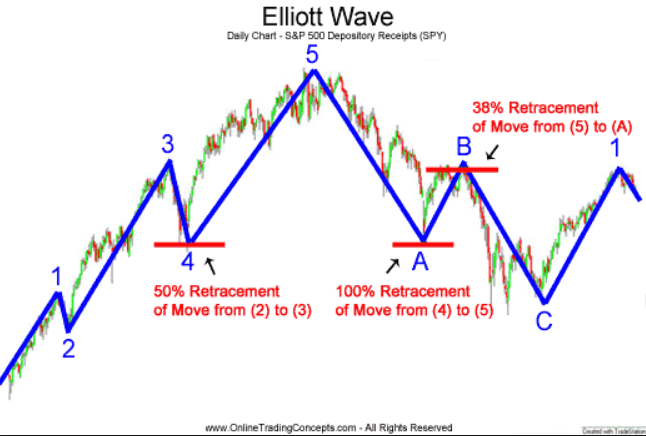

We note how the move has a distinctive five wave pattern which makes it look like an Elliot Wave, which is a type of cycle which appears in financial markets and reflects changing waves of social mood.

The classic Elliot Wave pattern is a five-wave affair with waves 1,3 and 5 rising in line with the broader trend (assuming the broader trend is bullish) and waves 2 and 4 corrective.

The four-hour chart is showing five wave Elliot Wave with its wave five currently in progress.

The wave five almost always reaches as high as the top of wave three, which corresponds to the 1.6571 peak, but usually surpasses it and goes higher. We therefore see a high probability of the current move extending up to the top of 1.6570 at the very least.

We, therefore, see a high probability of the current move extending up to the top of 1.6570 at the very least.

A break above the 1.6525 highs would probably confirm such an extension higher.

The consolidation range which has formed over the last few days, visible on the 4-hr chart also provides a clue as to how far any subsequent move will be.

Breakouts from ranges tend to move the same distance as the height of the range extrapolated in the direction of the breakout.

This also posits a target at around the 1.6570 mark too.